35

The derivatives were measured by estimating the present value of the future cash flows that will

arise under the terms and conditions arranged by the parties in the derivative contract. The cash

price is taken to be the reference exchange rates of the European Central Bank on 31 December

2013, the swap points (offer/bid) and the interest rates prevailing at themeasurement date.

The foreign currency derivatives have been arranged in such a way that they are fully effective at

each reference date and, accordingly, are recognised in full in equity, until the inventories are

recognised.

The sensitivity analysis indicates that positive or negative changes of 10% in spot EUR/USD

exchange rates would give rise to changes of approximately EUR 14million in the fair value of the

foreign currency derivatives (2012: EUR 9million). Increases in the value of the euro (depreciation

of the US dollar) would increase negative values while decreases in the value of the euro would

increase positive values.

Interest rate hedges

In August 2013 the Company arranged interest rate derivatives (IRSs) in order to fix the financial

cost arising from the floating interest rates applicable to each of the tranches of syndicated

financing arranged at that date.

These IRSs expire on August 2017 and the hedged amount is EUR 111,209 thousand with a fixed

interest rate of 1.01%. At 31 December 2013, the fair value thereof amounted to EUR 5 thousand.

12.- Non-current assets classified as held for sale

In 2013 the Company sold the investment in Unipublic, S.A. that was classified at 31 December

2012 under "Non-Current Assets Classified as Held for Sale". This transaction did not have any

impact on the income statement for 2013.

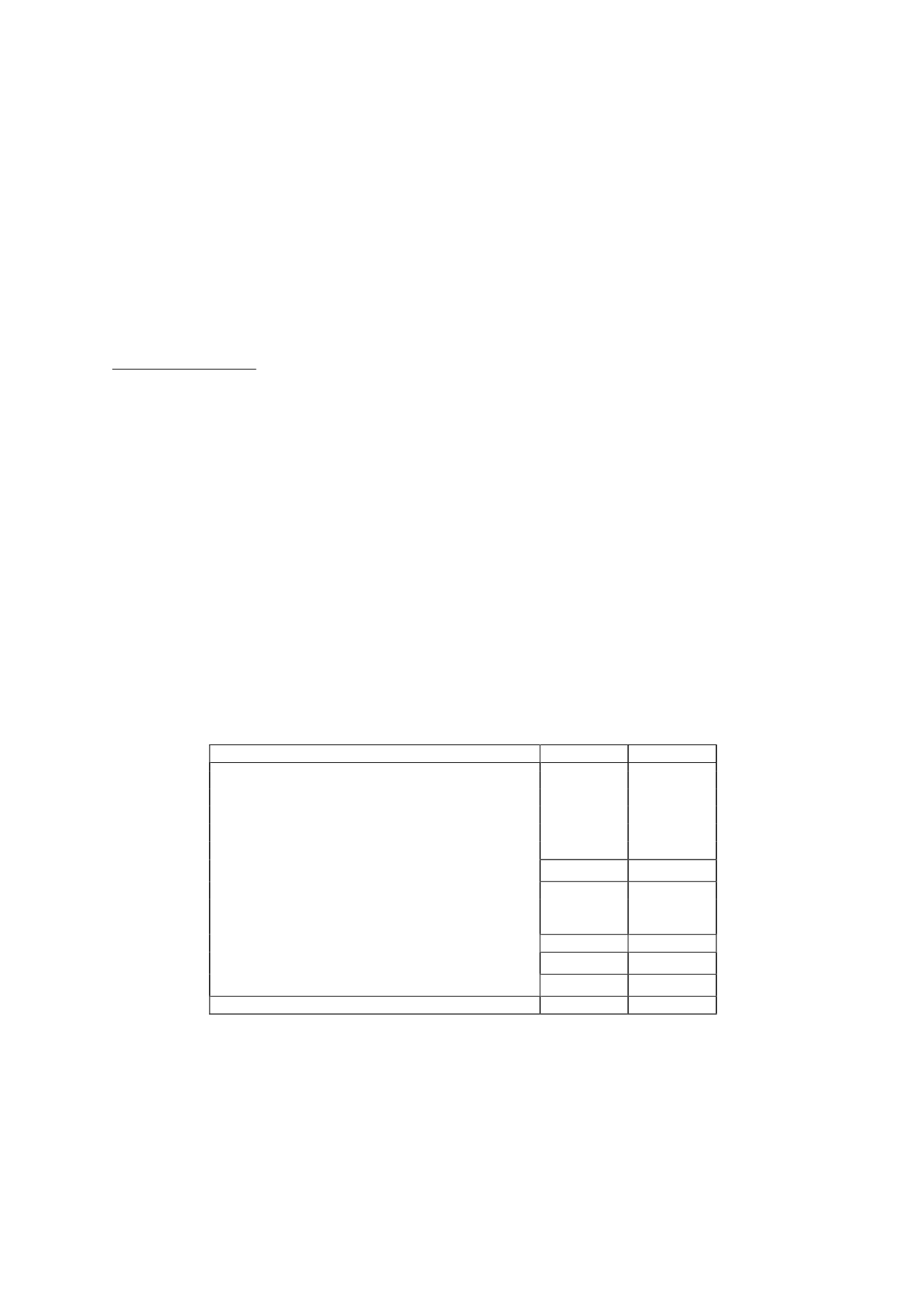

13.- Inventories

The detail of “Inventories” in the balance sheets at 31 December 2013 and 2012 is as follows:

Thousands of euros

2013

2012

Programme rights, net-

Rights on outside productions

254,144

189,363

In-house productions and programmes in process

36,455

43,876

Sports broadcasting rights

3,460

3,214

Inventory write-downs - outside productions

(33,754)

(19,516)

260,305

216,937

Consumables and other inventories-

Dubbings, soundtracks and titles

2,076

1,991

Other materials

940

930

3,016

2,921

Advances to suppliers

29,181

29,293

Total

292,502

249,151

“Advances to Suppliers” in the accompanying balance sheets at 31 December 2013 and 2012

includes basically advances paid in connectionwith outside production commitments.