On the basis of the timing estimate of future profits made by the Parent’s directors for the

offset and use of these tax items, only EUR 23,472 thousand were considered to be

recoverable in the tax return for the coming year, EUR 1,532 thousand of which relate to

deferred taxes, EUR 2,987 thousand to unused tax credits and tax relief and EUR 18,953

thousand to tax loss carryforwards.

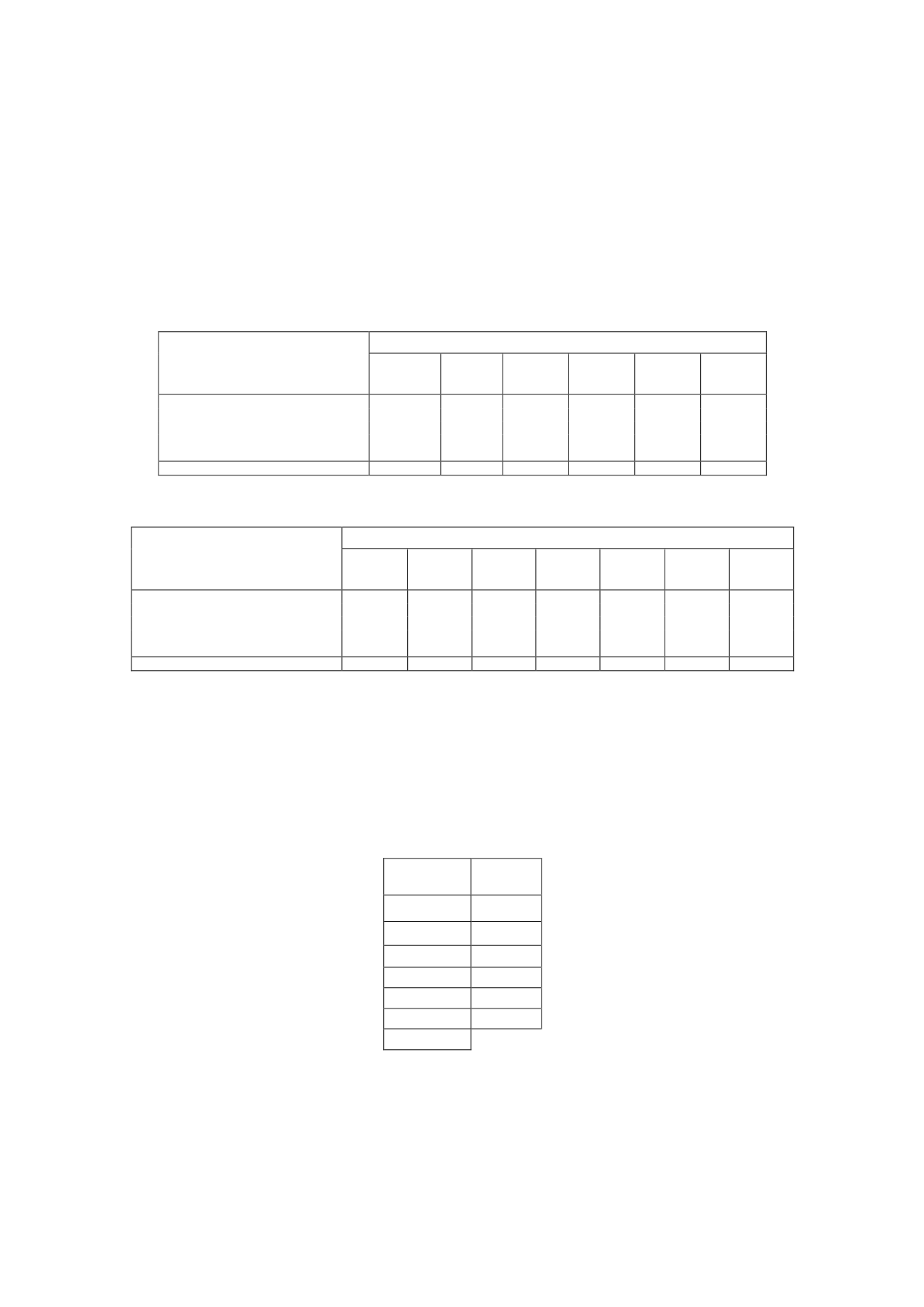

e) Deferred tax assets and liabilities recognised

The difference between the tax charge allocated to the current year and to prior years and

the tax charge already paid or payable for such years, which is recognised under deferred

tax assets, arose as a result of temporary differences derived from the following items:

CHANGES IN DEFERRED

TAX ASSETS

Thousands of euros

2014

Additions Disposals Other

Effect of

change in

tax rate

2015

Contingencies and charges

14,006

2,917

(2,653)

(767)

(989)

12,514

Accounts payable

717

129

(352)

(212)

(58)

224

Hedging instruments

(777)

-

(198)

-

21

(954)

Tax effect of assets at fair value

530

-

(544)

(201)

607

392

Other

6,656

-

(1,938)

(611)

831

4,938

Total

21,132

3,046 (5,685) (1,791)

412

17,114

The detail for 2014 is as follows:

CHANGES IN DEFERRED

TAX ASSETS

Thousands of euros

2013 Transfers Additions Disposals Other

Effect of

change in

tax rate

2014

Contingencies and charges

12,389

203

6,221 (3,323)

77

(1,561)

14,006

Accounts payable

607

181

300

(795)

568

(144)

717

Hedging instruments

(361)

-

(571)

-

-

155

(777)

Tax effect of assets at fair value

2,541

-

- (1,287)

-

(724)

530

Other

5,280

(384)

3,097

(212)

627

(1,752)

6,656

Total

20,456

-

9,047 (5,617)

1,272 (4,026) 21,132

The changes in deferred tax assets, included in the “Other” column, include most notably the

difference between the projected income tax expense for 2014 and the tax return actually

filed.

At 31 December 2015 the Group had unused tax credits amounting to EUR 112,349

thousand, of which EUR 2,148 relate to La Sexta. Of the total unused tax credits, the Group

has recognised EUR 103,363 thousand.

Amount

Limit

15,136

2025

26,166

2026

18,971

2027

12,955

2028

23,679

2029

15,442

2030

112,349

In 2014 the Group acquired ownership interests of 40% and 14% in the Enelmar

Productions

economic interest grouping (EIG) and Producciones Ramsés economic interest grouping

(EIG), respectively.