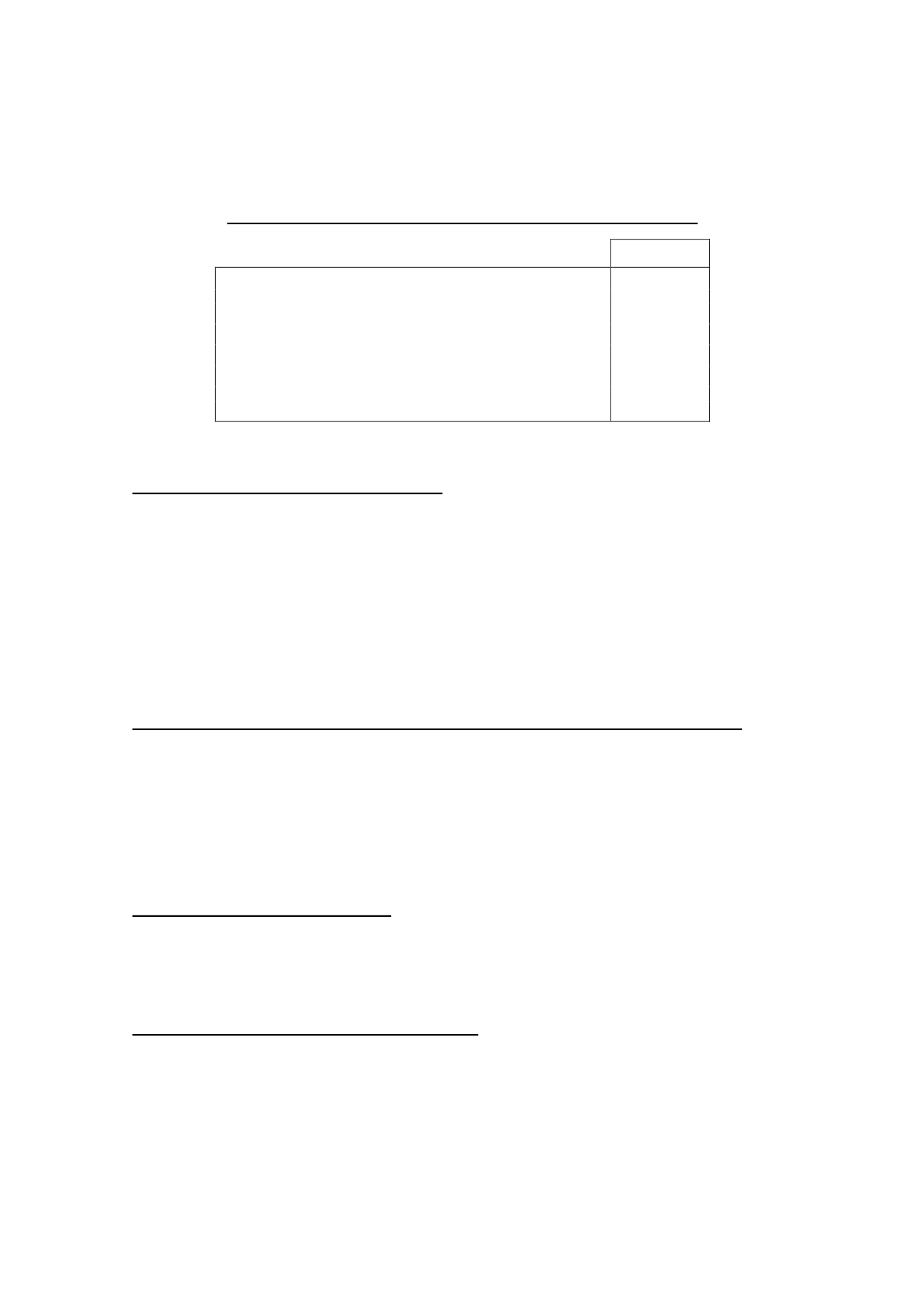

The provisional accounting statement prepared in accordance with legal requirements

evidencing the existence of sufficient liquidity for the distribution of the dividends is as

follows:

LIQUIDITY STATEMENT FOR THE PAYMENT OF THE 2015 INTERIM DIVIDEND

Thousands

of euros

Liquidity at 31 October 2015

150,331

Projected cash until 31 December 2015:

Current transactions from November to December 2015

8,557

Financial transactions from November to December 2015

10,347

Projected dividend payment

(37,717)

Projected liquidity at 31 December 2015

131,518

25. Remuneration of the Board of Directors

In 2015 the remuneration earned by the current and former members of the Parent’s Board

of Directors (composed at 31 December 2015 of three women and nine men) in the form of

salaries, attendance fees and life insurance premiums amounted to EUR 4,274 thousand,

EUR 777 thousand and EUR 15 thousand, respectively. In 2014 these remuneration items

amounted to EUR 3,940 thousand, EUR 795 thousand and EUR 16 thousand, respectively.

The Parent has not granted any loans or advances to its Board members and it does not

have any supplementary pension, retirement bonus or special indemnity obligations to them

in their capacity as directors.

26. Information regarding situations of conflict of interest involving the directors

Pursuant to Article 229 of the Spanish Limited Liability Companies Law (LSC), the

following information is included:

In 2015 none of the directors reported to the Board of Directors any direct or indirect conflict

of interest that they or persons related to them, as defined in Article 213 of the LSC, might

have with respect to the Company.

27. Events after the reporting period

There were no significant events between the reporting date and the date of formal

preparation of the consolidated financial statements.

28. Explanation added for translation to English

These financial statements are presented on the basis of the regulatory financial reporting

framework applicable to the Group in Spain (see Note 2-a). Certain accounting practices

applied by the Group that conform with that regulatory framework may not conform with

other generally accepted accounting principles and rules.