42

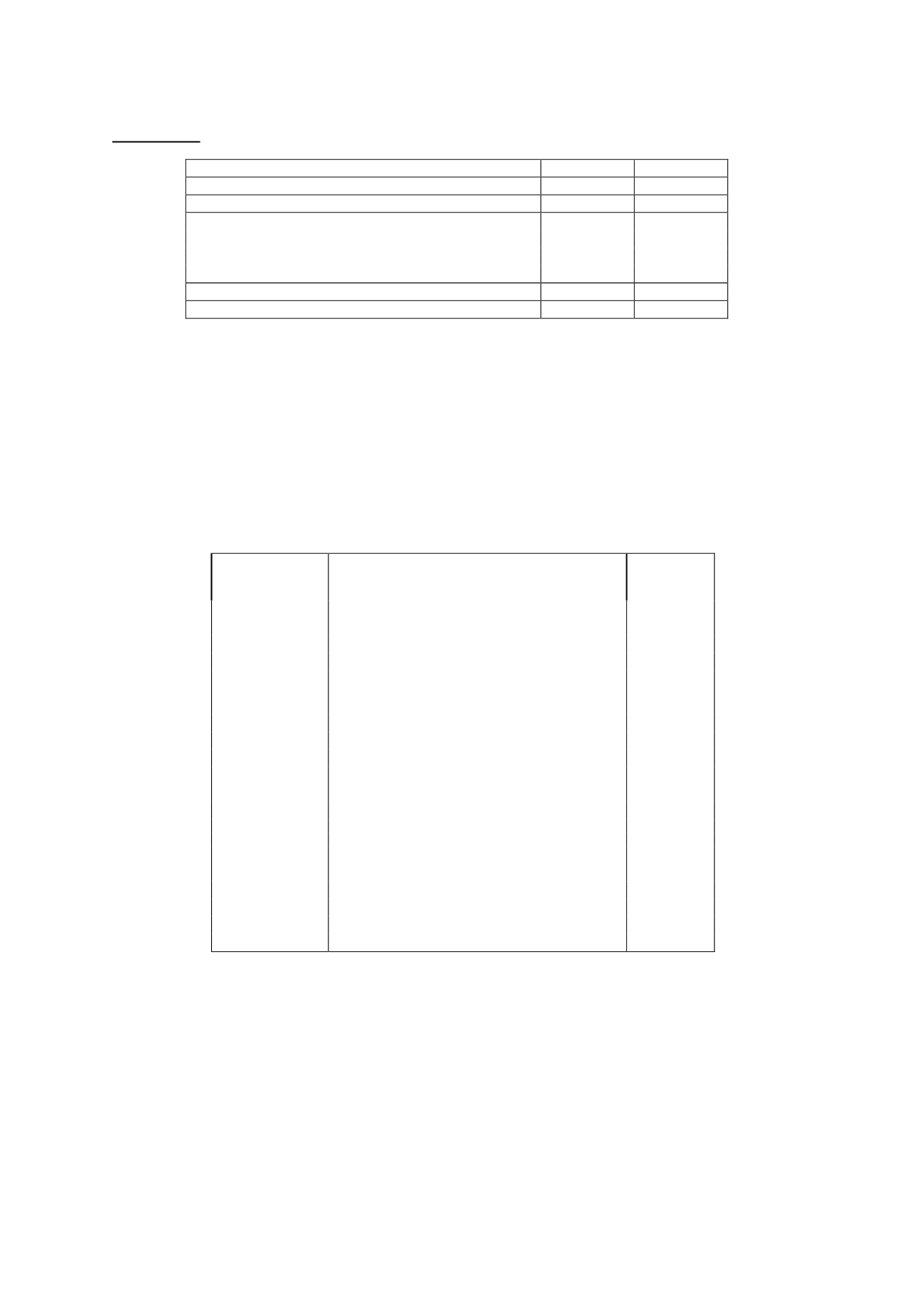

Taxpayables

2013

2012

Deferred tax liabilities

22,649

22,886

Total non-current liabilities

22,649

22,886

Short term

-

Taxwithholdings payable

2,229

2,073

Accrued social security taxes payable

696

621

VAT payable

5,633

4,452

Total current liabilities

8,558

7,146

TOTALTAXPAYABLE

31,207

30,032

18.2Reconciliationof the accountingprofit to the taxableprofit

Pursuant to Corporation Tax Law 43/1995, of 27 December, on 26 December 2000, Atresmedia

Corporación de Medios de Comunicación, S.A. (formerly Antena 3 de Televisión, S.A.) notified the

Madrid tax authorities of its decision to file income tax returns under the special regime for

corporate groups. This application is considered indefinite provided that the requirements

established in the current Article 67 of the Consolidated Spanish Corporation Tax Law aremet and

the Company does not opt to cease to apply the aforementioned regime.

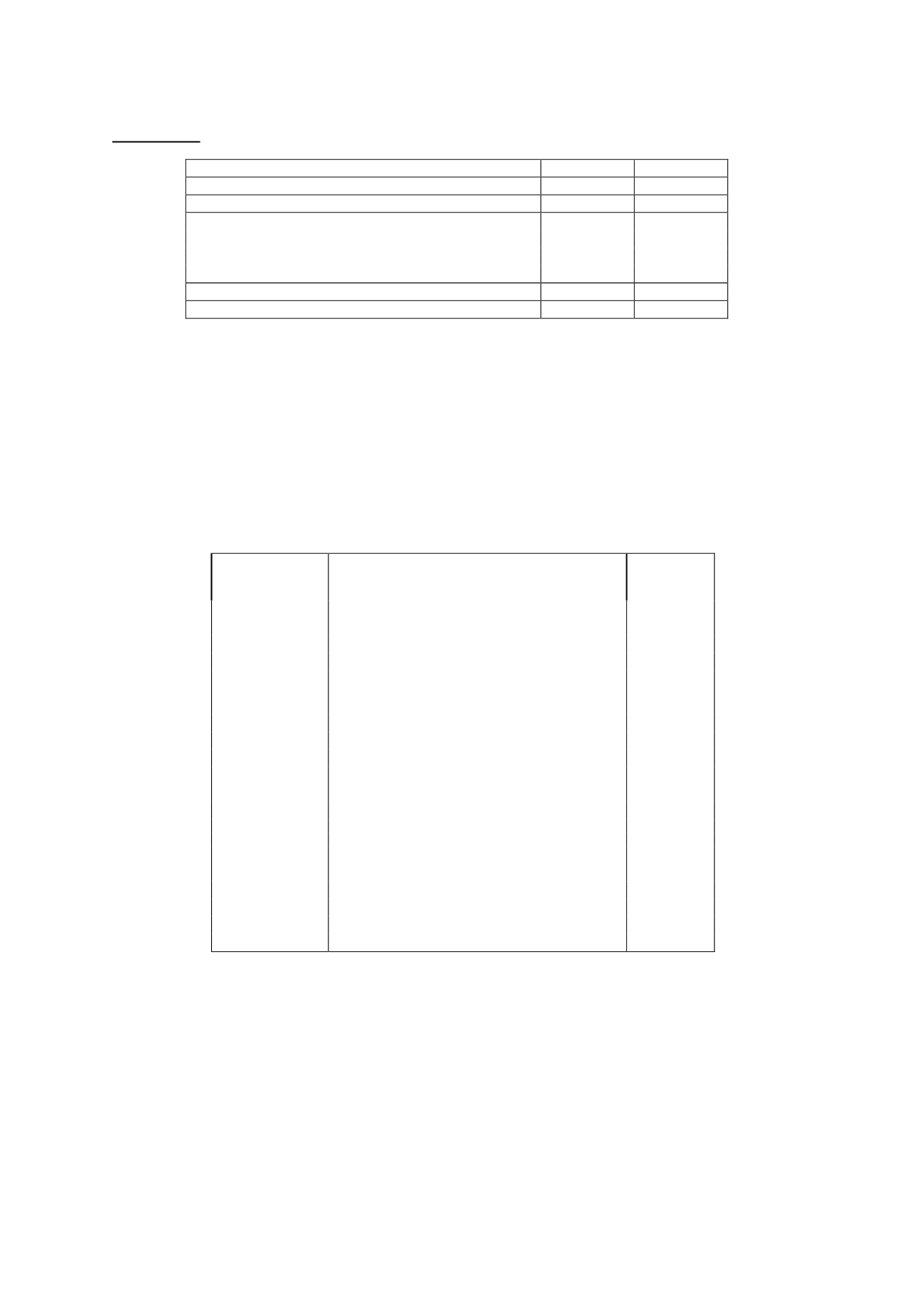

The companies composing the tax Group at 31 December 2013 are as follows:

TAXPAYER

IDENTIFICATION

NUMBER

SUBSIDIARY

Date of

inclusion in

theGroup

B85384881

Antena 3 Eventos, S.L.U.

01/01/08

B82832841

Antena 3 Films, S.L.U.

01/01/03

A86317872

Antena 3 Juegos, S.A.U.

01/01/11

B84187335

Antena 3Multimedia, S.L.U.

01/01/04

A84920230

Antena 3 Televisión Digital Terrestre de Canarias,

S.A.U.

01/01/06

B86424132

Antena 3 Noticias, S.L.U.

01/01/12

B84171453

Atres Advertising, S.L.U.

01/01/04

B86885530

Atresmedia Foto, S.L.

01/01/13

A81797656

Canal Media Radio, S.A.U.

01/01/05

A50005875

Estaciones Radiofónicas de Aragón, S.A.U.

01/01/03

A80847601

Guadiana Producciones, S.A.U.

01/01/01

A20175634

Ipar Onda, S.A.U.

01/01/03

B85408128

La Sexta Editorial Musical, S.L.U.

01/10/12

A79458535

Música Aparte, S.A.U.

01/01/01

A78683851

Onda Cero, S.A.U.

01/01/03

A84615178

Publiseis Iniciativas Comerciales, S.A.U.

01/10/12

B15609837

RadioMedia Galicia, S.L.U.

01/01/05

B84196914

Uniprex Televisión, S.L.U.

01/01/04

B84405422

Uniprex Valencia TV, S.L.U.

01/01/05

A28782936

Uniprex, S.A.U.

01/01/01

The filing of consolidated tax returns gives rise to reciprocal intra-Group balances, due to the

offset of the losses incurred by certain companies against the profit earned by other Group

companies. These balances are recognised under “Payable to Group Companies” and “Receivable

fromGroup Companies”, as appropriate.

Income tax is calculated on the basis of the accounting profit determined by application of

generally accepted accounting principles, which does not necessarily coincide with the taxable

profit.