41

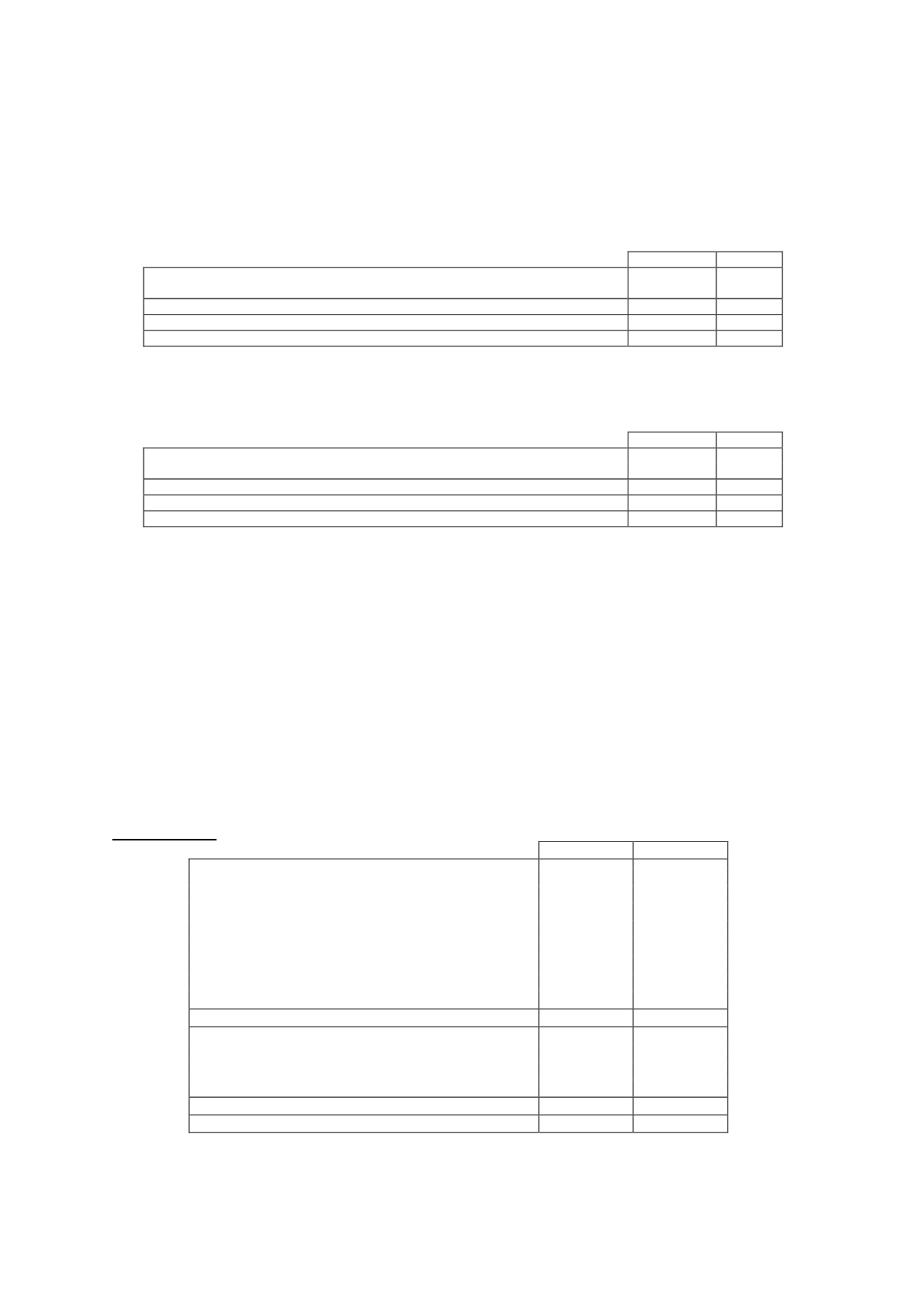

17.- Tradepayables

The maximum payment period applicable to the Company under Law 3/2004, of 29 December, on

combating late payment in commercial transactions and pursuant to the transitional provisions

contained in Law 15/2010, of 5 July, is 60 days in 2013 (2012: 75 days).

The detail of the amounts paid and payable at 31 December 2013 is as follows (in thousands of

euros):

Amount

%

Within themaximum payment period

189,760

35%

Other

359,981

65%

Total paymentsmade in2013

549,741

Weighted average period of late payment (in days)

47

Payments at year-end not made in themaximum payment period

37,084

The detail of the amounts paid and payable at 31 December 2012 is as follows (in thousands of

euros):

Amount

%

Within themaximum payment period

380,809

83%

Other

75,921

17%

Total paymentsmade in2012

456,730

Weighted average period of late payment (in days)

50

Payments at year-end not made in themaximum payment period

18,224

Weighted average period of late payment was calculated as the quotient whose numerator is the

result of multiplying the paymentsmade to suppliers outside themaximum payment period by the

number of days of late payment and whose denominator is the total amount of the payments

made in the year outside themaximum payment period.

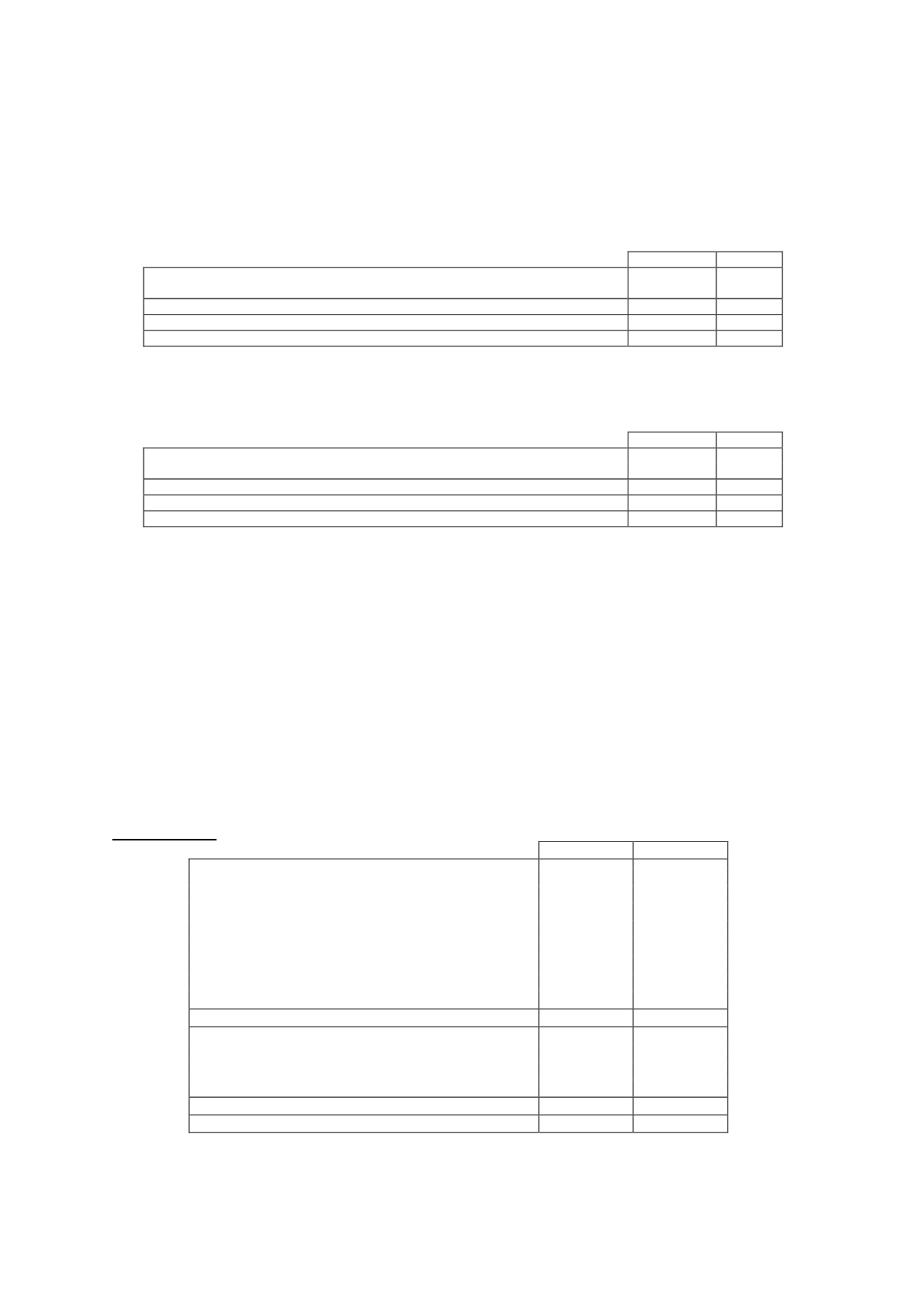

18.- Taxmatters

18.1 Current tax receivablesand taxpayables

The detail of the current tax receivables andpayables is as follows (in thousands of euros):

Tax receivables

2013

2012

Tobe settled in2014:

6,556

3,806

Deferred tax assets

1,472

2,779

Tax loss carryforwards

2,905

Unused tax credits and tax relief

2,179

1,027

Tobe settled from2015:

298,830

299,623

Deferred tax assets

14,429

19,572

Tax loss carryforwards

218,452

221,701

Unused tax credits and tax relief

65,949

58,350

Total non-current assets

305,386

303,429

Income tax refundable

911

1,188

2013 income tax refundable

647

566

Other tax receivables

128

1,343

Total current assets

1,686

3,097

TOTALTAXRECEIVABLE

307,073

306,526