39

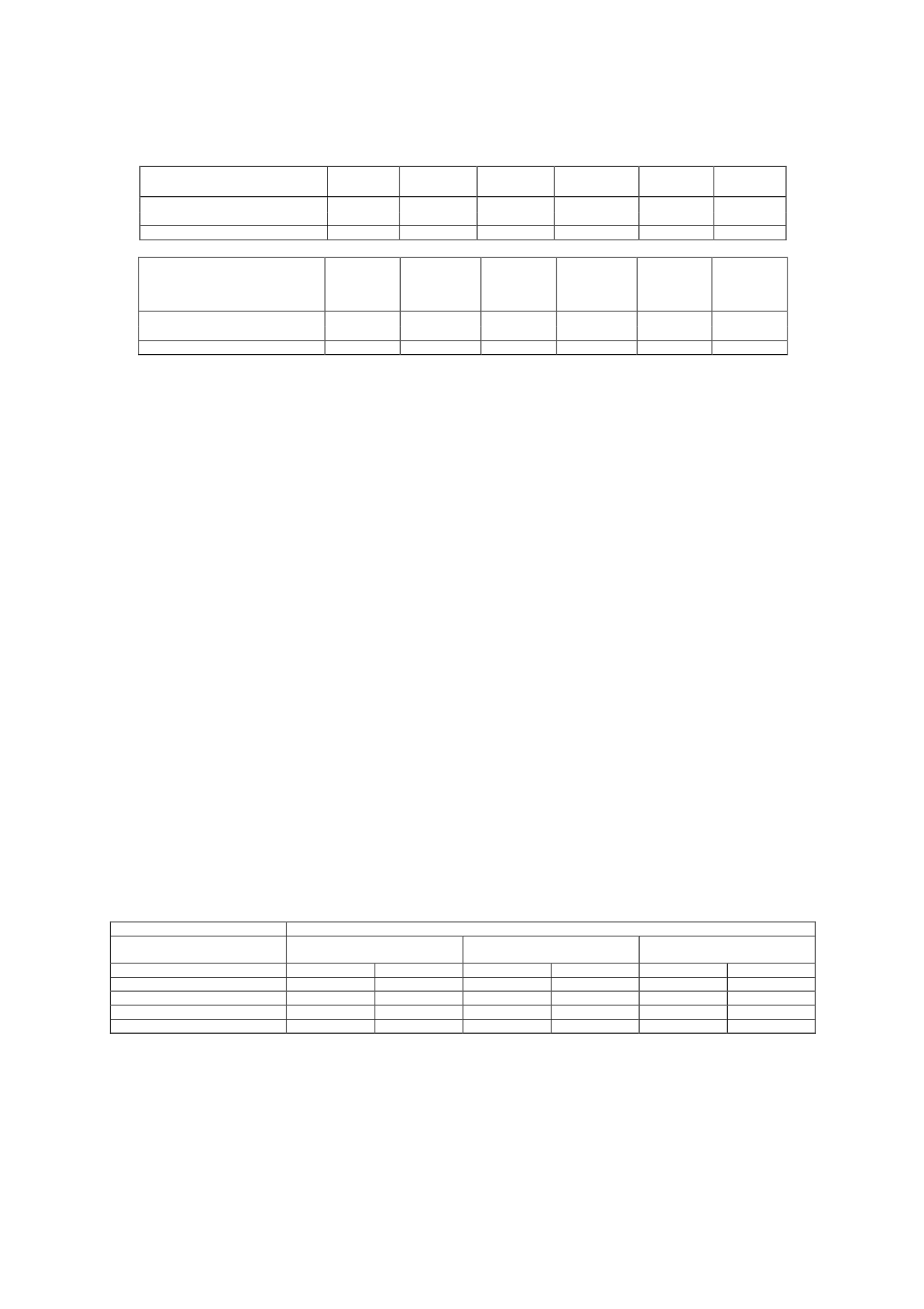

The detail of short- and long-term provisions in 2013 and 2012 were as follows (in thousands of

euros):

Provisions

Balance at

01/01/13

Charge for

the year

Transfers

Amounts

used

Excessive

provisions

Balance at

31/12/13

Litigation and other provisions

41,692

5,044

(6,566)

(1,739)

(4,127)

34,304

Total

41,692

5,044

(6,566)

(1,739)

(4,127)

34,304

Provisions

Balance at

01/01/12

Charge for

the year

Additions

due to

merger

(Note 5)

Amounts

used

Excessive

provisions

Balance at

31/12/12

Litigation and other provisions

31,540

6,261

14,079

(9,638)

(550)

41,692

Total

31,540

6,261

14,079

(9,638)

(550)

41,692

The charge for the year is reflected under "Outside Services" and the excessive provisions are

recognised under "Excessive Provisions” in the accompanying income statement.

At 31 December 2013 and 2012, certain civil, labour, criminal and administrative lawsuits had

been filed against the Company which were taken into account in estimating potential contingent

liabilities. Noteworthy, in view of their amount, were the lawsuits with certain collection societies.

As mentioned in Note 1, on 18 December 2013 the Supreme Court issued a writ of execution

enforcing the aforementioned judgment, rendering void the resolution of the Spanish Cabinet

regarding the allocation of channels. The Company does not consider it necessary to recognise a

provision in this connection.

In 2012 the tax authorities issued assessments relating to the levy on games of luck, betting or

chance, raffles and tombolas against the absorbed company Gestora de Inversiones Audiovisuales

La Sexta, S.A. for an amount of EUR 6,903 thousand. In this respect, the merger agreements

established that La Sexta shareholders must indemnify Atresmedia Corporación de Medios de

Comunicación, S.A. for any economic loss that could arise from these assessments.

The directors of the Company and its legal advisers do not expect anymaterial liabilities additional

to those already recognised to arise from the outcome of the lawsuits in progress.

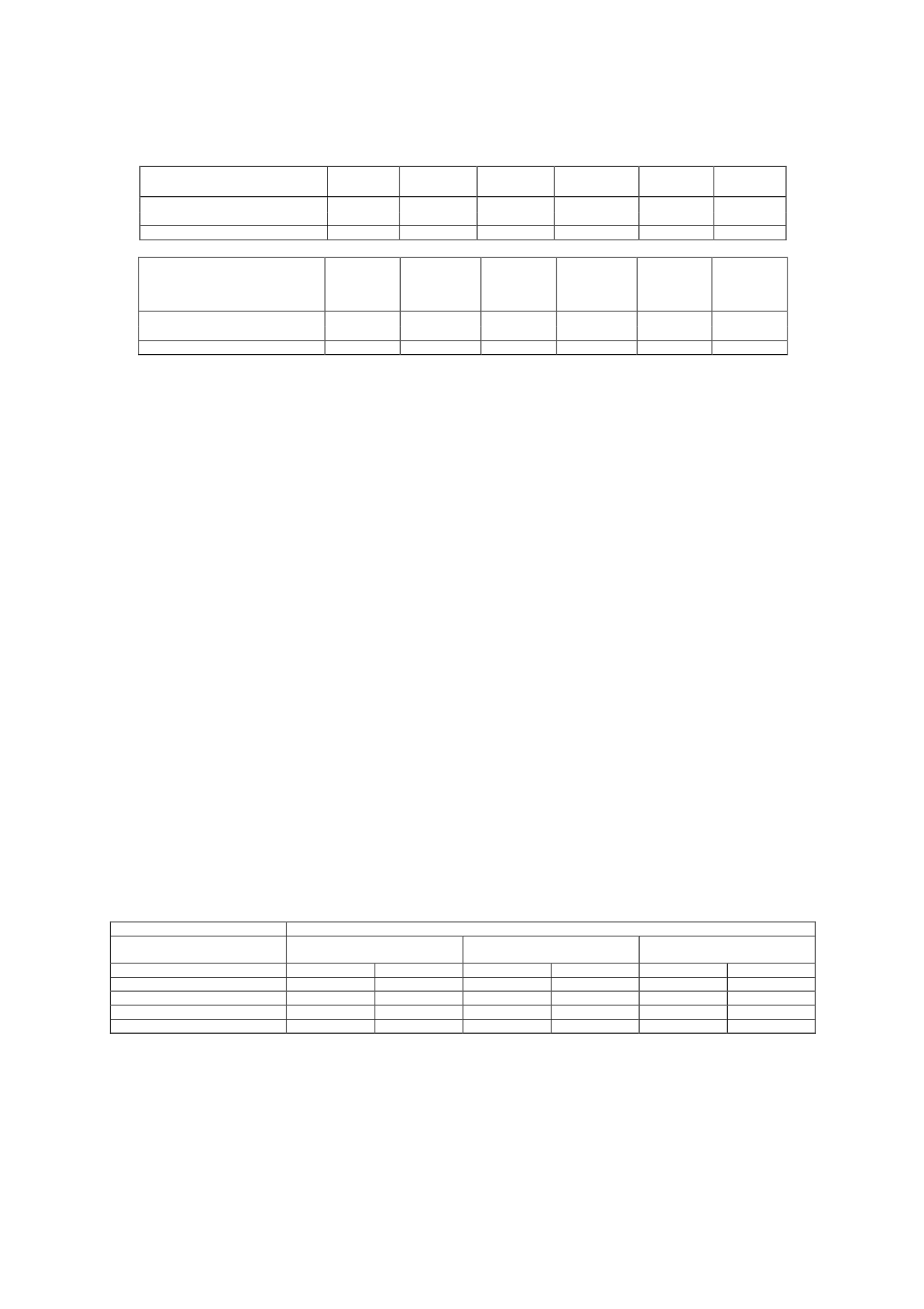

16.- Non-current and current liabilities

16.1Non-current financial liabilities

The detail of “Non-Current Payables” at the end of 2013 and 2012 is as follows (in thousands of

euros):

Non-current financial instruments

Bank borrowings

Derivatives and other

Total

2013

2012

2013

2012

2013

2012

Accounts payable

200,129

-

63,264

183

263,393

183

Derivatives

-

-

207

197

207

197

Total

200,129

-

63,471

380

263,600

380

The detail, bymaturity, of “Non-Current Payables” is as follows (in thousands of euros):