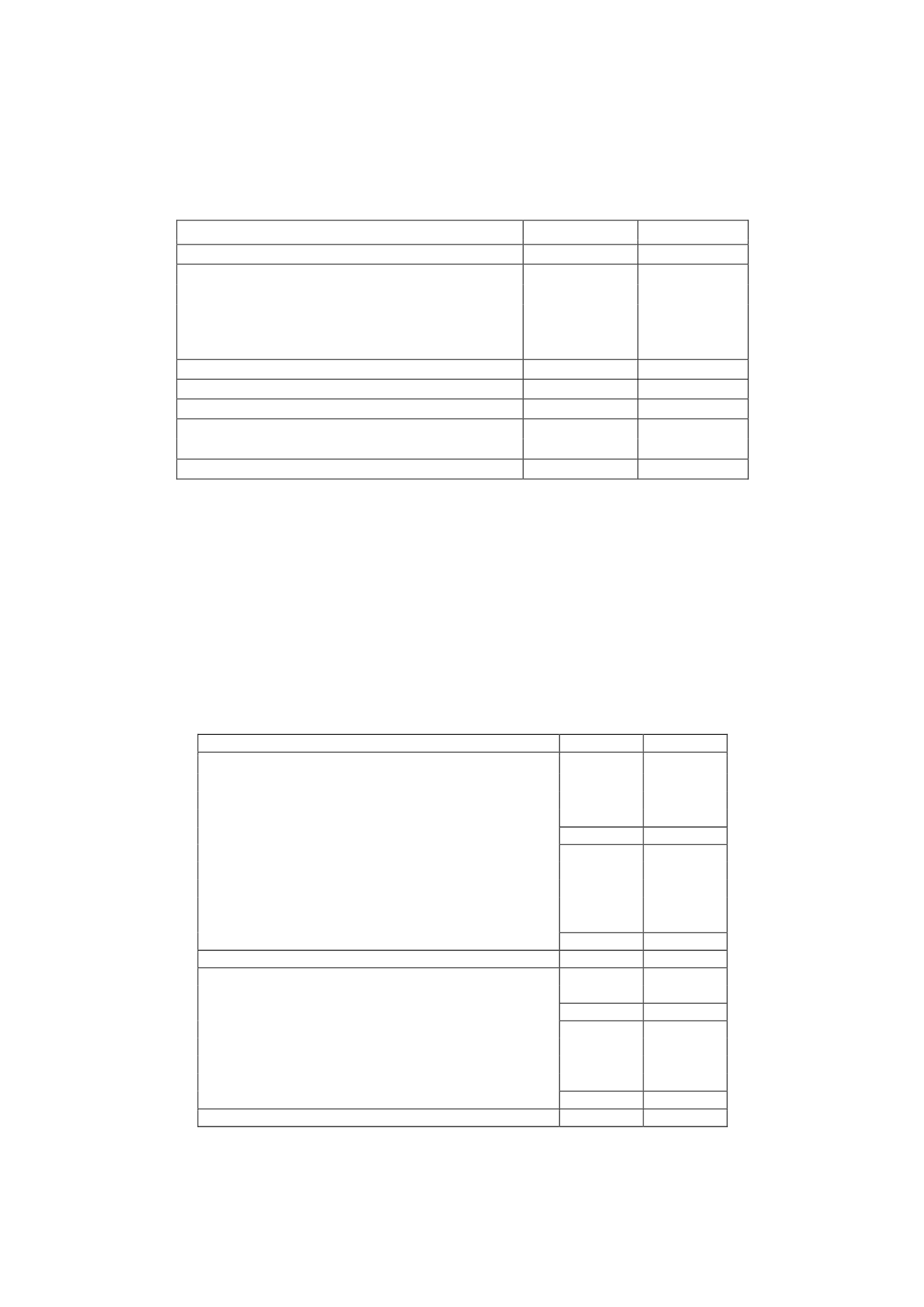

c) Reconciliation of the accounting profit to the taxable profit

The reconciliation of the accounting profit to the taxable profit for income tax purposes for

2015 and 2014 is as follows:

Thousands of euros

2015

2014

Accounting profit after tax

99,207

46,652

Income tax

32,340

48,675

Permanent differences

9,570

4,769

Temporary differences

(12,855)

13,134

Offset of prior years' tax losses

(32,070)

(28,313)

Taxable profit

96,192

84,917

Tax rate

28.00%

30.00%

Gross tax payable

26,933

25,475

Tax credits used in 2015

(7,552)

(6,704)

2015 tax prepayments

(23,865)

(19,739)

Tax payable (refundable)

(4,484)

(968)

The 2015 temporary differences include additions of EUR 11,669 thousand and reductions of

EUR 24,524 thousand (see Note 21-e).

Additions break down into deferred tax assets of EUR 10,878 thousand and deferred tax

liabilities of EUR 791 thousand, while reductions include deferred tax assets of EUR 19,598

thousand, EUR 3,935 thousand in relation to the tax losses of EIGs in which the Group has

an interest and EUR 991 thousand of deferred tax liabilities.

d) Tax receivables and payables

The detail of the tax receivables and payables at 31 December 2015 and 2014 is as follows:

Thousands of euros

2015

2014

NON-CURRENT ASSETS

Deferred tax assets (Note 21-e)

17,114

21,132

Tax loss carryforwards

168,851

177,485

Unused tax credits and tax relief

103,363

103,349

289,328

301,966

CURRENT ASSETS

Income tax refundable

2,309

1,247

2015 income tax refundable (Note 21-c)

4,484

968

Other tax receivables

8

10

VAT refundable

572

3,815

7,373

6,040

Total tax receivables

296,701

308,006

OTHER NON-CURRENT LIABILITIES

Deferred tax liabilities (Note 21-e)

26,180

26,097

CURRENT LIABILITIES

Tax withholdings payable

6,432

4,670

Accrued social security taxes payable

2,206

2,012

VAT payable

9,429

4,017

18,067

10,699

Total tax payables

44,247

36,796