16

-

Non-inventoriable in-house productions (programmes produced to be shown only once) are

measured using the same methods and procedures as those used to measure inventoriable in-

house productions. Programmes produced and not shown are recognised at year-end under

“Programme Rights - In-House Productions and Productions in Process” in the balance sheet. The

cost of these programmes is recognised as an expense under “Programme Amortisation and

Other” in the income statement at the time of the first showing.

-

Rights on outside productions (films, series and other similar productions) aremeasured at

acquisition cost. These rights are deemed to have been acquired when the term of the right

commences for the Company. Payments made to outside production distributors prior to

commencement of the term of the right are recorded under “Advances to Suppliers” in the balance

sheet.

The amortisation of the rights is recognised under “Programme Amortisation and Other” in the

income statement on the basis of the number of showings, in accordance with the rates shown

below, which are established on the basis of the number of showings contracted:

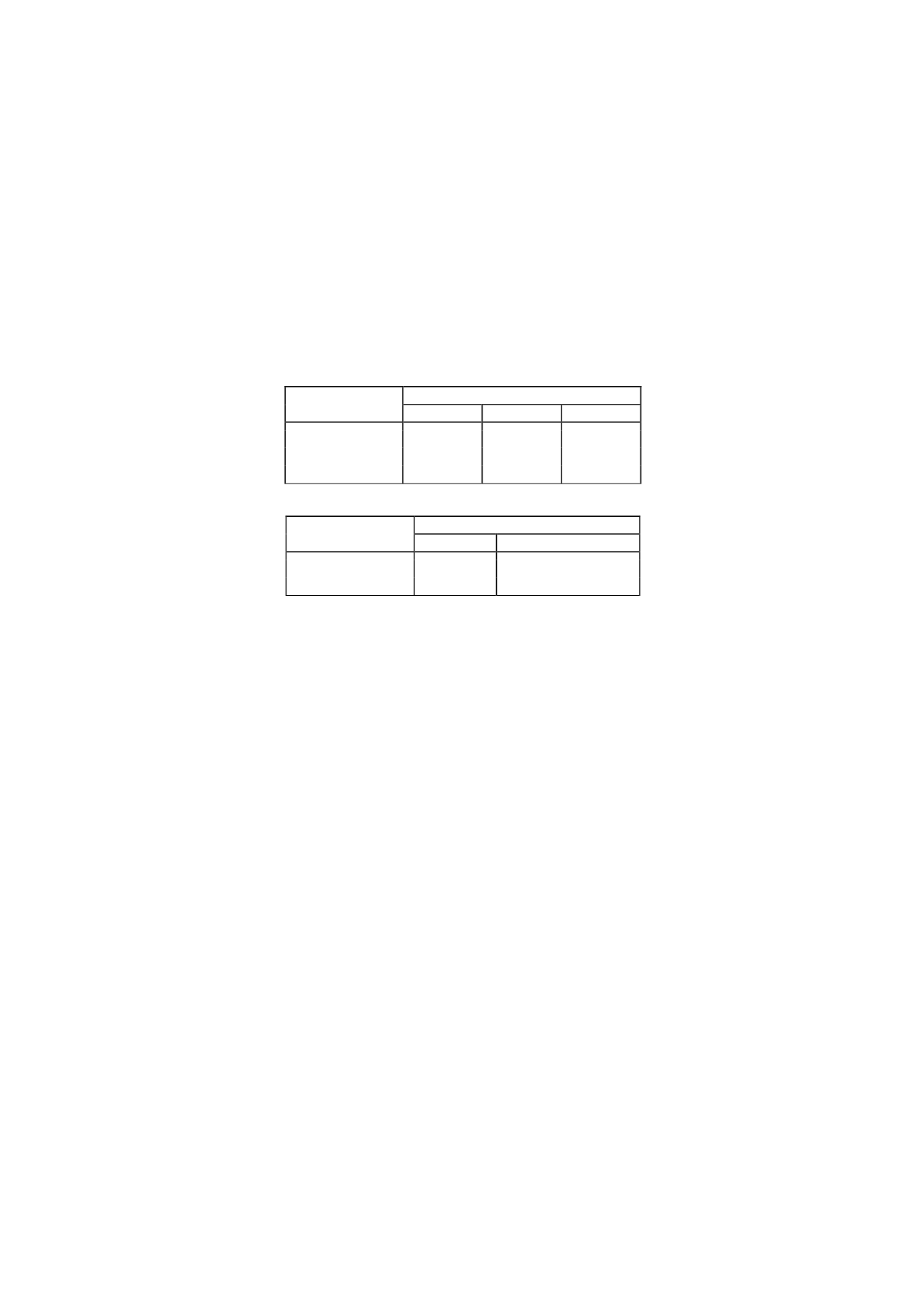

FILMS

Number of showings contracted

1

2

3ormore

1st showing

100%

50%

50%

2nd showing

-

50%

30%

3rd showing

-

-

20%

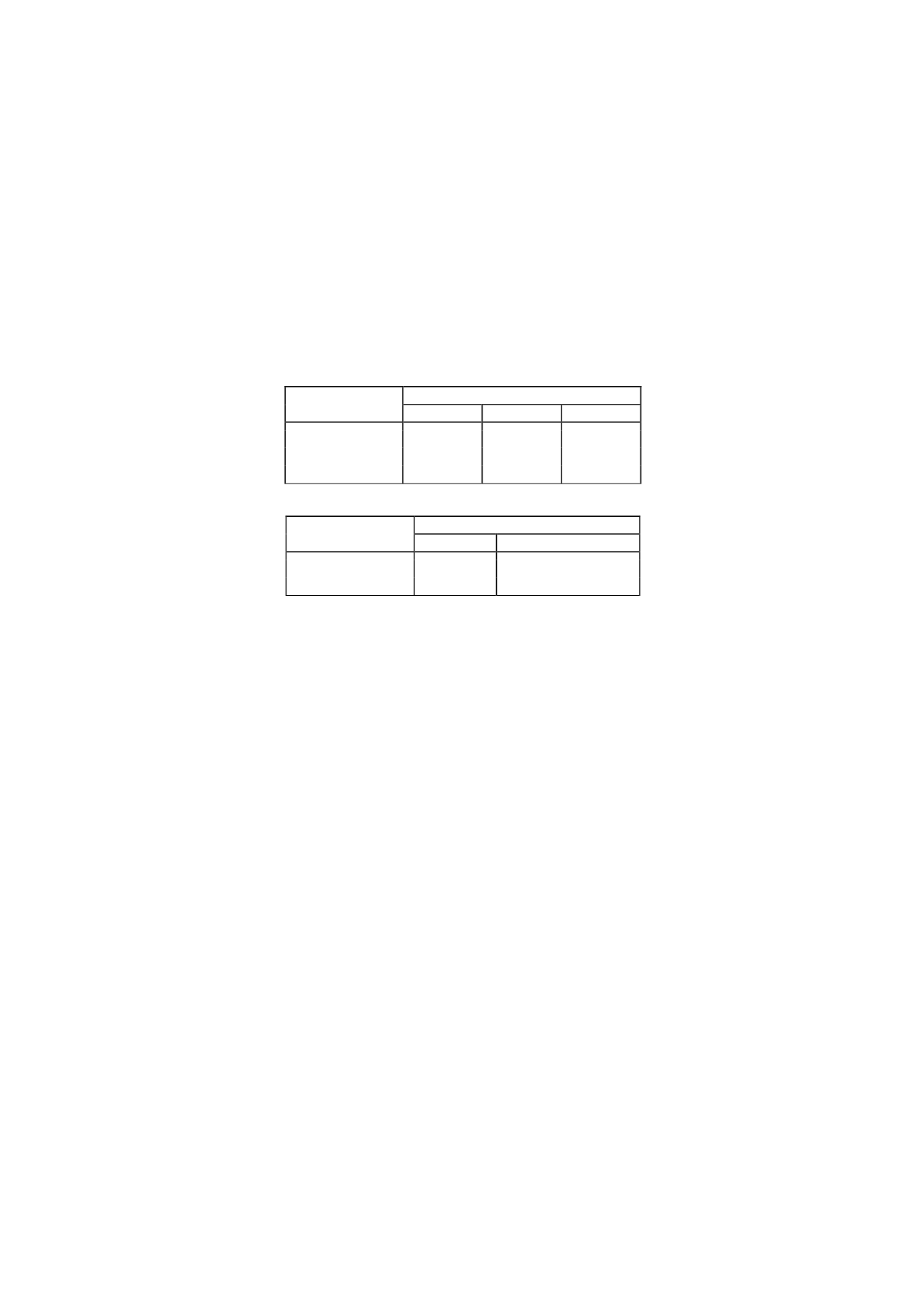

SERIES

Number of showings contracted

1

2ormore

1st showing

100%

50%

2nd showing

-

50%

-

Live broadcasting rights aremeasured at cost. The cost of these rights is recognised as an

expense under “Programme Amortisation and Other” in the income statement at the time of

broadcast of the event onwhich the rights were acquired.

Raw and othermaterials

Dubbings, sound tracks, titles and signature tunes of outside productions are recorded at

acquisition or production cost. The amortisation of rights is recorded under “Programme

Amortisation and Other” in the income statement at the time of the showing, using the same

methods as those used for outside productions.

Other inventories are recorded at acquisition cost and are allocated to profit or loss by the

effective or actual amortisationmethod over the production period.

Write-downs

The Company recognises write-downs to reduce the unamortised value of in-house productions

and of the rights on outside productions which it considers will not be shown. When these rights

expire, the valuation adjustments are recognised in profit or loss when the cost of the rights is

derecognised.

Classification of programmes

In accordance with the Spanish National Chart of Accounts, programme inventories are classified

as current assets on the basis of the normal business cycle and standard practice in the industry in

which the Company operates. However, programmes are amortised over several years (see Note

13).