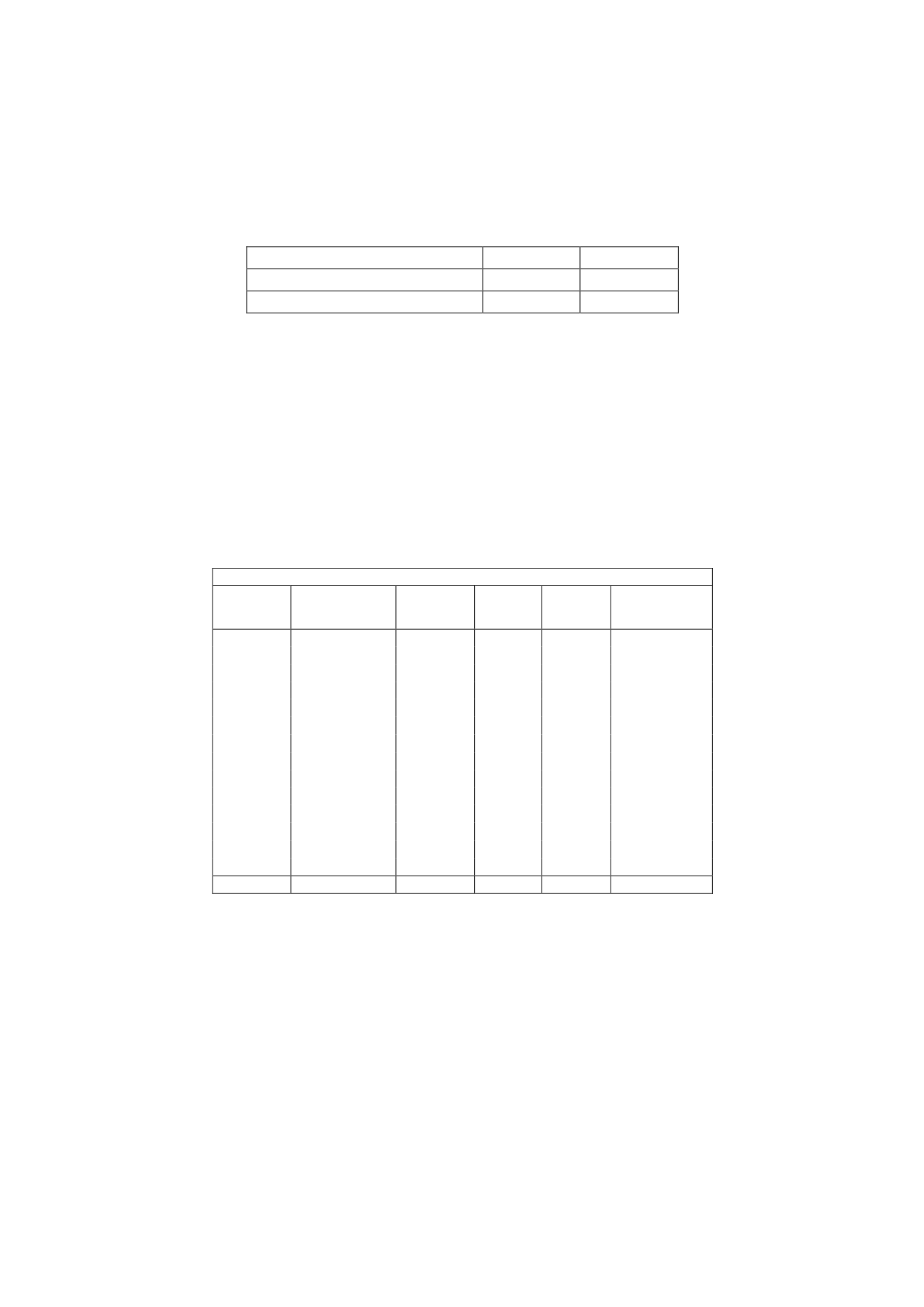

f) Tax recognised in equity

In addition to the income tax recognised in the consolidated statement of profit or loss, in

2015 and 2014 the Group recognised the following amounts in consolidated equity:

Thousands of euros

2015

2014

Hedging instruments

(1,044)

(932)

Total

(1,044)

(932)

g) Other information

Following is a detail of the last years for offset of prior years' tax loss carryforwards at 31

December 2015. EUR 168,851 thousand of these carryforwards have been recognised, of

which EUR 168,832 thousand were transferred to Atresmedia Corporación from the absorbed

company, Gestora de Inversiones Audiovisuales La Sexta, as a result of the universal

succession of the former to the rights and obligations of the transferor arising from the

application of the special tax regime for mergers, spin-offs, asset contributions and security

exchanges provided for in Title VII, Chapter VIII of the Consolidated Spanish Income Tax

Law approved by Legislative Royal Decree 4/2004, of 5 March.

Thousands of euros

Year

incurred

Available for

offset at

31/12/14

Deducted in

the year

Other

Effect of

change in

tax rate

Available for

offset at

31/12/15

1998

46

-

-

-

46

2001

6

(3)

-

-

3

2002

10

-

-

-

10

2003

1

-

-

-

1

2004

1

-

-

-

1

2006

42,166

(8,977)

572

96

33,857

2007

37,654

-

-

-

37,654

2008

31,918

-

-

-

31,918

2009

28,965

-

-

-

28,965

2010

8,379

-

-

-

8,379

2011

15,475

-

-

-

15,475

2012

12,896

-

-

77

12,972

2013

505

-

-

-

505

2014

416

-

(416)

-

-

178,438

(8,980)

156

173

169,787