Fixtures and equipment are stated at cost less accumulated depreciation and any

recognised impairment loss.

Depreciation is calculated, using the straight-line method, on the basis of the acquisition

cost of the assets less their residual value; the land on which the buildings and other

structures stand has an indefinite useful life and, therefore, is not depreciated.

The period property, plant and equipment depreciation charge is recognised in the

consolidated statement of profit or loss using the straight-line method at rates based on

the following average years of estimated useful life of the various assets:

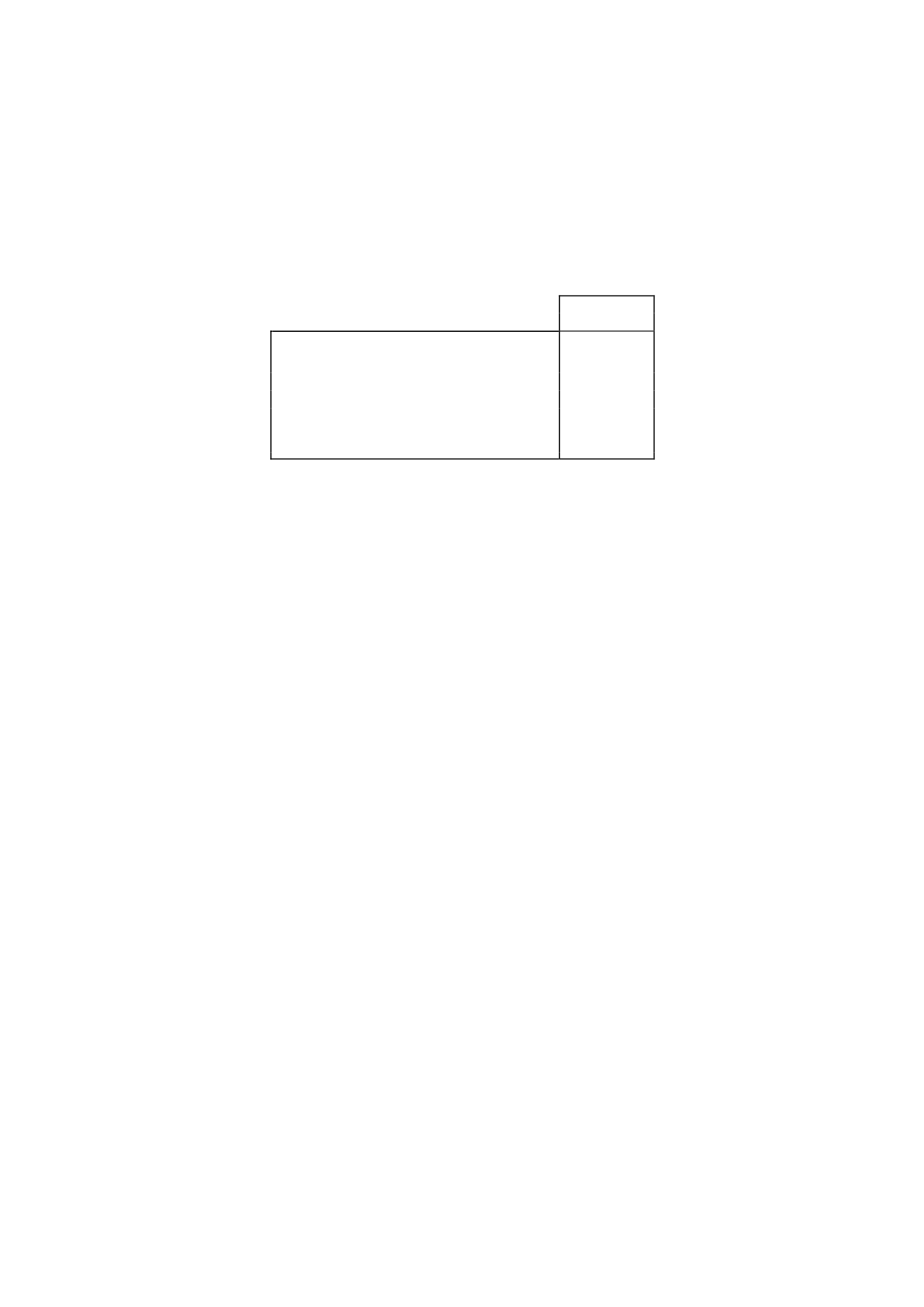

Years of

useful life

Buildings

33

Plant

5 to 8

Machinery and tools

6 to 10

Furniture

10

Computer hardware

3 to 7

Transport equipment and other items of property,

plant and equipment

5 to 10

Assets held under finance leases are recognised in the corresponding asset category and

are depreciated over their expected useful lives on the same basis as owned assets or,

where shorter, over the term of the relevant lease.

Impairment of other intangible assets and property, plant and equipment

At each balance sheet date, or whenever there is any indication of impairment of other

intangible assets and property, plant and equipment, the Group conducts an impairment

test to determine whether the recoverable amount of these assets has been reduced to

below their carrying amount.

Recoverable amount is the higher of fair value less costs of disposal and value in use.

In the case of property, plant and equipment and audiovisual productions, impairment is

calculated item by item, on an individual basis.

Where an impairment loss subsequently reverses, the carrying amount of the asset is

increased to the revised estimate of its recoverable amount, but so that the increased

carrying amount does not exceed the carrying amount that would have been determined

had no impairment loss been recognised in prior years. Such reversal of an impairment

loss is recognised as income.

e)

Financial assets

The financial assets held by the Group are classified in the following categories:

a)

Loans and receivables: financial assets arising from the sale of goods or the

rendering of services in the ordinary course of the Company's business, or financial

assets which, not having commercial substance, are not equity instruments or

derivatives, have fixed or determinable payments and are not traded in an active

market.

b)

Held-for-trading financial assets: assets acquired with the intention of selling them

in the near term and assets that form part of a portfolio for which there is evidence

of a recent actual pattern of short-term profit-taking. This category also includes

financial derivatives that are not financial guarantees (e.g. suretyships) and that

have not been designated as hedging instruments.