47

Also, the adjustments made to taxable profit since 2009 pursuant to Article 12.3 of the Spanish

Corporation Tax Lawwill be reversed, as the equity of the investees is recovered.

In 2013 the adjustments arising from the derogation of Article 12.3 of the Spanish Corporation Tax

Law relating to Canal 3 de Colombia, S.A. and Antena 3 de Televisión Colombia, S.A. will be

derecognised, since both companies were liquidated in 2013. The positive adjustment to taxable

profit amounted to EUR 351 thousand.

Also, in 2013 the investment in Unipublic, S.A. was sold and, accordingly, Atresmedia Corporación

derecognised the impairment losses previously recorded with a negative adjustment to taxable

profit of EUR 2,036 thousand.

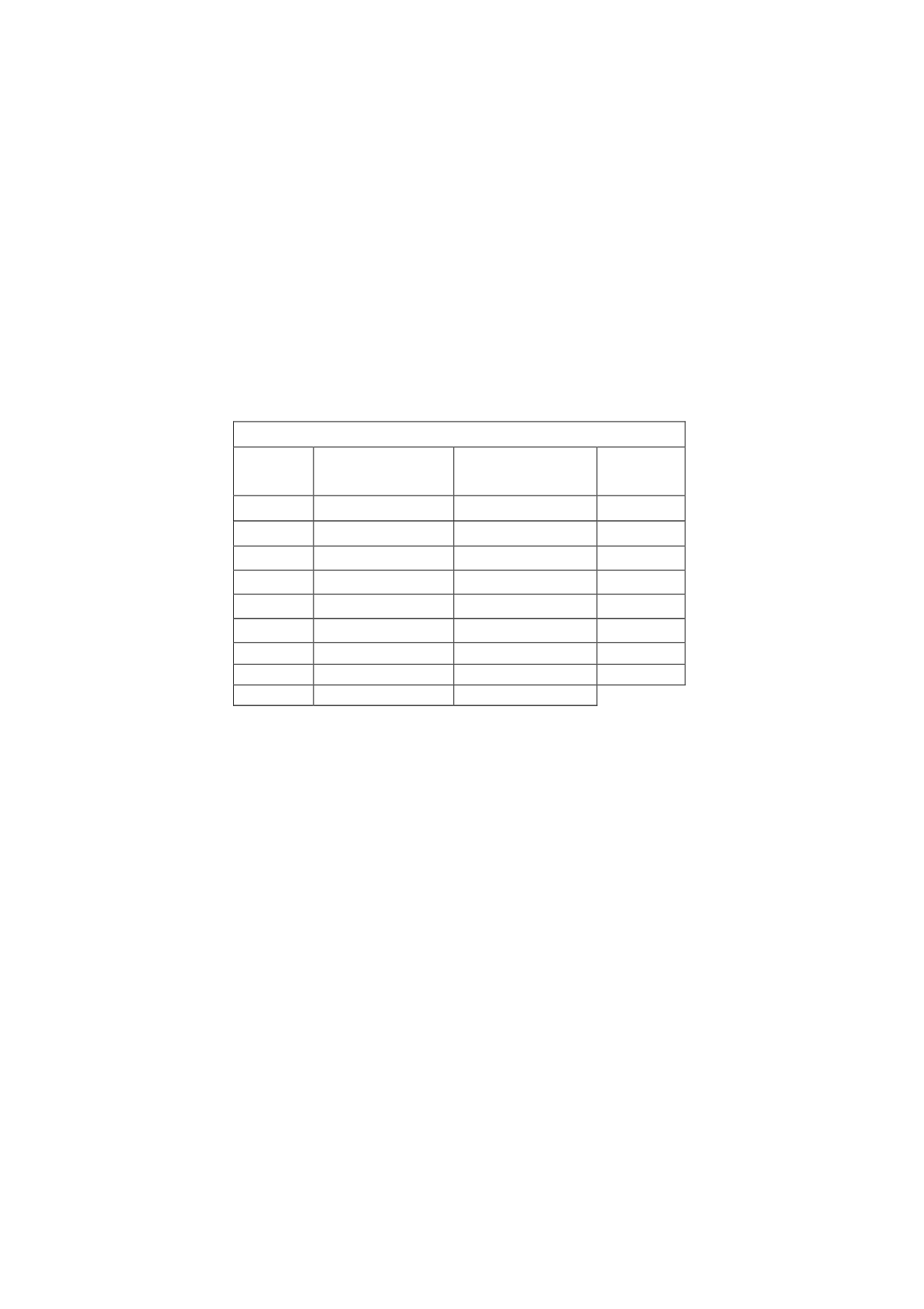

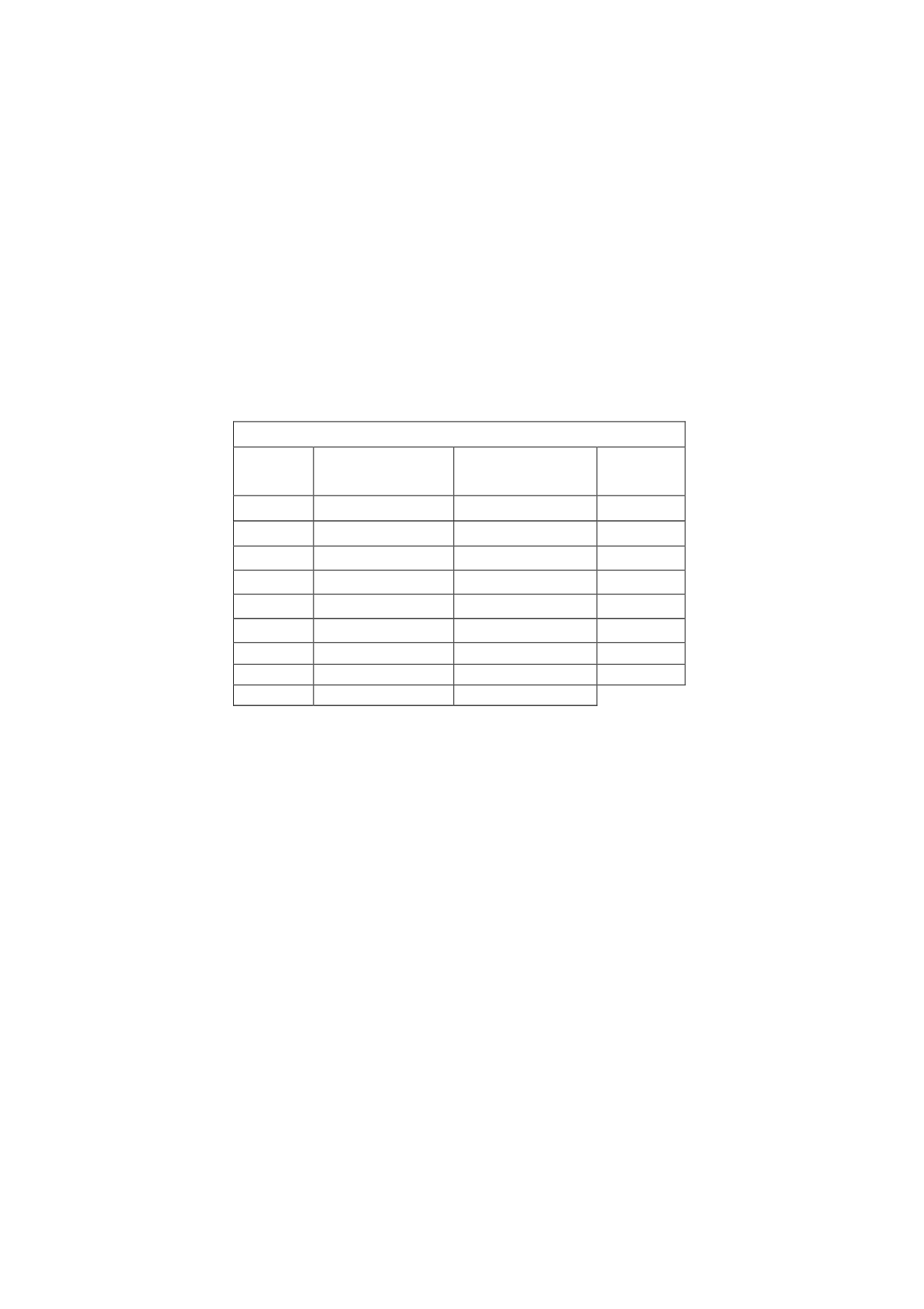

At 31 December 2013, the Company had recognised unused tax credits amounting to EUR 68,128

thousand (of which EUR 4,801 thousand arise from the merger with La Sexta) and tax loss

carryforwards (arising from themerger with La Sexta in their entirety) amounting to EUR 220,760

thousand.

Thousands of euros

Amount

Deducted in

the year

Carried forward

Last year

for

deduction

365

365

0

2016

625

625

0

2017

1,094

1,094

0

2018

4,347

129

4,218

2019

14,415

14,415

2020

21,025

21,025

2021

17,480

17,480

2022

10,990

10,990

2023

70,342

2,213

68,128

Of the EUR 3,002 thousand of tax credits taken in 2013, EUR 2,213 thousand were deductions for

audiovisual production, EUR 506 thousand for international double taxation and EUR 283 thousand

for donations to not-for-profit entities.