28

9.- Financial assets (non-current and current)

9.1Non-current financial assets

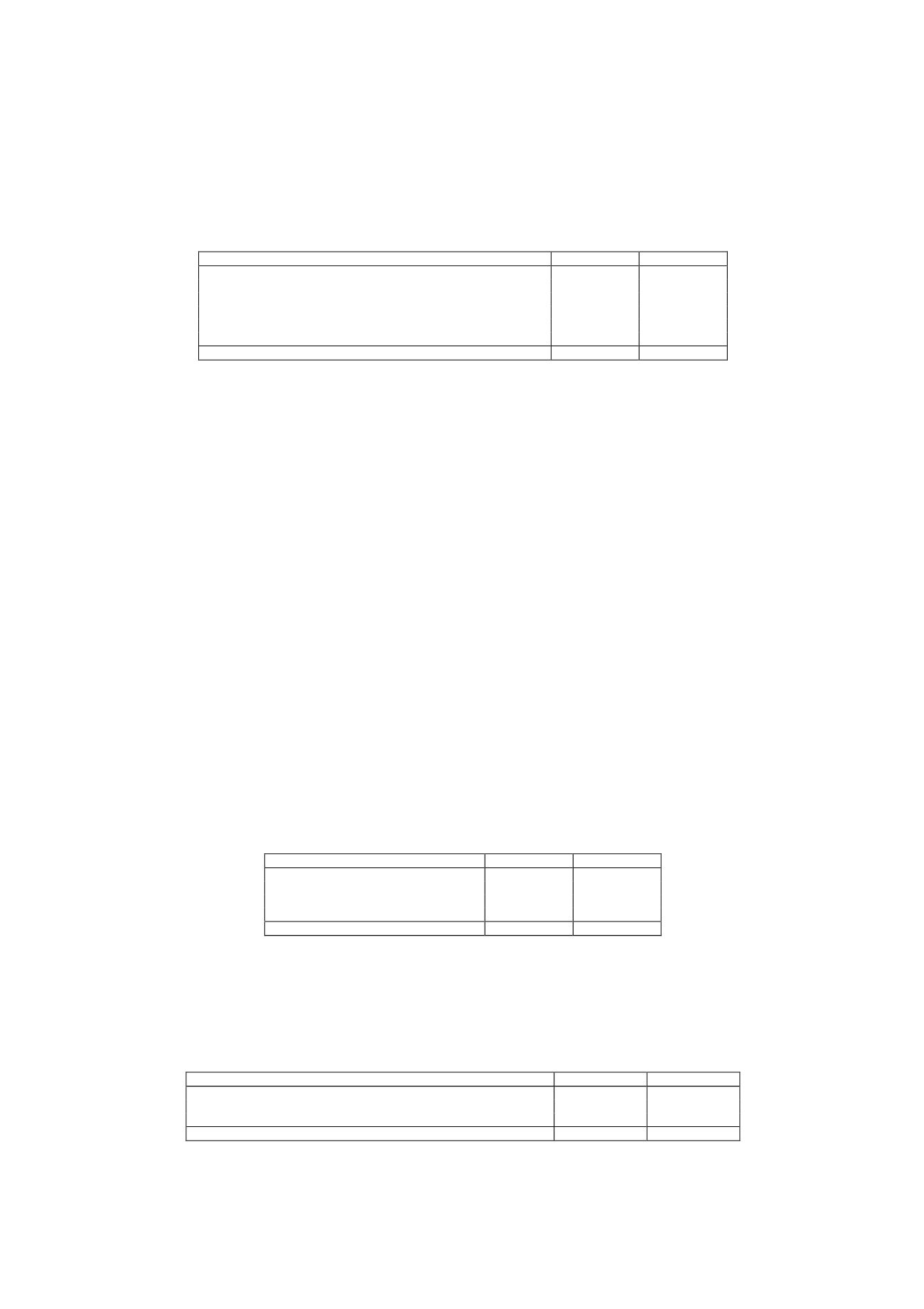

The detail of “Non-Current Financial Assets” at the end of 2013 and 2012 is as follows (in

thousands of euros):

2013

2012

Held-for-trading financial assets:

Other derivatives

9,413

7,402

Available-for-sale financial assets:

At cost (Note 21.2)

1,472

-

Loans and receivables:

Long-term guarantees and deposits

75

8,983

Total

10,960

16,385

In relation to "Other Derivatives", in December 2012 the Company entered into various

agreements with the former shareholders of Gestora de Inversiones Audiovisuales La Sexta, S.A.,

including one whereby, in exchange for a fixedmarket consideration determined at the date of the

agreement and deliverable by Antena 3 de Televisión, S.A. (premium), the aforementioned

counterparty undertook to pay the Company a variable cash amount to be determined on the basis

of the future economic results of the Antena 3 Group and payable in 2017. The positive impact

thereof was included under "Changes in the Fair Value of Financial Instruments" in the

accompanying income statement. This agreement was amended in February 2014 (see Note 23).

"Available-For-Sale Financial Assets" includes non-current financial investments in the equity

instruments of companies over which the Company does not exercise significant influence under

Rule for the Preparation of Financial Statements no. 13 since it does not participate in the

process to set financial or commercial policies. At 2013 year-end, this amount related to the 45%

ownership interest in El Armario de la Tele, S.L.

At 31 December 2012, "Long-Term Guarantees and Deposits" included EUR 8,840 thousand

relating to the amount deposited in connection with the appeal filed by La Sexta against

assessments issued by the tax authorities relating to the levy on games. In 2013 this amount was

transferred to current assets.

9.2Current financial assets

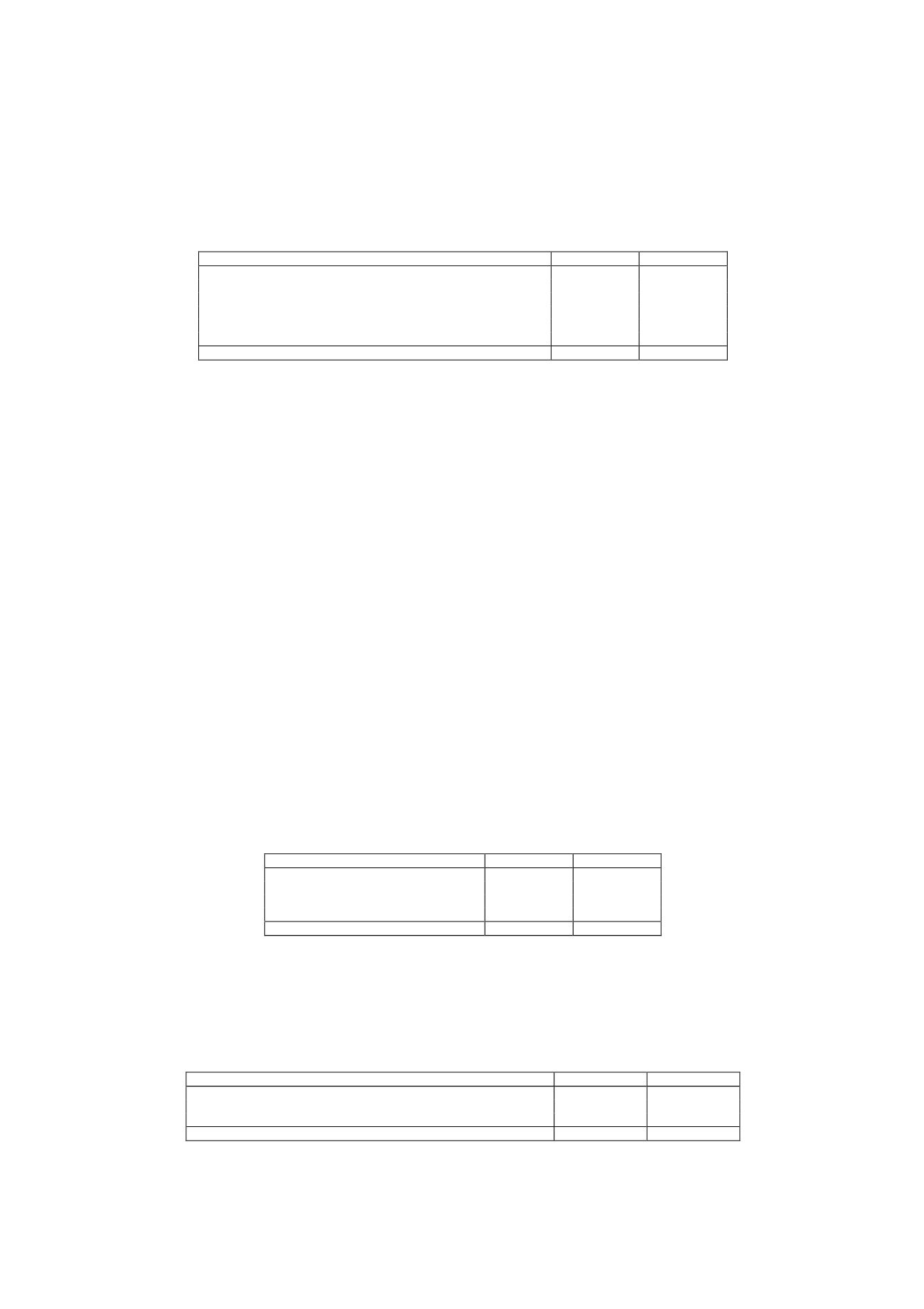

The detail of “Current Financial Assets” at the end of 2013 and 2012 is as follows (in thousands of

euros):

2013

2012

Derivatives:

Derivatives (Note 11)

698

1,245

Loans and receivables:

Short-term guarantees and deposits

678

1,209

Total

1,376

2,454

9.3Non-current investments inGroup companies and associates

The detail of “Non-Current Investments in Group Companies and Associates” at the end of 2013

and 2012 is as follows (in thousands of euros):

2013

2012

Investments in Group companies and associates (Note 21.2)

76,288

74,445

Long-term loans to Group companies and associates (Note 21.2)

125,322

137,301

Total

201,610

211,746