46

49,269 thousand. The capital increase, including both the par value and the share

premium, was fully paid as a result of the transfer en bloc of the assets and liabilities of

the acquiree on the date on which the merger deed was filed at the Madrid Mercantile

Registry (i.e. 31October 2012).

In accordance with Article 304.2 of the Spanish Limited Liability Companies Law, approved

by Legislative Royal Decree 1/2010, of 2 July, shareholder pre-emption rights were

disapplied on the occasion of this increase.

At 31 December 2013 and 2012, the share capital of the Parent amounted to EUR 169,300

thousand and was represented by 225,732,800 fully subscribed and paid shares of EUR

0.75 par value each, with the same rights except for the restriction on dividend rights

mentioned inNotes 12-a and 12-e.

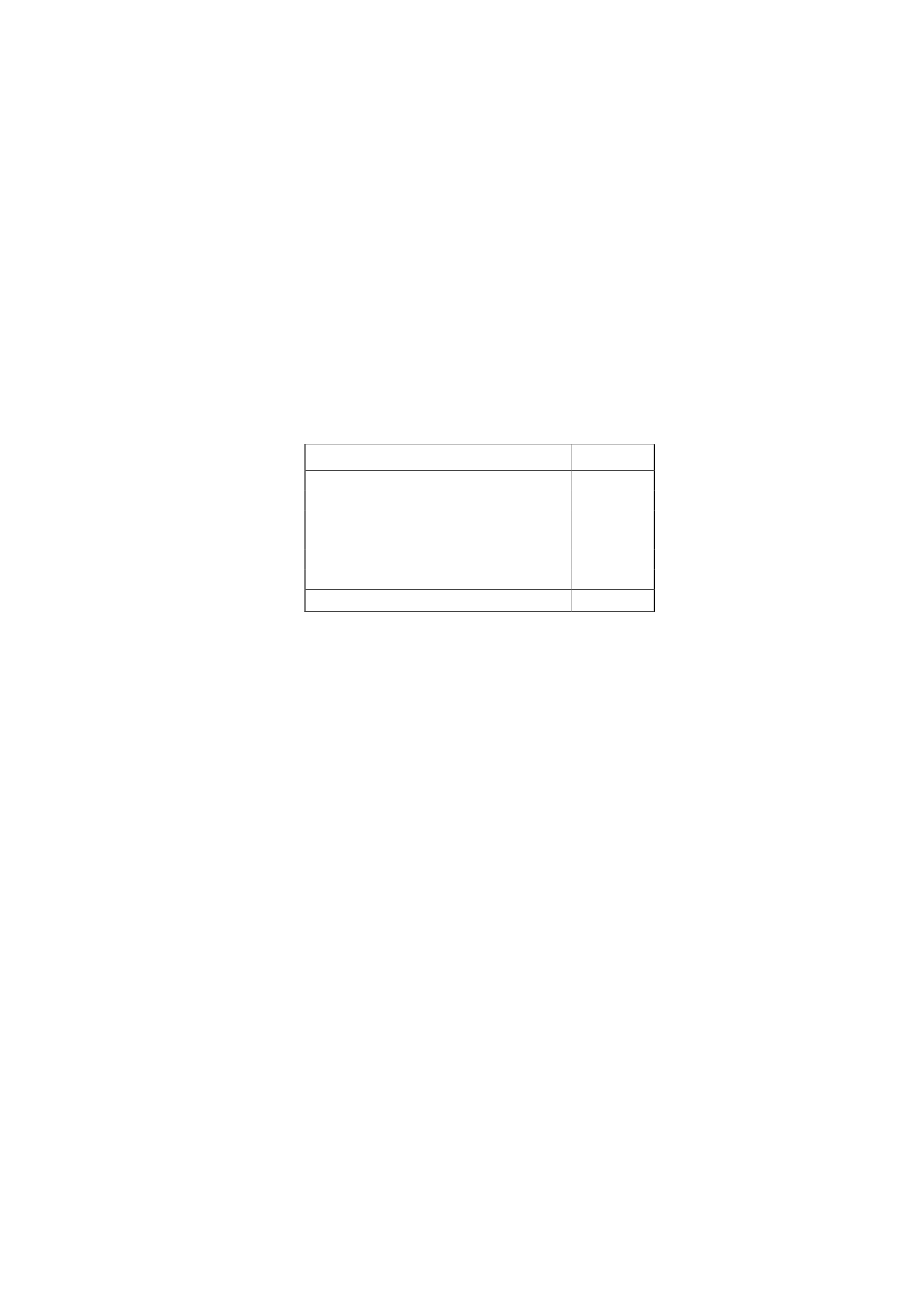

At the end of 2013 the Parent's shareholder structurewas as follows:

% of ownership

2013

Grupo Planeta-de Agostini, S.L.

41.70

Ufa Film und Fernseh, GMBH

19.17

Treasury shares

7.01

Gamp Audiovisual, S.A.*

3.64

ImaginaMedia Audiovisual, S.L.

2.85

Other shareholders

25.63

Total

100.00

* Gamp Audiovisual, S.A. is an Imagina Group company, which is controlled, within the meaning

of Article 4 of the Spanish Securities Market Law, by the Imagina Group through

MEDIAPRODUCCIÓN, S.L.

The Parent's shares are listed on the Spanish stockmarket interconnection system and all

carry the same voting and dividend rights, except for the 1,181,296 shares mentioned

above, which will be admitted to trading once 24 months have elapsed following the date

on which the merger was registered at the Mercantile Registry, in accordance with the

draft terms of merger.

There are agreements among the main shareholders that guarantee the Parent’s

shareholder stability, the grant of mutual rights of acquisition on their shares, the

undertaking not to take control of the Parent or to permit a third party to do so, and also

include Groupmanagement agreements, as described in the consolidated directors’ report.

For management purposes, the Group treats the equity attributable to the Parent as

capital. The only external requirements to which this capital for management purposes is

subject are those contained in current Spanish corporate law, and there are no other legal

restrictions thereon.

The Group determines the financial resources required with the two-fold objective of

ensuring the Group companies’ capacity to continue operating andmaximising profitability

by optimising Group debt and equity. The Group’s financial structure taken as a whole

consists of the equity attributable to the Parent’s shareholders (comprising share capital,

share premium, retained earnings and other items), bank borrowings and cash and cash

equivalents. The Group reviews this structure regularly and, taking into account the costs

and risks associated with each type of funding (debt or equity), takes the appropriate

decisions to achieve the aforementioned objectives.