48

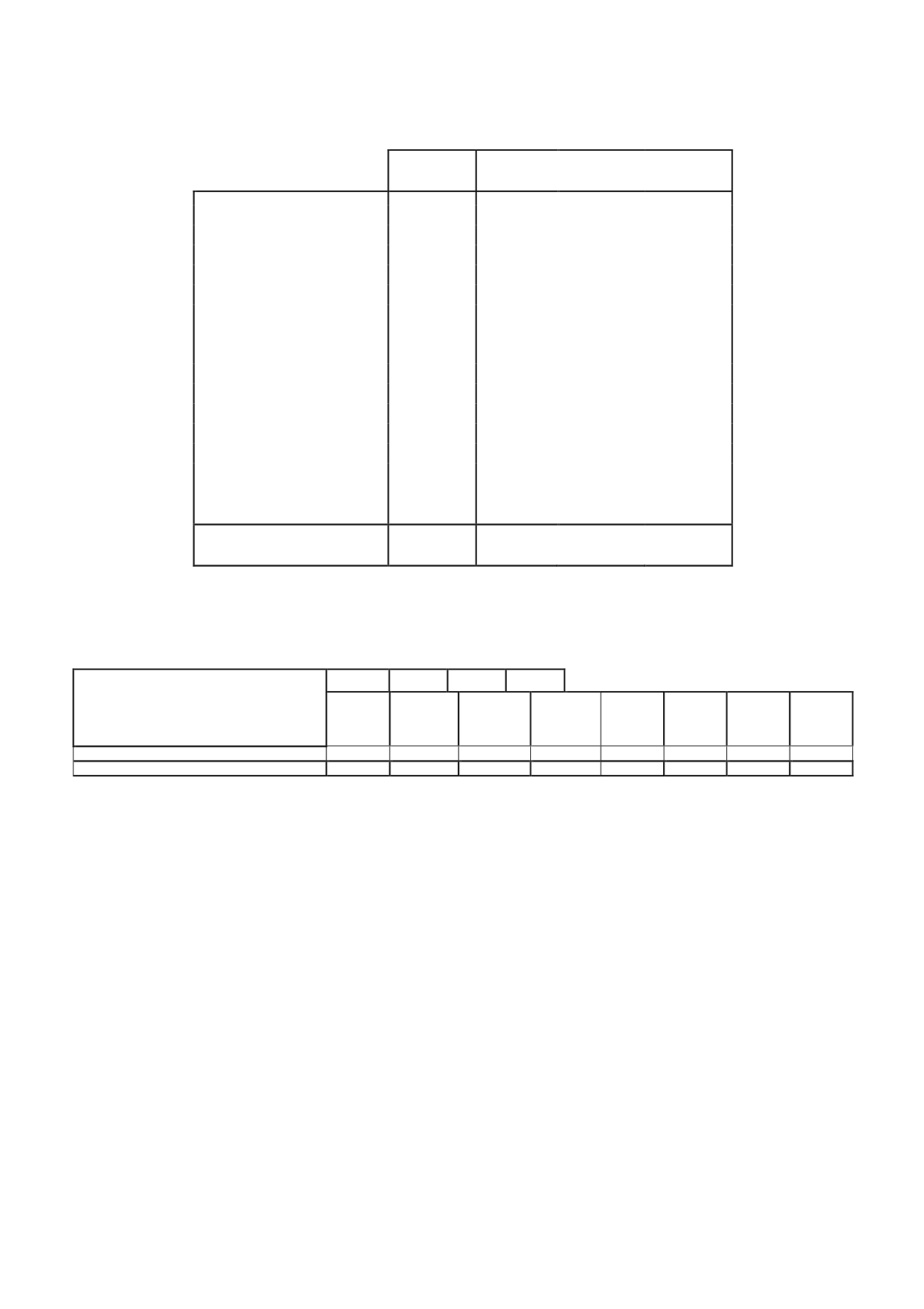

As a result of the merger by universal succession, the Company assumed the right to deduct the

tax credits and tax loss carryforwards of the transferor, in accordance with the following schedule

of deductions:

Thousands

of euros at

31/12/12

Deducted

in the

year

Unused tax

credits at

31/12/13

Last year

for

deduction

Unused tax credits

6,886

2,085

4,801

2006

366

366

-

2007

625

625

-

2008

1,094

1,094

-

2009

1,617

1,617

2019

2010

1,034

1,034

2020

2011

2,150

2,150

2021

Tax loss carryforwards

221,701

343

221,358

2005

207

207

-

2006

59,064

136

58,928

2024

2007

45,185

45,185

2025

2008

38,301

38,301

2026

2009

34,758

34,758

2027

2010

10,053

10,053

2028

2011

18,568

18,568

2029

2012

15,565

15,565

2030

Total deferred tax assets

recognised relating to La

Sexta

228,587

2,428

226,159

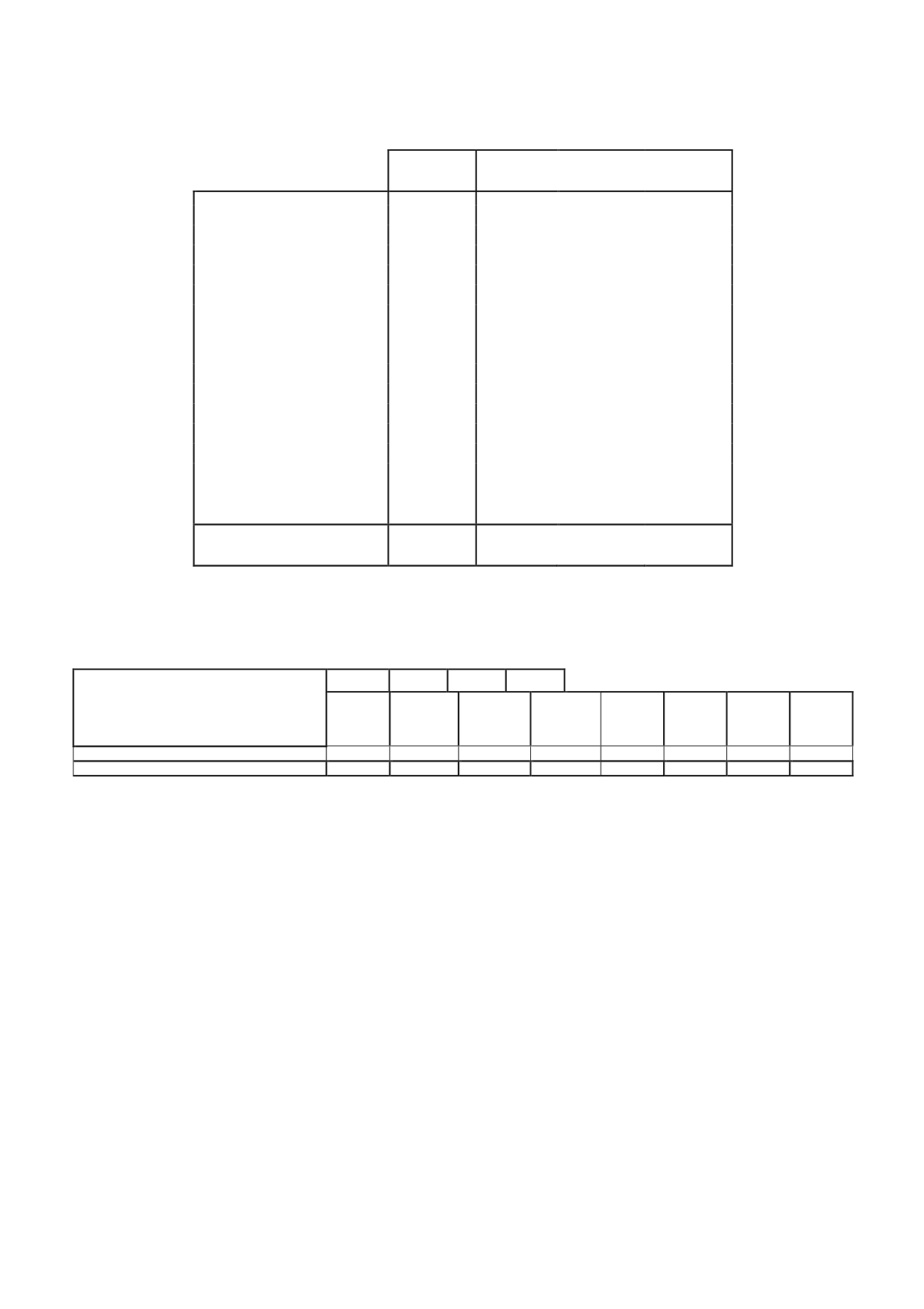

18.6Deferred tax liabilities recognised

The detail of “Deferred Tax Liabilities" and of the changes therein is as follows:

DEFERRED TAX LIABILITIES

2011 Additions Disposals

Inclusion

due to

merger

(Note 5)

2012 Additions Disposals 2013

Tax effect of identification of intangible assets

-

-

(59)

22,945

22,886

-

(237)

22,649

Total

-

-

(59)

22,945 22,886

-

(237) 22,649

In accordance with income tax recognition and measurement standard number 13, the Company

will recognise the deferred tax liabilities relating to goodwill provided that these do not arise on the

initial recognition thereof.

The deferred tax liabilities relate to the identification of the "La Sexta" brand and signal

transmission licence.

The brand is amortised for accounting purposes at an annual rate of 5% (amortisation charge for

2012: EUR 792 thousand), while the licence is not amortised.

The amortisation is not deductible for tax purposes and, therefore, gives rise to a positive

adjustment to the taxable profit (tax loss) which is recognised as a deferred tax liability.