24

arising in a business combinations in this connection. The fair value of the licence was calculated

on the basis of its capacity to generate income with an indefinite useful life using the discounted

cash flowmethod. The royalty relief method was used to calculate the fair value of the trademark,

considering a useful life of 20 years.

At 2012 year-end, the allocation of the fair values of the assets acquired and liabilities assumed, in

particular of trademarks and licences, was subject to possible adjustments within one year from

the acquisition date, as required by accounting legislation. The purpose of these adjustments is to

reflect, in general, any additional information obtained during the aforementioned measurement

period, and, in the Company's particular case, the information referring to the Spanish Supreme

Court judgment of 27 November 2012 relating to the assignment of digital multiplexes with

national coverage. Once this period had elapsed and following a review by the Company, based on

a report by an independent expert, of the values initially assigned to the aforementioned assets

(using various widely accepted valuationmethods for this purpose), there was no change in those

values.

Had the business combination been performed at the beginning of 2012, revenue would have

amounted to EUR 671,483 thousand and a loss of EUR 16,249 thousand would have been incurred

in the year.

After integration of the merged entity at the acquisition date, and in view of the fact that it was

not possible to extract separate information on the revenue and net profit or loss attributable to

the business combination, this informationwas not included.

The directors consider that these pro forma figures represented a reasonable approximation of the

annual performance of the new merged entity and an initial point of reference for comparison in

future years. In order to determine these pro forma revenue and profit or loss figures, Company

management took into account non-current asset depreciation and amortisation calculated on the

basis of the acquisition-date fair values and borrowing costs calculated on the basis of the situation

of the debt existing after the date of the business combination.

Lastly, it should be noted that fees paid to legal advisers and other professionals involved in the

transaction amounted to EUR 3,428 thousand, EUR 2,131 thousand of which related to 2012 and

was recognised under "Other Operating Expenses" in the income statement.

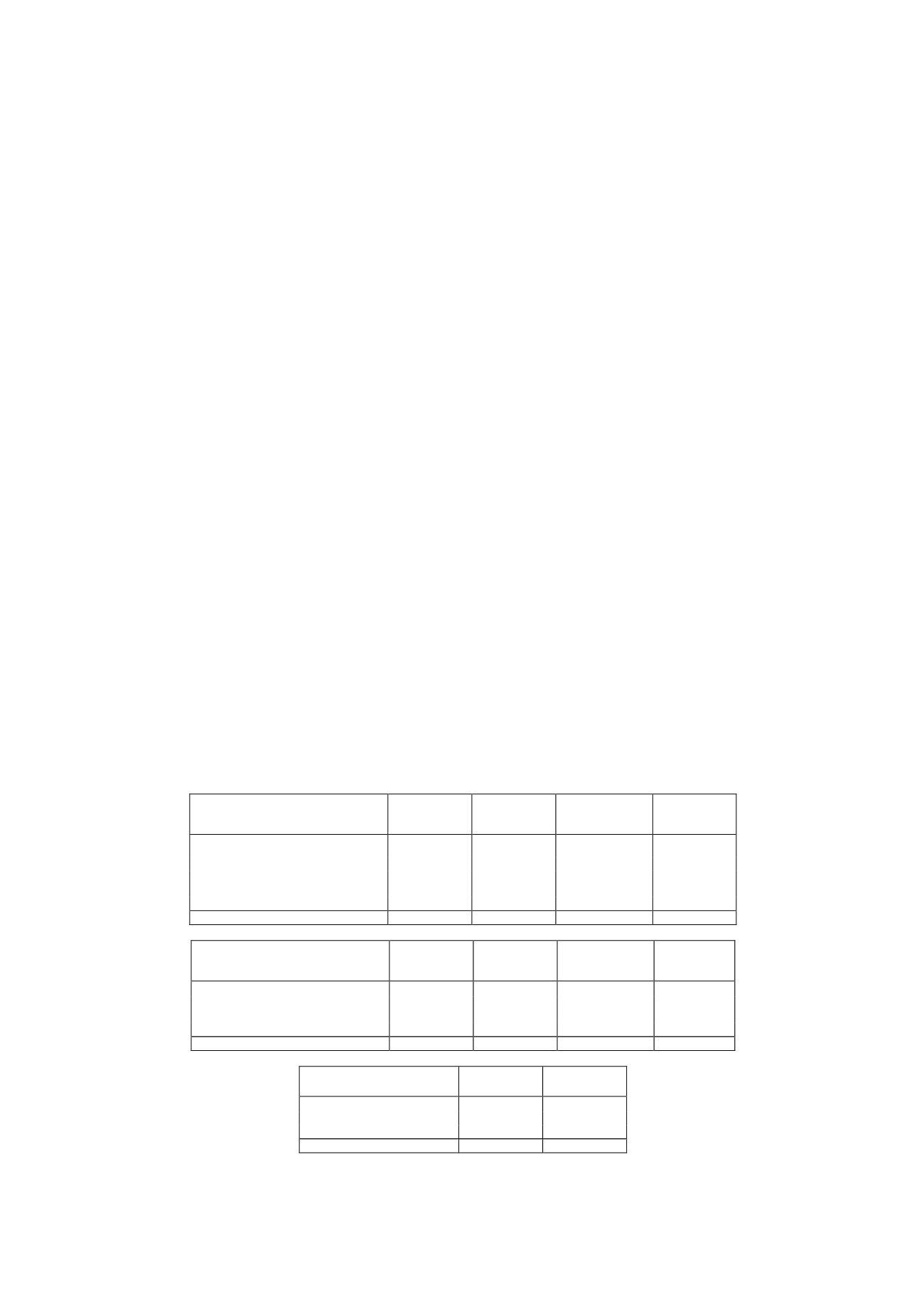

6.- Intangible assets

The changes in “Intangible Assets” in the balance sheets in 2013 and 2012 were as follows (in

thousands of euros):

Cost

Balance at

01/01/13

Additions

Increase or

decrease due

to transfer

Balance at

31/12/13

Licence

60,666

-

-

60,666

Trademark

15,819

-

-

15,819

Computer software

33,675

2,583

(368)

35,890

Other intangible assets

304

-

-

304

Total cost

110,464

2,583

(368)

112,679

Accumulated amortisation

Balance at

01/01/13

Charge for

the year

Increase or

decrease due

to transfer

Balance at

31/12/13

Trademark

(198)

(791)

-

(989)

Computer software

(27,127)

(2,989)

15

(30,101)

Other intangible assets

(304)

-

-

(304)

Total accumulated amortisation

(27,629)

(3,780)

15

(31,394)

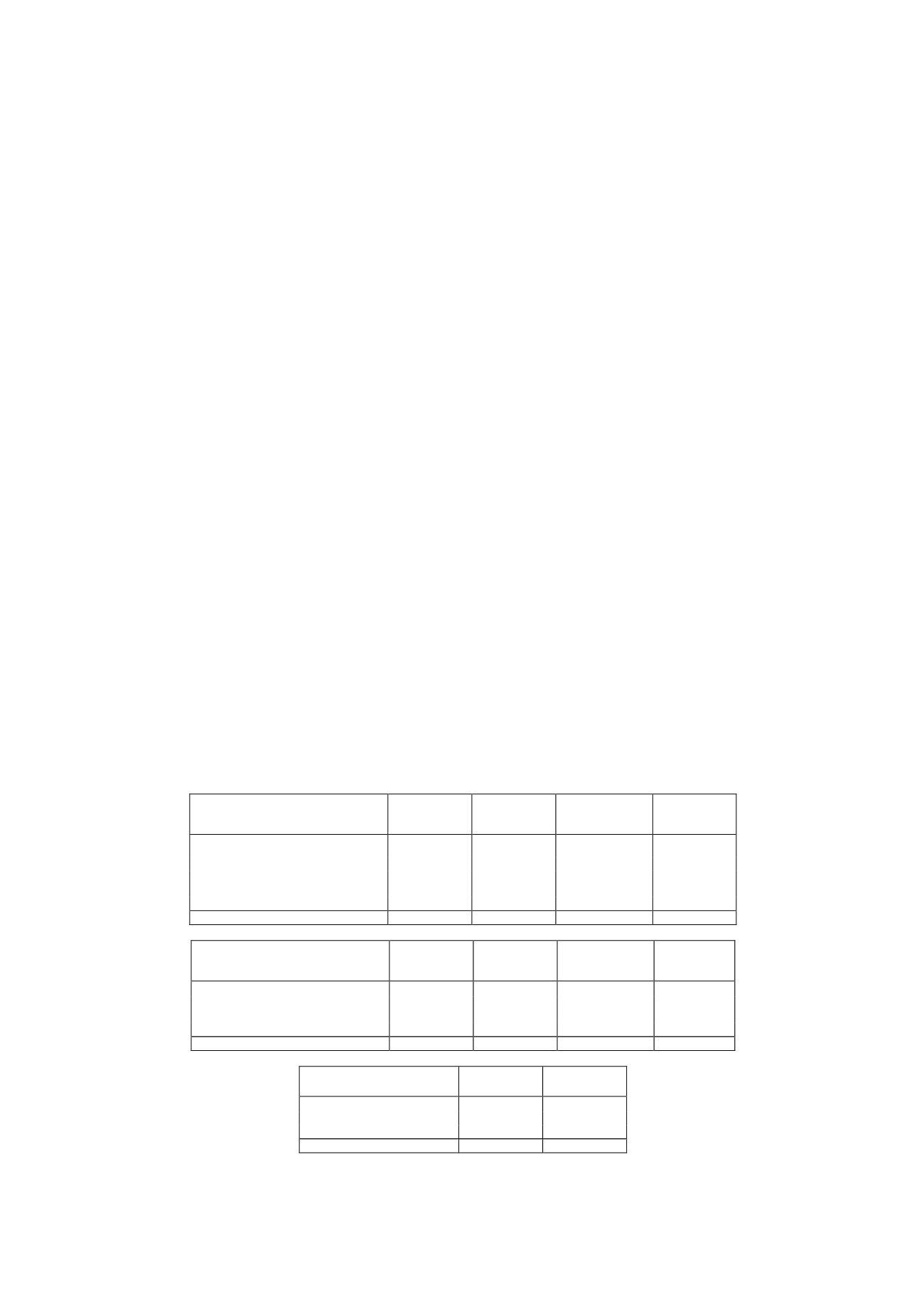

Total intangible

assets

Balance at

01/01/13

Balance at

31/12/13

Cost

110,464

112,679

Accumulated amortisation

(27,629)

(31,394)

Total, net

82,835

81,285