49

18.7Years open for review and tax audits

Under current legislation, taxes cannot be deemed to have been definitively settled until the tax

returns filed have been reviewed by the tax authorities or until the four-year statute-of-limitations

period has expired. At 31 December 2013, the Company had from 2005 onwards open for review

for income tax since in 2010 it underwent a partial review in this connection. The Company has

from 2009 onwards open for review for all the other taxes applicable to it.

The Company's directors consider that the tax returns for the aforementioned taxes have been

filed correctly and, therefore, even in the event of discrepancies in the interpretation of current tax

legislation in relation to the tax treatment afforded to certain transactions, such liabilities as might

arisewould not have amaterial effect on the accompanying financial statements.

18.8. Other disclosures

In 2008 the Company acquired non-current assets as required under the terms established in

Article 36.ter of the Spanish Corporation Tax Law as amended in Law 24/2001, for the

reinvestment of the extraordinary income obtained by the Group company Uniprex Televisión,

S.L.U. on the transfer of the ownership interest in a company. This reinvestment (EUR 499,950)

gave rise to a tax credit of EUR 42 thousand, whichwas taken in 2008.

The aforementioned non-current assets continue to be held in use at Atresmedia Corporación de

Medios de Comunicación, S.A. in accordance with Article 42.8 of Spanish Corporation Tax Royal-

Decree Law 4/2004.

Also, in 2009 the Company used the aforementioned tax credit for the reinvestment of

extraordinary income deriving from the transfer of the ownership interest of Gloway Broadcasting

Services, S.L., in compliance with the requirement of Article 42. In 2009 the Company acquired

non-current assets amounting to EUR 6,414 thousand, under the terms and conditions established

in the aforementioned Article to comply with the reinvestment and earned tax credits of EUR 46

thousand that it did not use.

The Company used these tax credits in 2011.

These non-current assets continue to be used and are held in the equity of Atresmedia

Corporación deMedios de Comunicación, S.A.

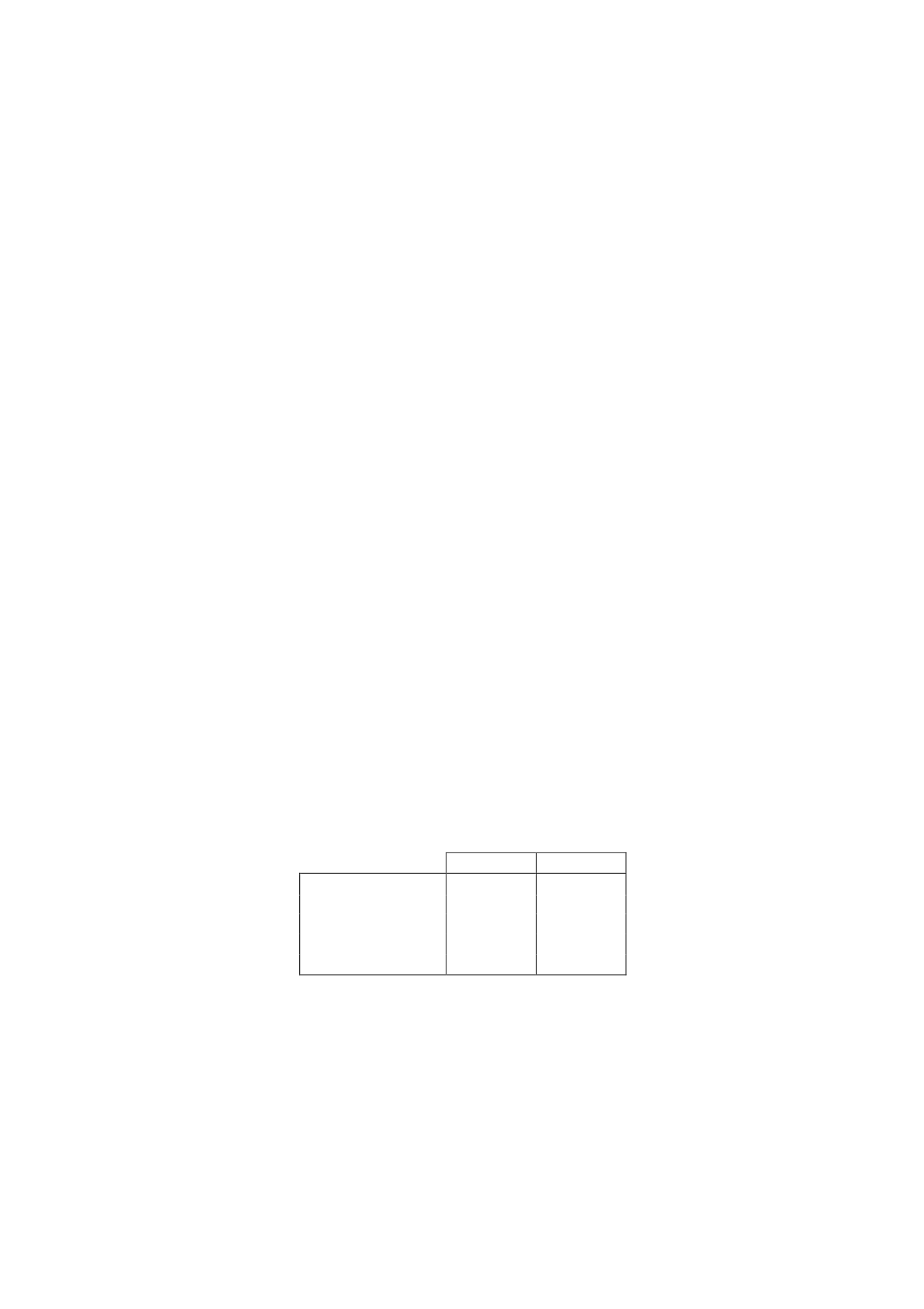

19.- Foreign currency balances and transactions

The detail of themost significant balances and transactions in foreign currency, valued at the year-

end exchange rate and the average exchange rates for the year, respectively, is as follows (in

thousands of euros):

2013

2012

Accounts receivable

1,075

1,141

Accounts payable

201,386

121,224

Sales

3,181

2,377

Purchases

128,370

104,070