45

In the process of allocating the price of the business combination to assets and liabilities, certain

intangible assets were identified, such as the "La Sexta" brand and its audiovisual operating

licence. The brand will be amortised for accounting purpose in 20 years, while the licence is

considered to be an intangible asset with an indefinite useful life.

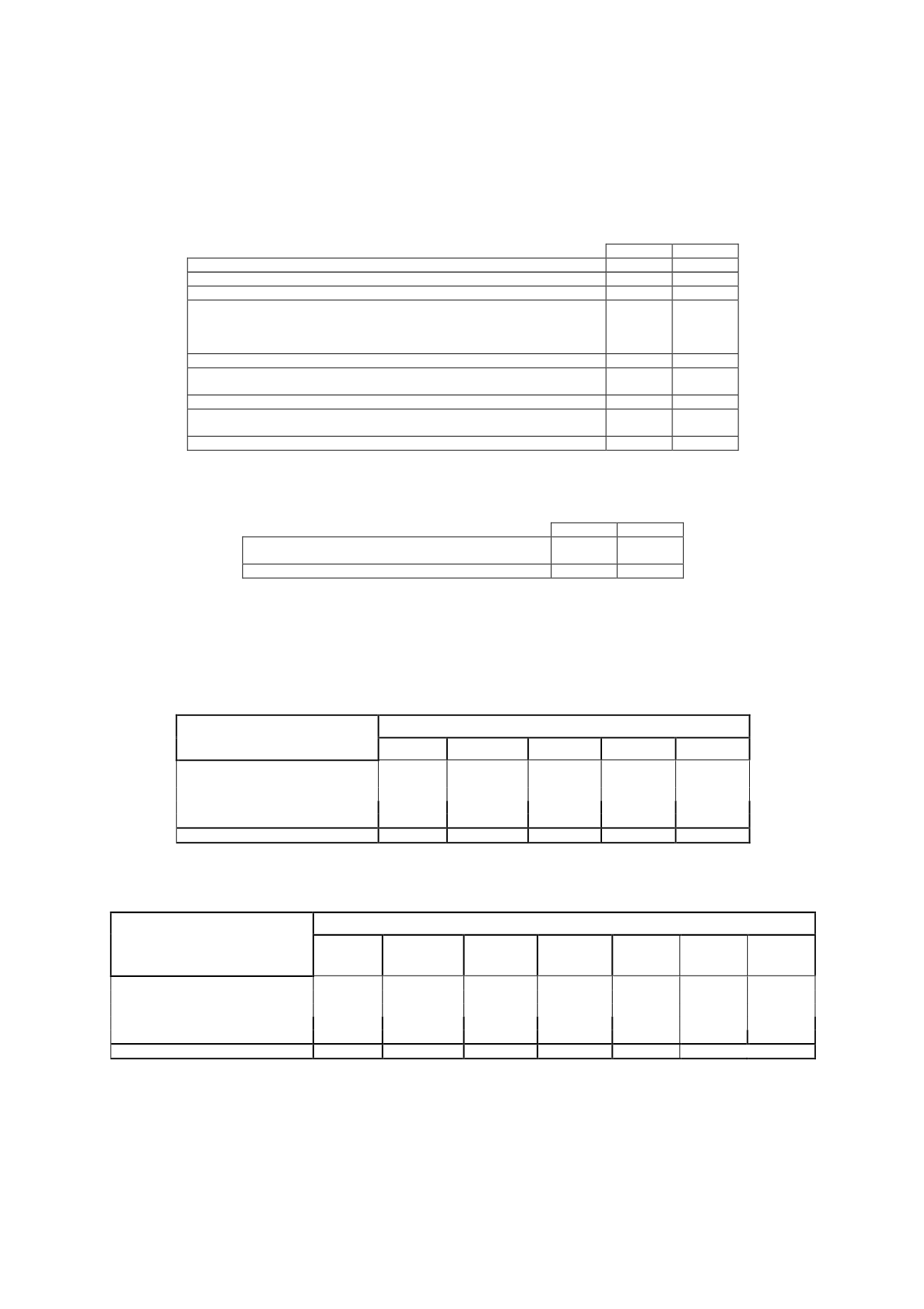

The reconciliation of the accounting profit to the income tax expense is as follows (in thousands of

euros):

2013

2012

Accounting profit before tax

30,462

14,400

Tax charge at 30%

9,139

4,320

Tax credits earned in the year:

Audiovisual productions

Donations to not-for-profit entities

Other

(11,273)

(10,990)

(283)

-

(17,532)

(17,532)

-

-

Offset of tax losses:

Other -

Permanent differences (Note 18.2)

(1,594)

(7,971)

Total income tax expense for the year

(3,728) (21,183)

Income tax adjustments

Adjustment - difference in income tax per tax return

(278)

(278)

(279)

(279)

Total income tax expense recognised inprofit or loss

(4,006) (21,462)

The breakdown of the income tax expense for the year is as follows (in thousands of euros):

2013

2012

Current tax

(10,332) (18,385)

Deferred tax

6,604

(2,798)

Total income tax expense for the year

(3,728) (21,183)

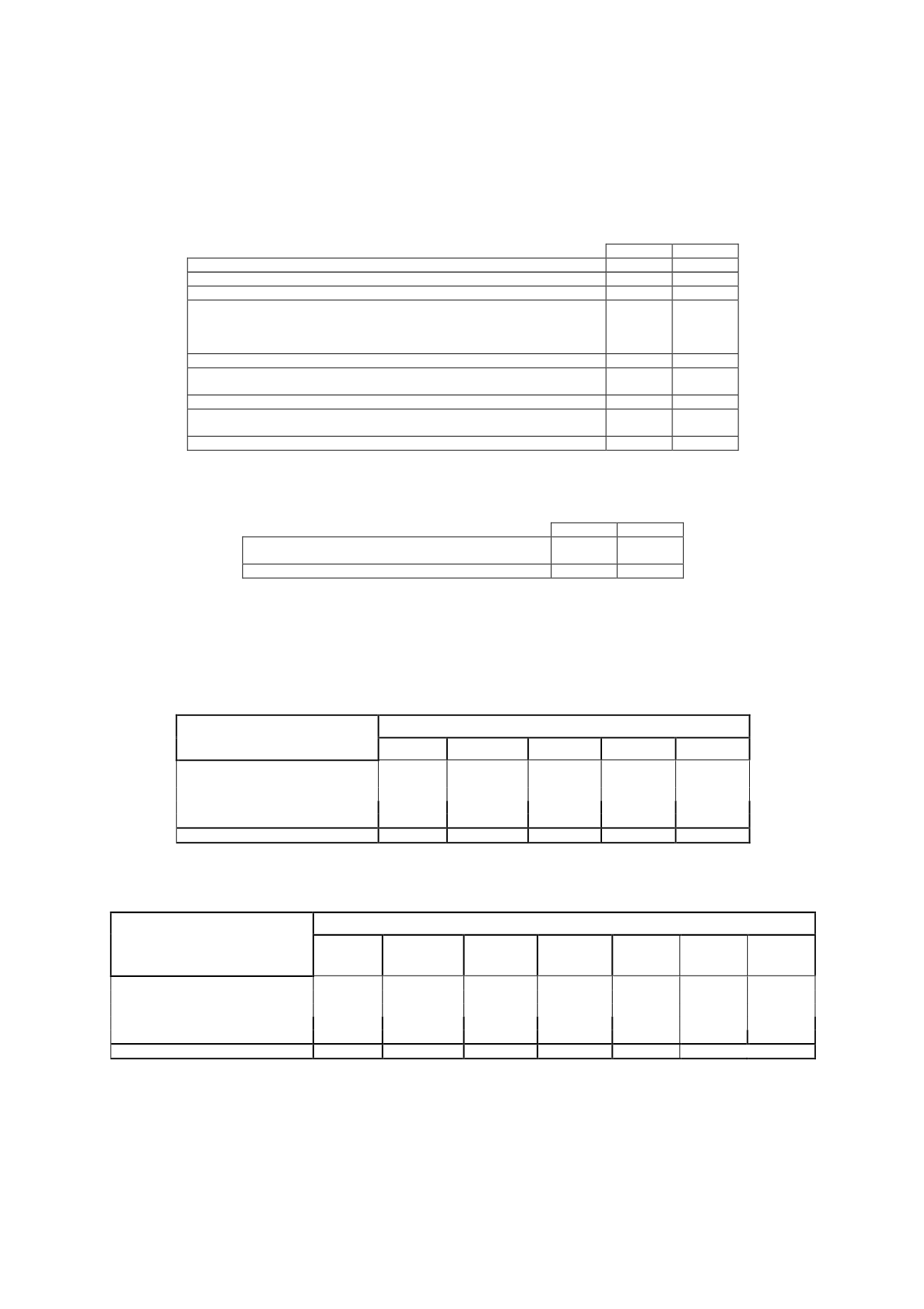

18.5Deferred tax assets recognised

The difference between the tax charge allocated to 2013 and to prior years and the tax charge

already paid or payable for such years, which is recognised under “Deferred Tax Assets”, arose as

a result of temporary differences derived from the following:

CHANGES INDEFERRED TAX

ASSETS

Thousands of euros

2012

Additions Disposals

Other

2013

Contingencies and charges

9,609

3,217

(2,630)

551

10,747

Accounts payable

2,148

-

(955)

(540)

653

Other items

1,320

1,327

(611)

285

2,321

Tax effect of assets at fair value

9,483

-

(6,845)

(97)

2,541

Financial hedging instruments

(209)

(152)

-

(361)

Total

22,351

4,544 (11,193)

199

15,901

The detail for 2012 is as follows:

CHANGES INDEFERRED TAX

ASSETS

Thousands of euros

2011

Additions Disposals

Other

Transfers

Inclusion

due to

merger

2012

Contingencies and charges

5,960

2,508

(205)

-

(215)

1,561

9,609

Accounts payable

871

1,242

(604)

237

(95)

497

2,148

Other items

262

1,101

(272)

(81)

310

-

1,320

Tax effect of assets at fair value

-

-

(1,030)

-

-

10,513

9,483

Financial hedging instruments

(401)

192

-

-

-

-

(209)

Total

6,692

5,043 (2,111)

156

-

12,571

22,351