34

11.- Derivative financial instruments

The Company uses derivative financial instruments to hedge the risks to which its business

activities, operations and future cash flows are exposed. As part of these transactions, the

Company has arranged certain hedging financial instruments, the detail of which is as follows:

Foreign currency hedges

The Company uses currency derivatives to hedge significant future transactions and cash flows.

The instruments purchased are denominated in US dollars.

The Company applies hedge accounting and documents the hedging relationships and the

measurement of their effectiveness as required by current legislation. In all cases, these include

the cash flow hedges of firm commitments, of which the EUR/USD forward exchange rate

exposures to possible variations in the cash flows payable in euros associated with broadcasting

rights is hedged.

For 2013, due to the commencement of the period in which the broadcasting rights being hedged

come into force, EUR 52 thousand was capitalised to inventories from equity. For 2012, inventories

were reduced by EUR 303 thousand with a charge to equity. The changes in the fair value of the

derivatives arranged by the Company depend on the change in the EUR/USD exchange rate and

on the euro yield curve.

At 31 December 2013, the Company had arranged instruments to hedge its foreign currency asset

and liability positions amounting to USD 89,863 thousand, at a weighted average exchange rate of

EUR 1.3117/USD 1. At 31 December 2012, the Company had arranged hedging instruments

amounting to USD 89,611 thousand, at a weighted average exchange rate of EUR 1.3058/USD 1.

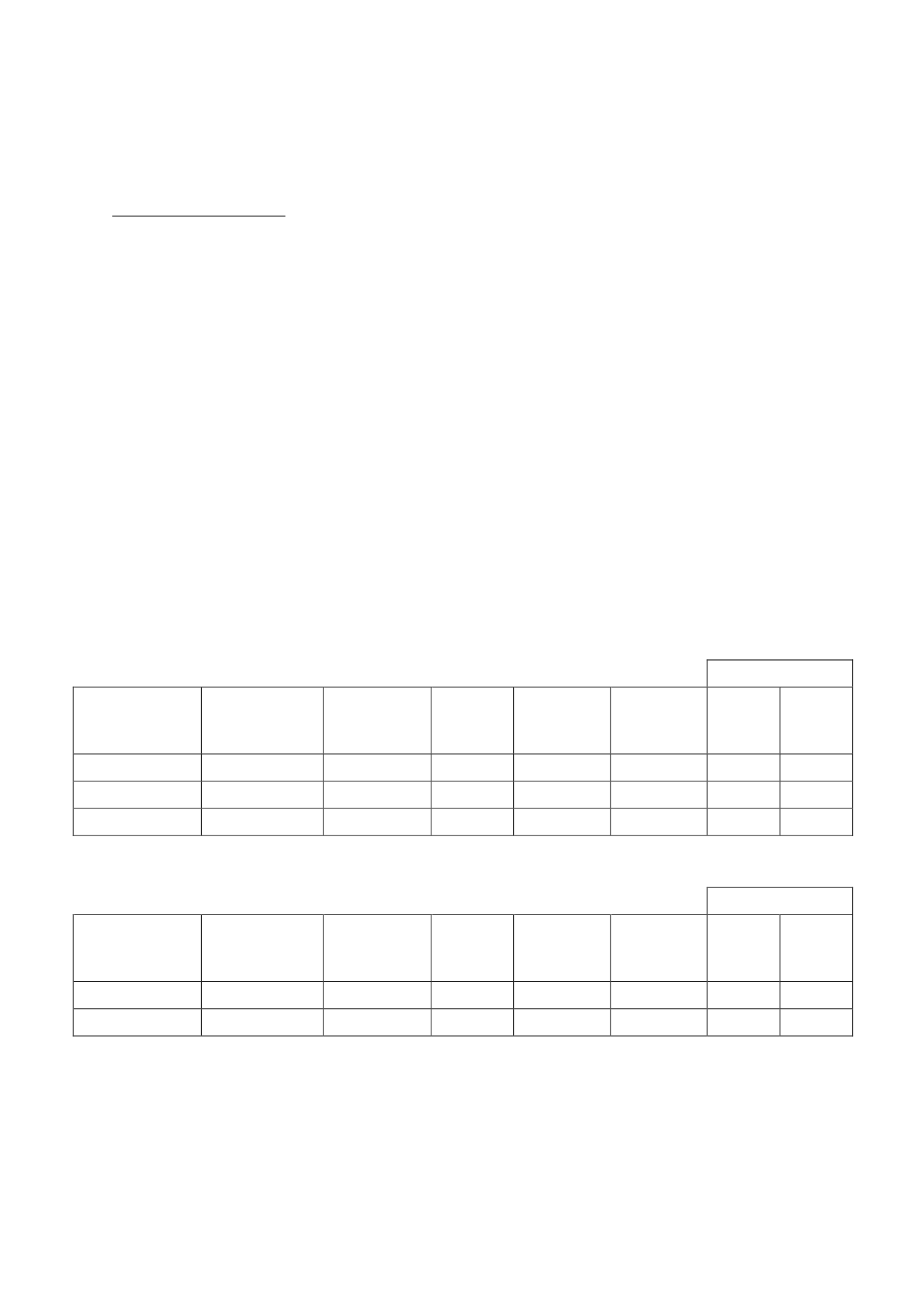

At the end of 2013 and 2012, the total amount of outstanding forward currency contracts entered

into by the Group is as follows (the terms reflect the moment in which the hedged portion is

recognised and in which the value of the hedging instruments is adjusted in equity as an increase

in/reduction of inventories):

Fair value

(thousands of euros)

Classification

Type

Maturity

Amount

arranged

(thousands

of euros)

Ineffectiveness

recognised in

profit or loss

(thousands

of euros)

Assets

Liabilities

Foreign currency

hedges

Foreign currency

hedge

Purchase of USD

2014

62,520

-

698

3,025

Foreign currency

hedges

Foreign currency

hedge

Purchase of USD

2015

7,313

-

-

189

Foreign currency

hedges

Foreign currency

hedge

Purchase of USD

2016

8,053

-

-

18

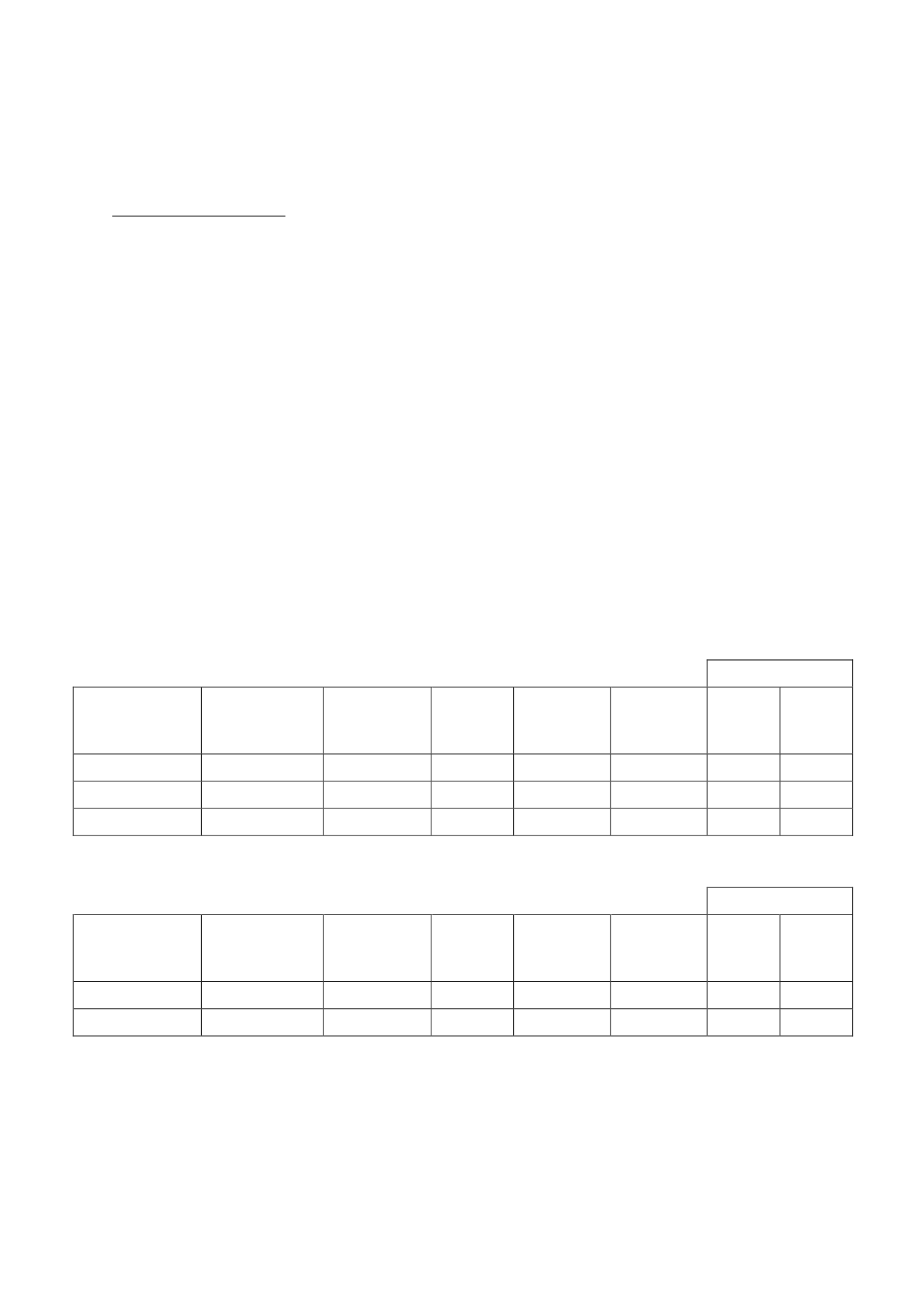

The information in this connection at 31 December 2012 is as follows:

Fair value

(thousands of euros)

Classification

Type

Maturity

Amount

arranged

(thousands

of euros)

Ineffectiveness

recognised in

profit or loss

(thousands

of euros)

Assets

Liabilities

Foreign currency

hedges

Foreign currency

hedge

Purchase of USD

2013

60,575

-

1,245

485

Foreign currency

hedges

Foreign currency

hedge

Purchase of USD

2014

8,053

-

-

197

At 31 December 2013, the fair value of the Company’s foreign currency derivatives, which are

designated and are effective as cash flow hedges, was estimated to be positive by EUR 698

thousand and negative by EUR 3,232 thousand (31 December 2012: positive by EUR 1,245

thousand and negative by EUR 682 thousand). This amount was deferred and recognised in equity.