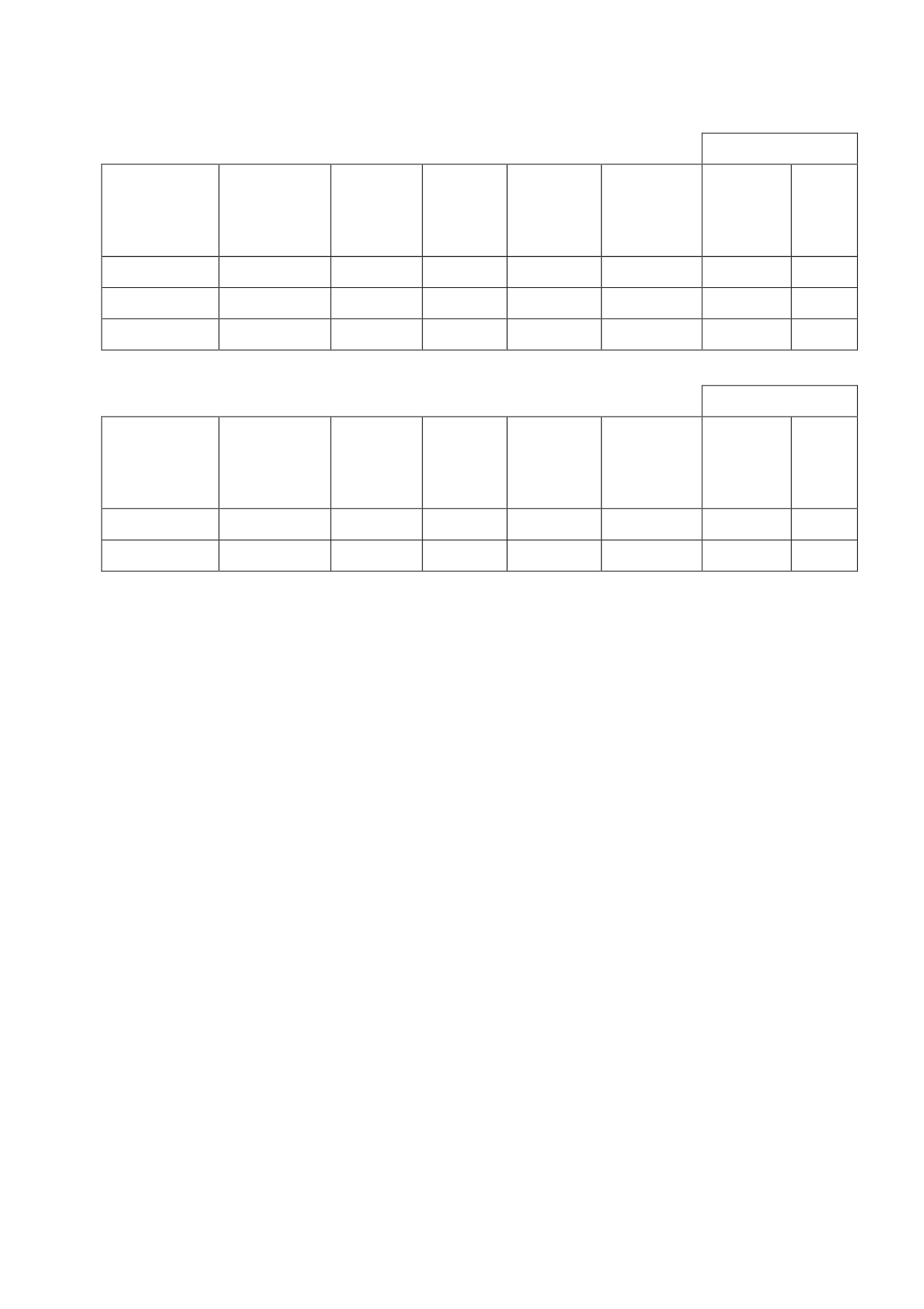

52

Fair value

(thousands of euros)

2013

Classification

Type

Maturity

Amount

arranged

(thousands

of euros)

Ineffective

portion

recognised in

profit or loss

(thousands

of euros)

Assets

Liabilities

Currency forwards

Foreign currency

hedge

Purchase of

USD

2014

62,520

-

698

3,025

Currency forwards

Foreign currency

hedge

Purchase of

USD

2015

7,313

-

-

189

Currency forwards

Foreign currency

hedge

Purchase of

USD

2016

8,053

-

-

18

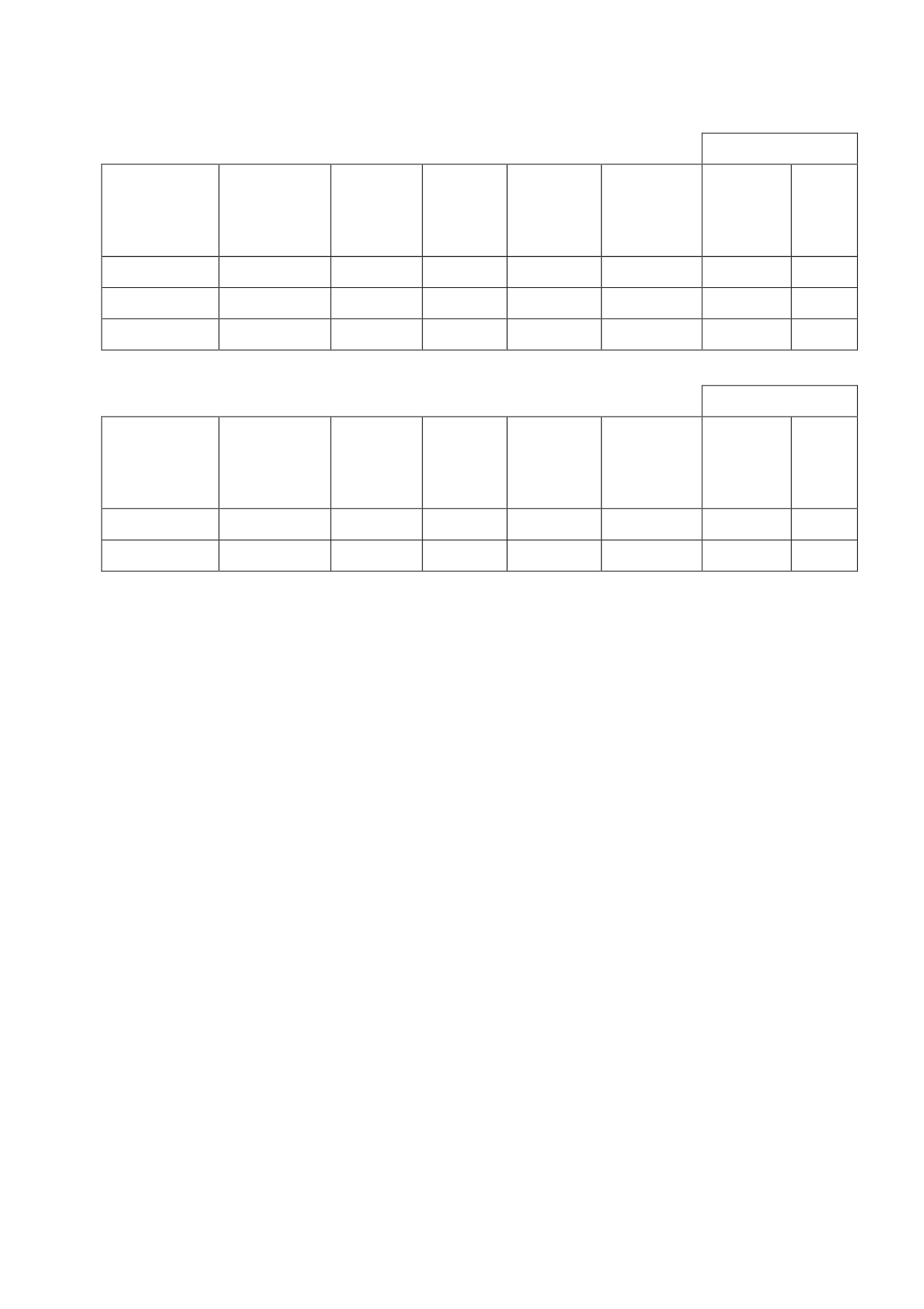

Fair value

(thousands of euros)

2012

Classification

Type

Maturity

Amount

arranged

(thousands

of euros)

Ineffective

portion

recognised in

profit or loss

(thousands

of euros)

Assets

Liabilities

Currency forwards

Foreign currency

hedge

Purchase of

USD

2013

60,575

-

1,245

485

Currency forwards

Foreign currency

hedge

Purchase of

USD

2014

8,053

-

-

197

At 31 December 2013, the estimated fair value of the Group's foreign currency derivatives,

which are designated and effective as cash flow hedges, represented a financial asset of EUR

698 thousand and a financial liability of EUR 3,232 thousand (2012: asset of EUR 1,245

thousand and liability of EUR 682 thousand). This amount was deferred and recognised in

equity, taking into account the tax effect.

The valuationmethod consists of estimating the present value of the future cash flows that will

arise under the terms and conditions arranged by the parties for the derivative instrument.

The spot price is taken to be the reference exchange rate of the European Central Bank on 31

December 2013, the swap points (offer/bid) and the interest rates prevailing at the valuation

date.

The foreign currency derivatives have been arranged in such a way that they are totally

effective and, therefore, they are recognised in full in equity until inventories are recognised.

The sensitivity analysis indicates that positive or negative changes of 10% in the spot

EUR/USD exchange rate would give rise to changes of approximately EUR 14million in the fair

value of the foreign currency derivatives in 2013 (2012: EUR 9million). Increases in the value

of the euro (depreciation of the US dollar) would increase negative values while decreases in

the value of the eurowould increase positive values.

Financial instruments measured at fair value must be classified as levels 1 to 3, based on the

degree of verification of their fair value. Therefore, fair values derived from quoted prices on

activemarkets will be classified as level 1. Those derived from external information other than

quoted prices will be classified as level 2. And values obtained using valuation techniques

including data that are not observable in active markets will be classified as level 3. The

Group’s derivative instruments detailed in this section on “Foreign Currency Hedges” would be

classified as level 2.