In view of the particular nature of income taxation of EIGs (including the assignation of tax

credits and tax losses to the partners), in 2015 the Group recognised a tax loss amounting to

EUR 3,936 thousand.

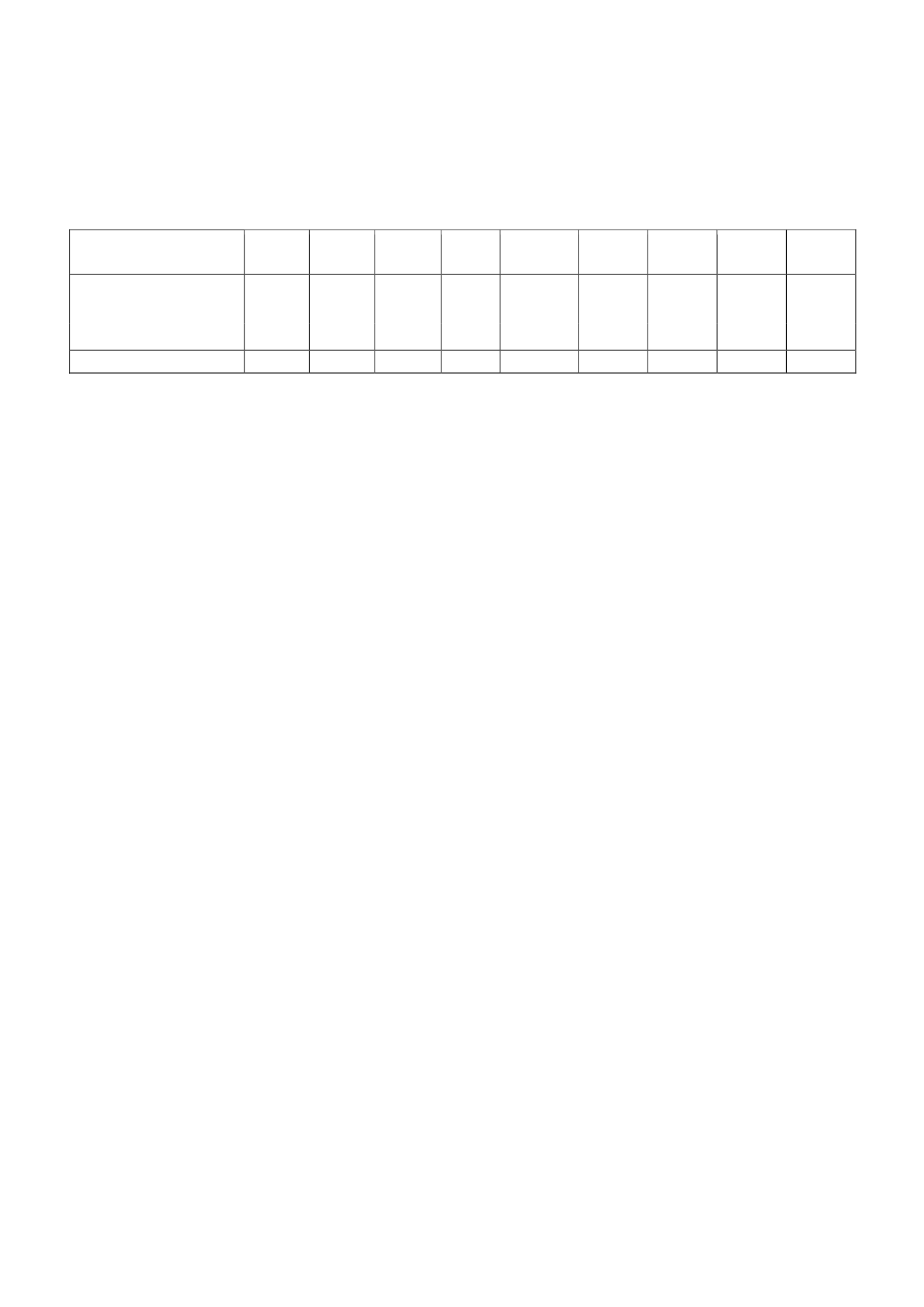

The changes in “Deferred Tax Liabilities” were as follows:

DEFERRED TAX

LIABILITIES

Thousands of euros

Balance at

31/12/13 Additions Disposals Other

Income

tax rate

effect

Balance at

31/12/14 Additions Disposals Balance at

31/12/15

Recognition of intangible

assets at fair value

30,914

-

(324)

-

(5,051)

25,539

-

(302)

25,237

Grants

59

-

(48)

96

(13)

94

108

-

202

Amortisation of merger

goodwill

372

297

-

(76)

(129)

464

277

-

741

Total

31,345

297

(372)

20

(5,193)

26,097

385

(302)

26,180

“Hedging Instruments” in the “Deferred Tax Assets” table is not included in the temporary

differences or deferred tax assets in the tables in Note 21-c) since for tax purposes they are

recognised directly in equity.

The “Recognition of Intangible Assets at Fair Value” deferred tax liability relates to the

temporary difference arising as a result of the difference between the carrying amount and

the tax base of the identified trademark and signal broadcasting licence (IAS 12).

The trademark is amortised for accounting purposes at a rate of 5%, the amortisation charge

in 2015 being EUR 1,079 thousand.

The amortisation is not deductible for tax purposes and, therefore, gives rise to a positive

adjustment to the taxable profit which is recognised as a deferred tax liability.

The different interpretation provided under International Financial Reporting Standards, as

compared with local accounting standards, in relation to the recognition of intangible assets

at fair value, gives rise to a greater deferred tax liability under IFRSs than that recognised in

accordance with the Spanish National Chart of Accounts, to which the income tax legislation

is not applicable.

On the basis of the timing estimate of future profits made by the Parent’s directors for the

offset and use of these deferred tax assets, EUR 15,582 thousand were considered to be

recoverable in the long term while EUR 1,532 thousand were considered to be recoverable in

the short term. Both amounts are recognised under “Deferred Tax Assets”.

Also, on the basis of the aforementioned timing estimate of future profits, the directors

consider that there are no reasonable doubts as to the recovery of the amounts recognised

in the accompanying balance sheet within the statutory time periods and limits on the basis

of the projections prepared.

The key assumptions on which these projections are based relate mainly to advertising

markets, audience, advertising efficiency ratios and the evolution of expenses. Except for

advertising, the data of which are measured on the basis of external sources of information,

the assumptions are based on past experience and reasonable projections approved by

Parent management and updated in accordance with the performance of the advertising

markets. These future projections cover the next ten years.

The Group analyses the sensitivity of the projections to reasonable changes in the key

assumptions used to determine the recoverability of these assets. Therefore, the sensitivity

analyses are prepared under various scenarios based on the variables that are considered to

be most relevant, i.e. advertising income, which depends mainly on the performance of the

advertising market, the investment share reached and the operating margin achieved. The

aforementioned analyses do not disclose any evidence of non-recoverability of the tax assets

and tax credits recognised.