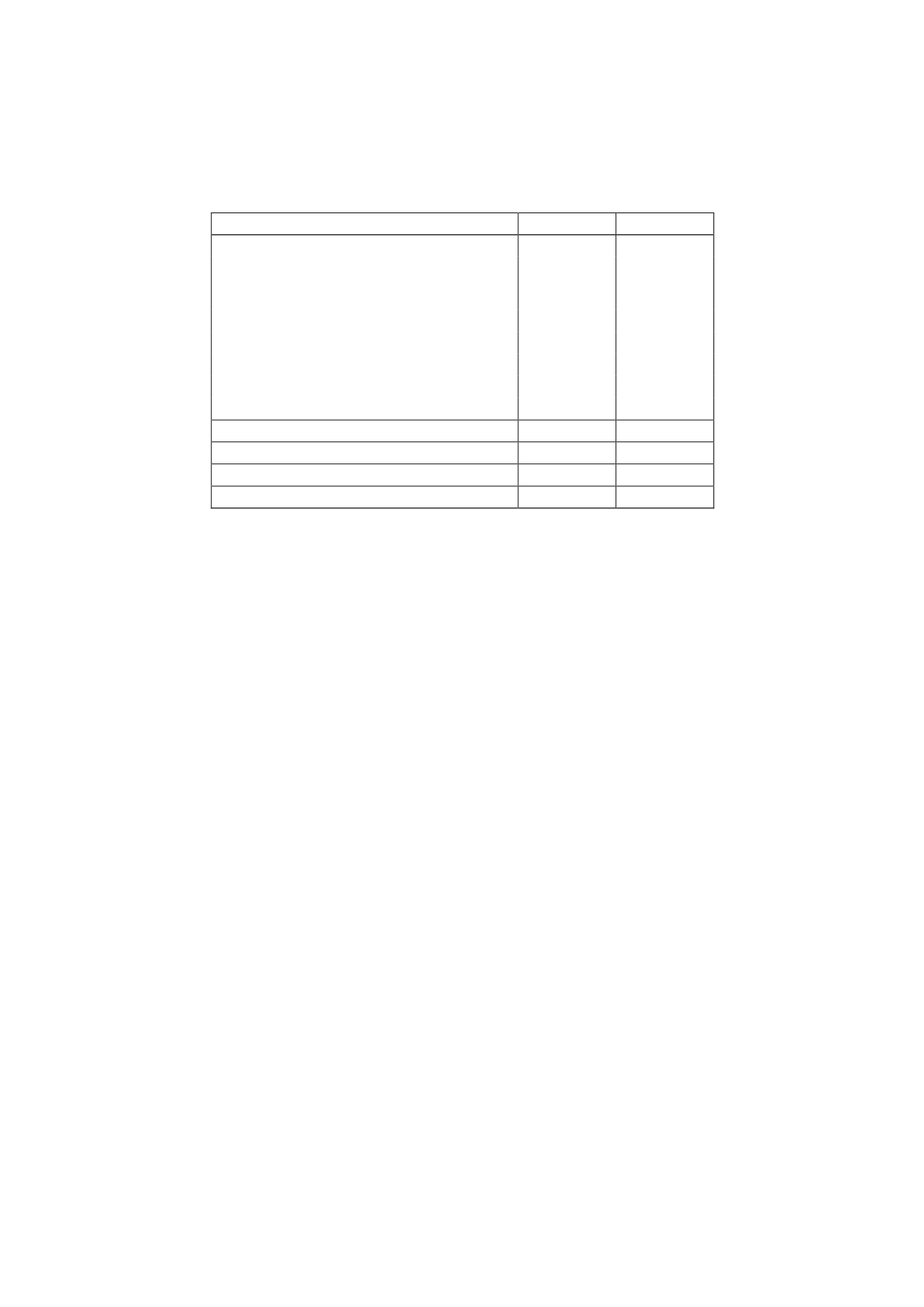

b) Reconciliation of the accounting profit to the income tax expense

The reconciliation of the accounting profit to the income tax expense is as follows:

Thousands of euros

2015

2014

Consolidated profit before tax

131,547

95,327

Permanent differences

9,570

4,769

Tax losses incurred prior to the formation of the

tax group used in 2015

(9)

(9)

Adjusted profit

141,108

100,087

Tax rate

28.00%

30.00%

Adjusted profit multiplied by tax rate

39,510

30,026

Tax credits

(6,520)

(13,158)

Current income tax expense

32,990

16,868

Deferred tax expense

(61)

(1,426)

Income tax adjustment

(589)

33,233

Total tax expense

32,340

48,675

Effective tax rate

24.58%

51.06%

The 2015 permanent differences include mainly negative consolidation differences (EUR

4,124 thousand), non-deductible impairment losses on equity instruments (EUR 11,036 miles

thousand), other non-deductible expenses (EUR 1,956 thousand) and donations (EUR 703

thousand).

The negative consolidation differences arise from the share of results of companies

accounted for using the equity method (+ EUR 2,321 thousand), increased amortisation of

the trademark under IFRSs (+ EUR 289 thousand) and accounting elimination differences (-

EUR 6,734 thousand).

In 2015 the Group earned tax credits for investment in audiovisual production amounting to

EUR 15,442 thousand. However, the tax credits indicated in the table above were recognised

by the Group in 2015 of which EUR 6,274 thousand relate to investment in audiovisual

production and EUR 246 thousand to donations to not-for-profit organisations.

In 2014 the Group made adjustments to bring the existing balance of deferred tax assets

and deferred tax liabilities -calculated in the past at a rate of 30%- into line with the

recoverable amount thereof calculated at 25%, based on the Company's best estimates of

the recovery of tax assets in future reporting periods.

The differences between the estimate made at year-end and the tax return effectively filed

gave rise to differences that not only affect the income tax expense, but also the adjustment

arising from the change in the tax rate, amounting to EUR 8 thousand and EUR (597)

thousand, respectively. These amounts are included under "Income Tax Adjustment".

The deferred tax expense relates to the tax effect of the deferred tax liability under IFRSs

(see Note 21-e).