44

At 2013 year-end, the balance of “Other Derivatives” represented the fair value (Level 2) of

the financial instrument at that date. The positive impact thereof amounted to EUR 2,011

thousand and was included under “Net Gain (Loss) due to Changes in the Value of Financial

Instruments at Fair Value” in the consolidated income statement. The market variables that

influence the value of this asset are themarket price of the Parent's share, its volatility and its

dividend yield. The Group's estimated results also have an influence. The market price and

historical volatility at 31 December 2013 were used to measure the value of the asset at that

date, and the market consensus at year-end and credit risk (due to application of IFRS 13)

were used to estimate results and the dividend yield.

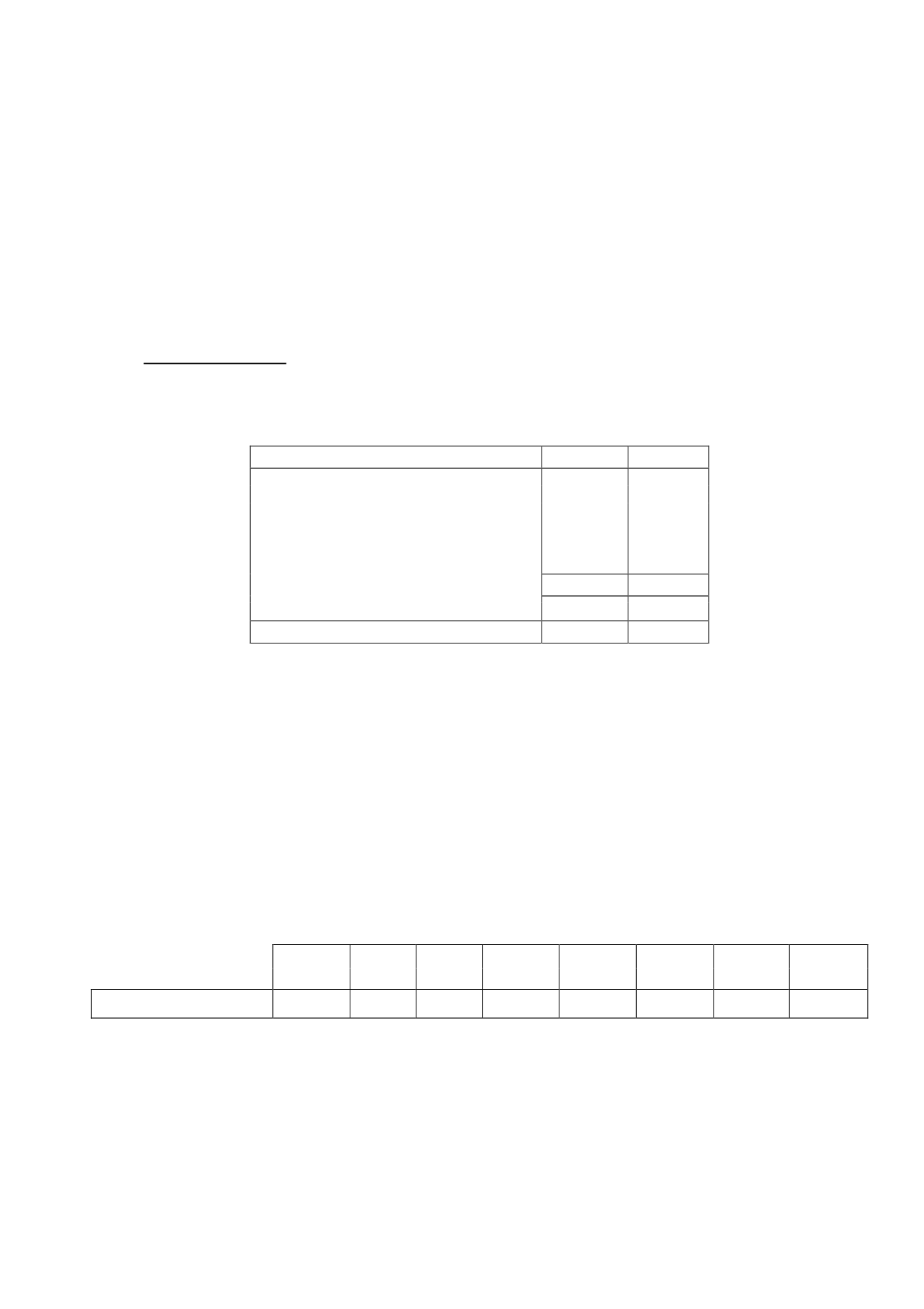

10.Programme rights

The detail of “Programme Rights” is as follows:

Thousands of euros

2013

2012

Programme rights, net

Rights on external productions

242,329

178,050

In-house productions and productions in process

36,456

43,876

Sports broadcasting rights

3,460

3,214

Write-down of external productions

(33,755)

(19,516)

248,490

205,624

Advances to suppliers

31,543

33,353

Total

280,033

238,977

At 31 December 2013, the Parent had commitments, mainly for the purchase of audiovisual

property rights, amounting to EUR 114,342 thousand (2012: EUR 149,617 thousand). In

addition, the Parent has purchase commitments to distributors, the definitive amount and

price of which will be determined once the programmes are produced and, in certain cases, by

establishing the acquisition price on the basis of box-office takings. In 2013 the best estimate

of these commitments amounted to EUR 80,400 thousand (2012: EUR 12,826 thousand).

It is estimated that inventoriable in-house productions will be amortised in full and

approximately EUR 160,000 thousand of external production rights will be amortised in 2014.

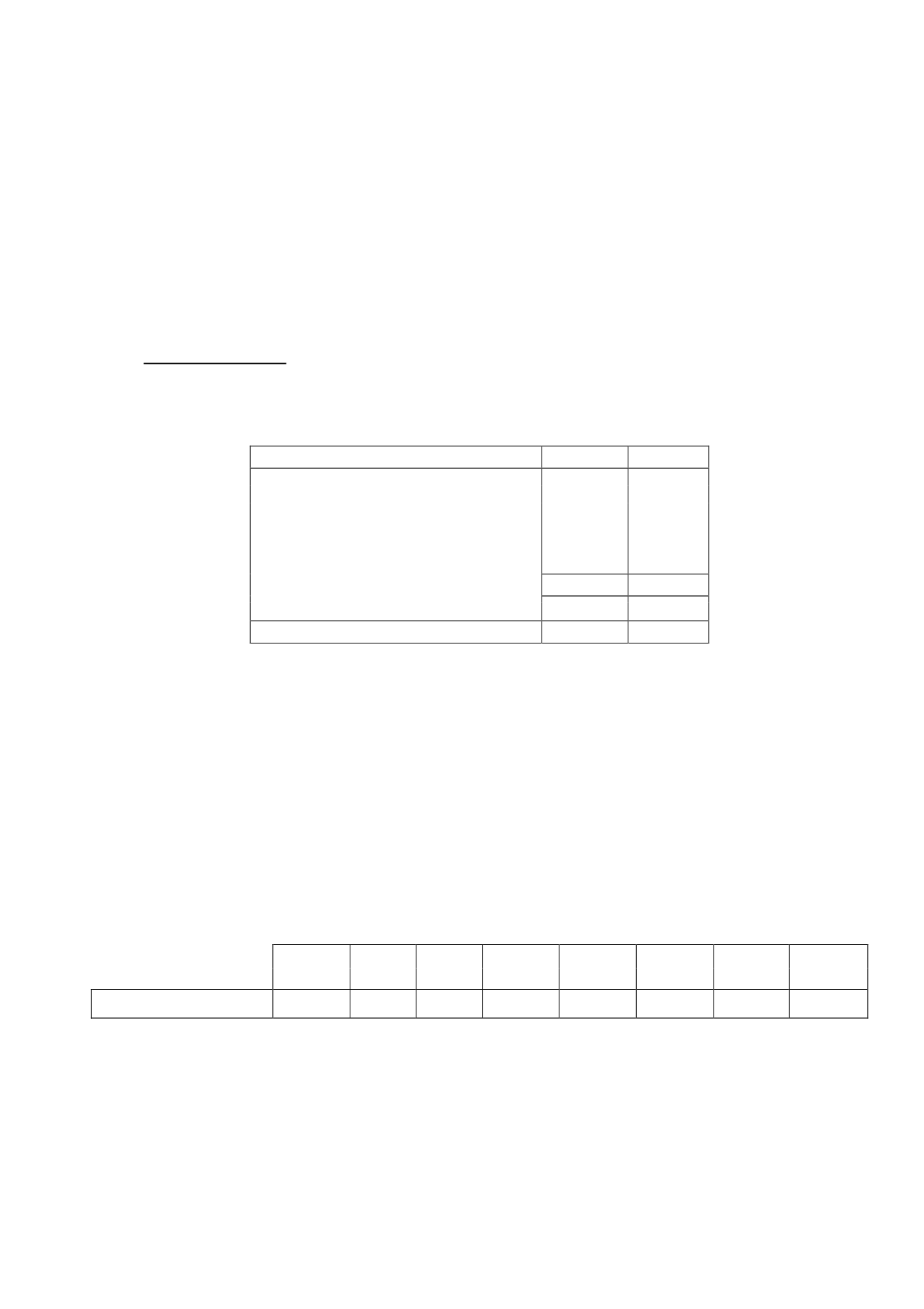

The changes in the write-downs included under “Programme Rights” in the consolidated

balance sheet were as follows (in thousands of euros):

The write-downs recognised arose since it was decided that certain titles would not be

marketable and it was not likely that they would form part of the Parent’s programme

schedule. These write-downs were recognised under “Programme Amortisation and Other

Procurements” in the consolidated income statement.

Balance at

Disposals or

reductions

Balance at

Disposals or

reductions

Balance at

31/12/11

Additions

31/12/12

Additions

Transfers

31/12/13

Write-downs

(17,801)

(1,956)

241

(19,516)

(6,976)

(9,509)

2,246

(33,755)