37

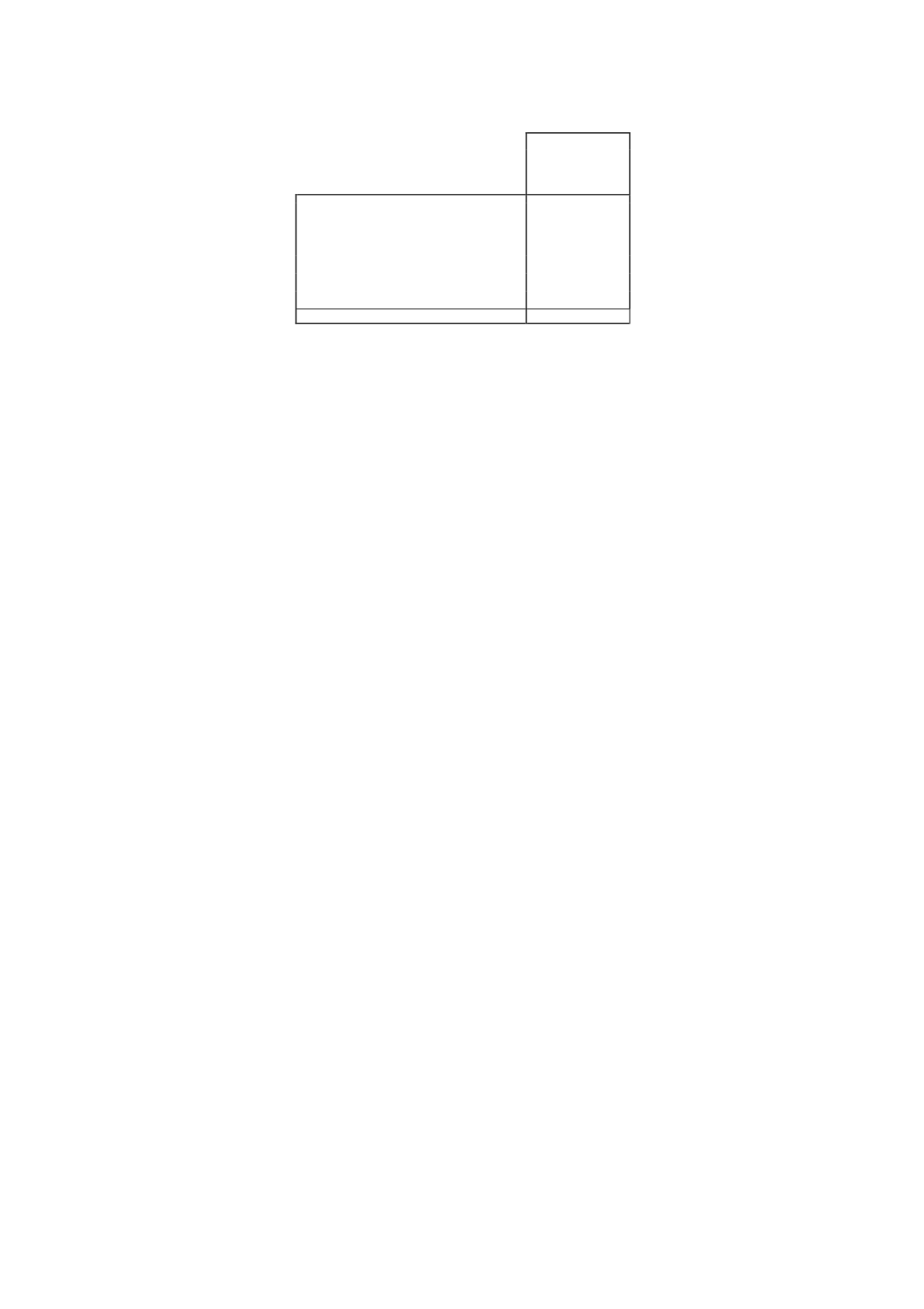

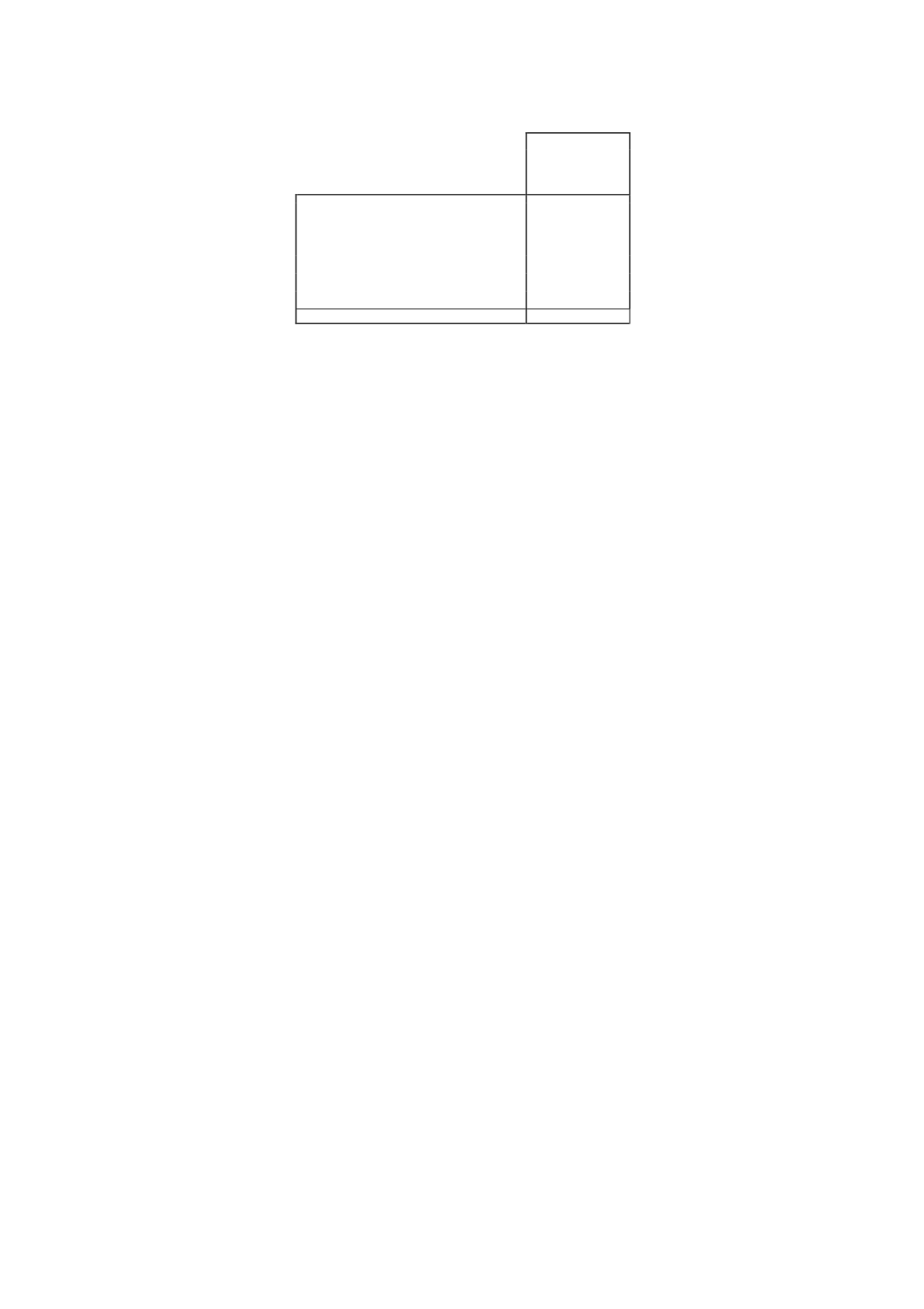

The detail of the shareholder structure at the end of 2013 is as follows:

2013

% of

ownership

Planeta-de Agostini, S.L. Group

41.70

Ufa Film und Fernseh, GMBH

19.17

Treasury shares

7.01

Gamp Audiovisual, S.A. (*)

3.64

ImaginaMedia Audiovisual, S.L.

2.85

Other shareholders

25.63

Total

100.00

*Gamp Audiovisual, S.A. is an Imagina Group company, which is controlled, pursuant to Article 4 of the Spanish

Securities Market Law, by the Imagina Group throughMediaproducción, S.L.

The Company's shares are listed on the Spanish stockmarket interconnection system and all carry

the same voting and dividend rights, except for the 1,181,296 shares mentioned above, which will

be admitted to trading 24 months following the date on which the merger was filed at the

Mercantile Registry in accordancewith the draft terms of merger.

There are agreements between the main shareholders that guarantee the Company’s shareholder

stability, the grant of mutual rights of acquisition on their shares and the undertaking not to take

control of the Company or to permit a third party to do so, and also include management

agreements, as described in the Corporate Governance Report.

14.1Reserves

Legal reserve

Under the Spanish Limited Liability Companies Law, the Company must transfer 10% of net profit

for each year to the legal reserve until the balance of this reserve reaches at least 20% of the

share capital. The legal reserve can be used to increase capital provided that the remaining

reserve balance does not fall below 10% of the increased share capital amount. Otherwise, until

the legal reserve exceeds 20% of share capital, it can only be used to offset losses, provided that

sufficient other reserves are not available for this purpose.

At 31 December 2013, the legal reserve had reached the legally requiredminimum.

Other reserves

“Other Reserves” includes an amount of EUR 281 thousand which is restricted as to its use since it

corresponds to the “Reserve for the Adjustment of Share Capital to Euros”.

As a result of the capital reduction made in 2006, a reserve of EUR 8,333 thousand was

established, equal to the par value of the retired shares, which may only be used if the same

requirements as those for the reduction of share capital are met, pursuant to Article 335-c of the

Spanish Limited Liability Companies Law.

The remaining reserves recognised under “Other Reserves” are unrestricted.

14.2Other equity instruments

As indicated in Note 5, pursuant to the agreement to merge the two companies, Antena 3 de

Televisión, S.A. and Gestora de Inversiones Audiovisuales La Sexta, S.A. agreed to grant La Sexta

shareholders an additional ownership interest of 15,818,704 Antena 3 shares representing 7% of

its share capital, although the delivery thereof is conditional upon the earnings of the Antena 3

Group from 2012 to 2016. The delivery of these additional shares will be carried out in full through

treasury shares of Antena 3 and, therefore, does not constitute an additional issue. "Other Equity

Instruments" includes the measurement of the aforementioned consideration at the fair value of

the shares whose deliverywas deferred, calculated as indicated inNote 5.