35

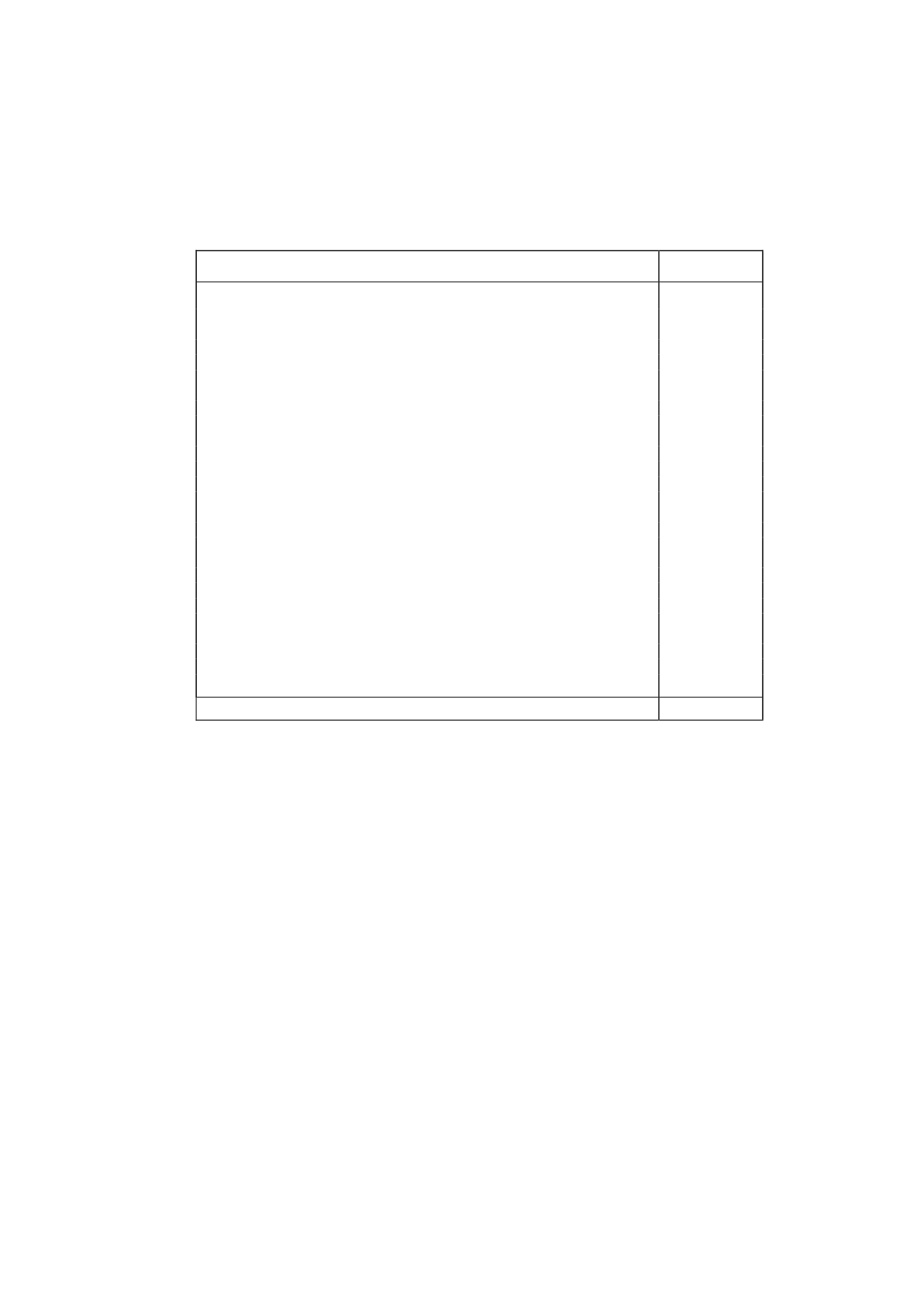

Assets acquired and liabilities assumed at the acquisitiondate

The acquisition-date fair values of the assets and liabilities of Gestora de Inversiones

Audiovisuales La Sexta, S.A. were as follows:

Thousands

of euros

Current assets:

62,718

Inventories

21,790

Trade receivables

24,787

Investments in Group companies

13,331

Current financial assets

696

Current prepayments and accrued income

184

Cash and cash equivalents

1,930

Non-current assets:

365,847

Intangible assets

105,111

Property, plant and equipment

615

Investments in Group companies and associates

9,445

Non-current financial assets

8,926

Deferred tax assets (*)

241,596

Non-current trade receivables

154

Current liabilities:

(213,282)

Short-term provisions

(14,079)

Current payables

(6)

Current payables to Group companies and associates

(22,879)

Trade payables

(176,318)

Non-current liabilities:

(99,854)

Deferred tax liabilities (*)

(31,319)

Non-current payables to Group companies and associates

(68,535)

Total fair value of net identifiable assets acquired

115,429

(*) Under current accounting legislation, deferred tax assets and liabilities recognised in a business combination are

not measured at fair value, but rather at their nominal amount.

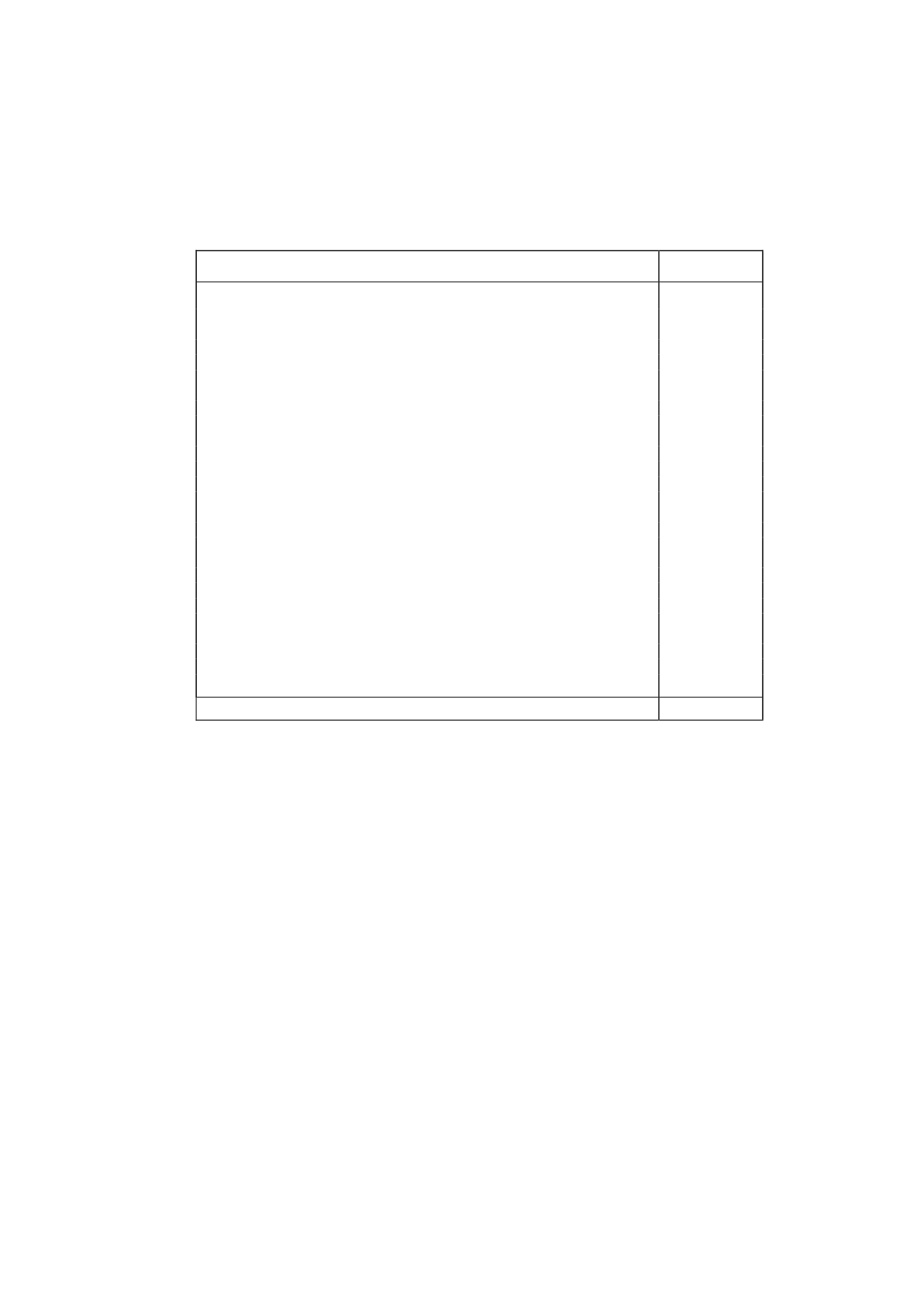

The gross contractual amount receivable in relation to the accounts receivable acquired, which

related in full to trade receivables and were recognised at their fair value of EUR 24,787

thousand, is EUR 24,795 thousand.

The detail, by year of acquisition, of the intangible assets and property, plant and equipment

included as a result of the merger (excluding the licence and trademark) is as follows (in

thousands of euros):