34

Also, within the framework of the merger agreement, the parties resolved to grant the

shareholders of La Sexta an additional fixed ownership interest of 15,818,704 shares of

Atresmedia Corporación de Medios de Comunicación, S.A., representing 7% of its share

capital, the delivery of which is conditional upon the fulfilment in 2012, 2013, 2014, 2015 and

2016 of certain objectives relating to the consolidated earnings of Atresmedia. The delivery of

these additional shares will be carried out in full by way of treasury shares of Atresmedia

Corporación de Medios de Comunicación, S.A., to the extent that the related objectives are

met and, in any case, these shares will be delivered no later than in 2017.

Themain advantage and economic benefit of this transaction is the synergy achieved, with an

extended range of contents, greater efficiency in the use of Group resources and increased

advertising efficiency.

On 19 February 2014, the Parent entered into a partial novation of this agreement, modifying

the content thereof with respect to two of the three former shareholders of La Sexta (see Note

28).

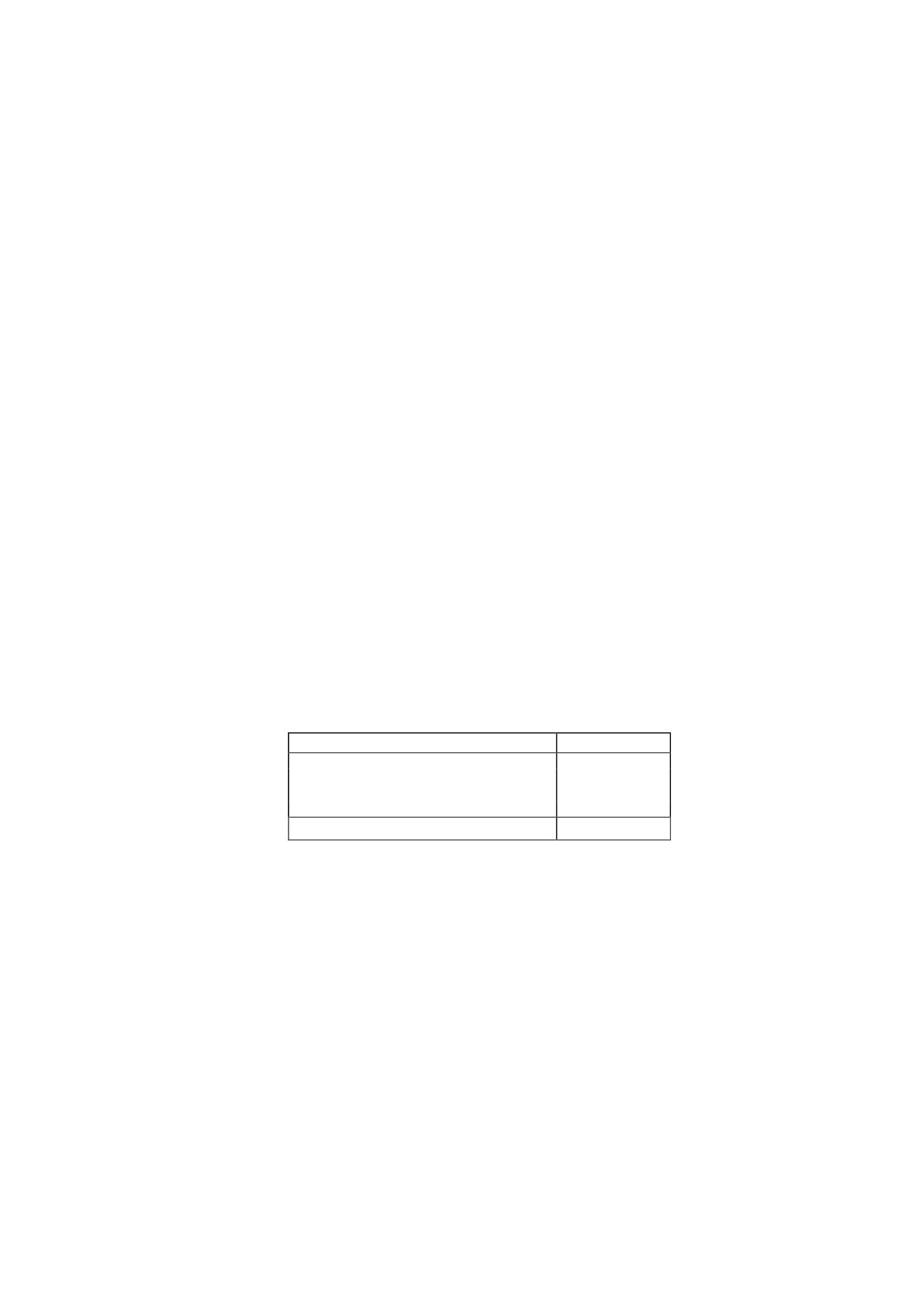

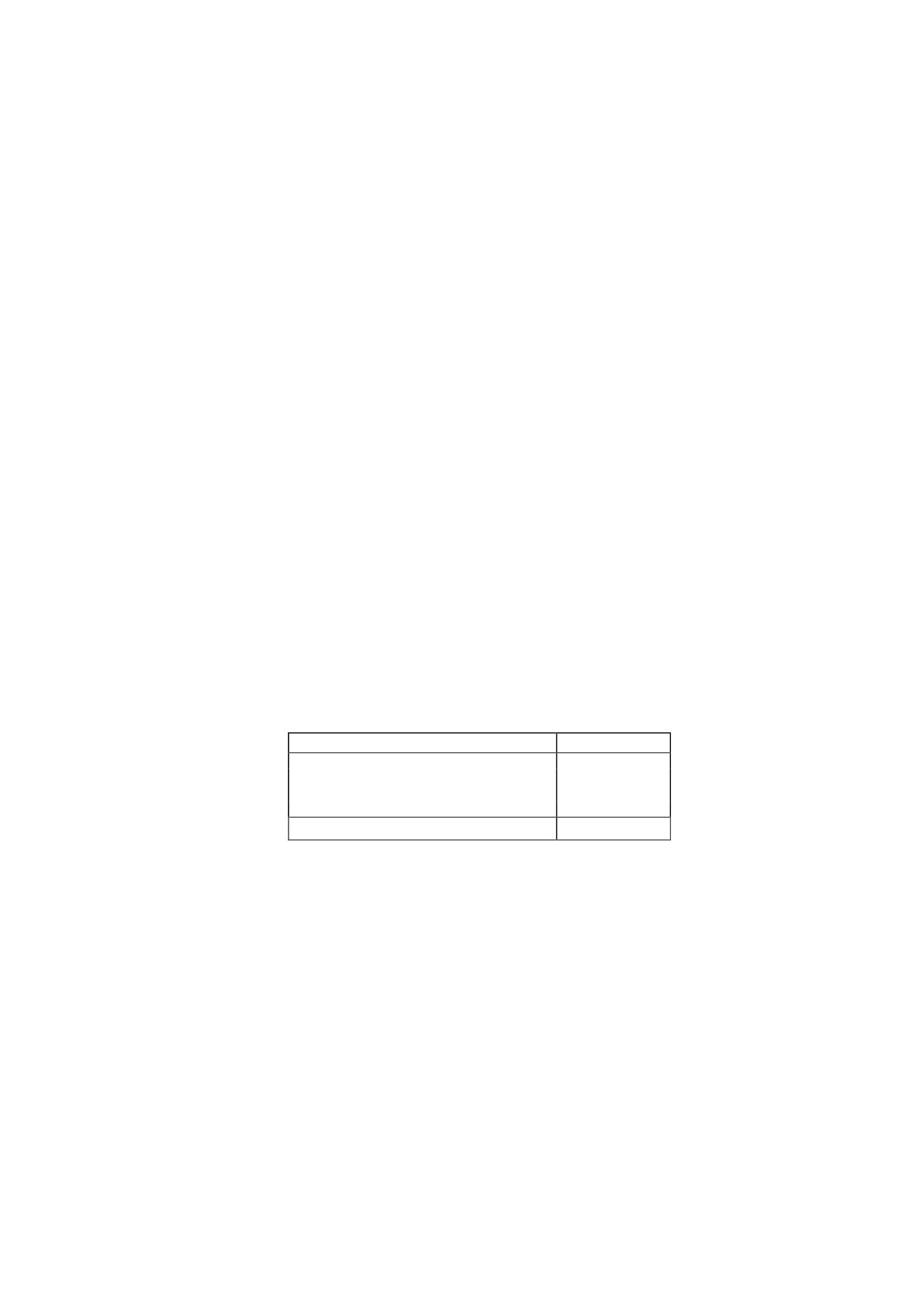

Consideration transferred

The consideration for the business combination was estimated as: i) the fair value (at the date

of the combination) of the shares delivered to the shareholders of Gestora de Inversiones

Audiovisuales La Sexta, S.A. (a total of 15,801,296 shares representing 7% of the Parent's

share capital, delivered as a result of the capital increase described in Note 12-a, the fair value

being the share price at the 5 October 2012 close), and ii) the fair value of the shares subject

to deferred delivery, calculated on the basis of the forward price of Atresmedia Corporación de

Medios de Comunicación, S.A. shares, taking into account a 0.90% IRS rate and

management's estimate of the profit for 2012 to 2016, in order to estimate the delivery date.

The fair value of the consideration transferred in the business combination amounted to EUR

95,893 thousand. The breakdown of this amount is as follows:

Thousands of euros

7% ownership interest in the share capital

53,250

Deferred delivery of shares (additional 7%)

42,643

Total consideration transferred

95,893

In order to enable the shareholders of La Sexta to receive a number of Atresmedia

Corporación de Medios de Comunicación, S.A. shares that is proportional to their respective

ownership interests in La Sexta, the Parent increased its share capital through the creation of

newly issued shares and the delivery of treasury shares.

Also, Atresmedia agreed to grant La Sexta shareholders an additional ownership interest of

15,818,704 Atresmedia shares representing 7% of its share capital, although the delivery

thereof is conditional upon Atresmedia's consolidated earnings from 2012 to 2016. The

delivery of these additional shares will be carried out in full through treasury shares of the

Parent and, therefore, does not constitute an additional issue.

On 19 February 2014, the Parent entered into a partial novation of this agreement, modifying

the content thereof with respect to two of the three former shareholders of La Sexta (see Note

28).