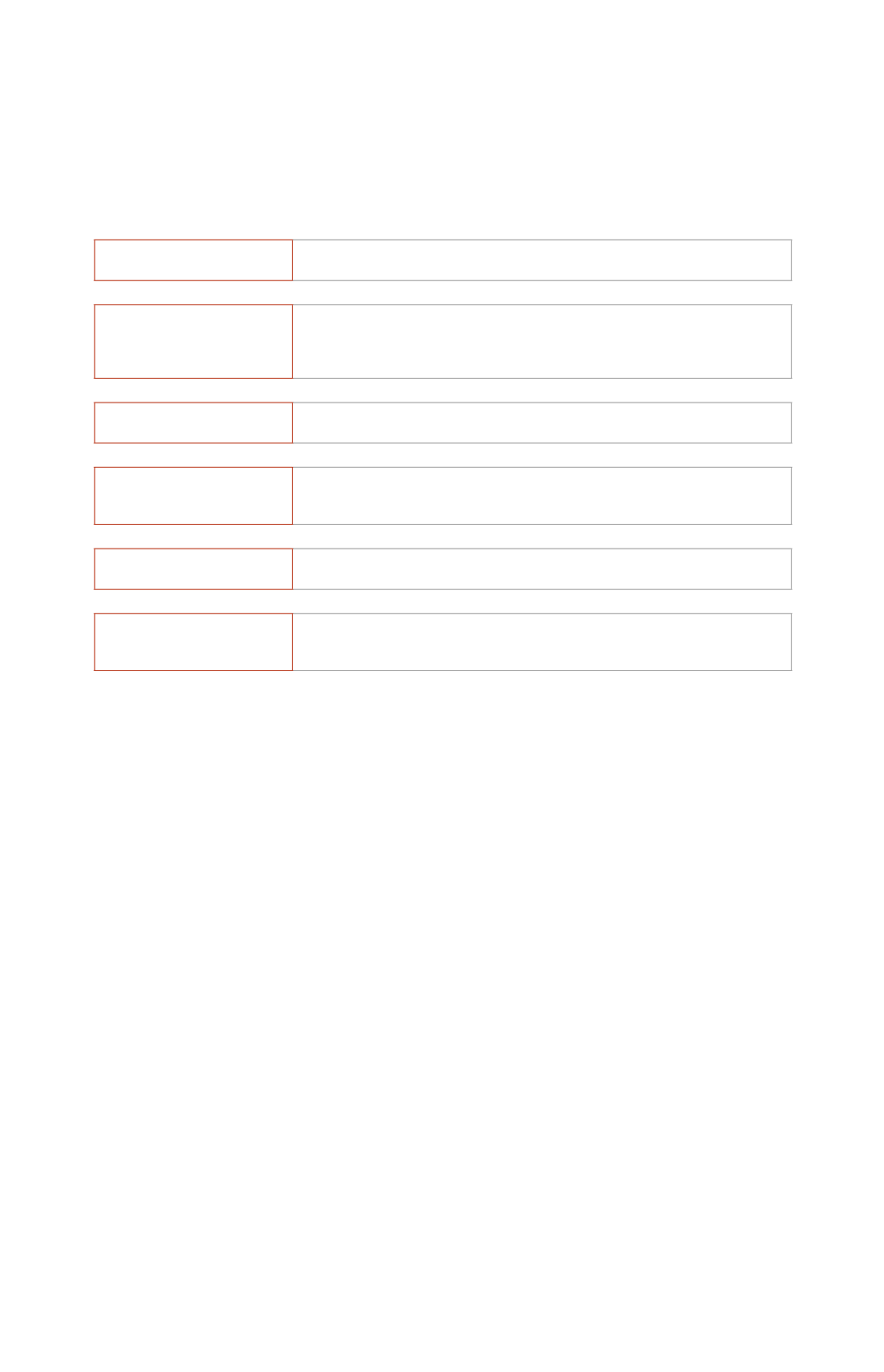

Responsibilities

The main responsibilities related to the Risk and Control Management System are

summarised in the following section:

Business units and corporate

units

Responsible for the controls, evaluation and supervision.

Compliance with regulations: external and internal (policies, standards and procedures).

Finance department

Responsible for most of the financial controls and the Internal Control System for

Financial Reporting (ICFR).

Compliance with policies and standards related to budgets, accounts and financial

statements, and financial reporting.

Legal affairs department/board

secretary

Responsible for most of the compliance and Corporate Governance controls.

Regulatory compliance

committee (RCC)

The body that monitors the Group’s regulatory compliance.

Responsible for monitoring the Code of Conduct, the Enquiries and Complaints Channel

and the Internal Regulations in issues of the securities market.

Criminal compliance manager

Responsible for the introduction and monitoring of the Group’s Criminal Compliance

Model.

Internal audit

Coordinates and administers the Risk and Control Management System. Designs policies

and procedures and identifies new controls.

Test controls and reports to the Audit and Control Committee.

The Audit and Control Committee is

responsible for supervising the system’s

operation and reporting to the Board

of Directors so that the action plans or

new measures to be implemented can be

approved or amended, as appropriate.

Key components of the Risk and

Control Management Model

The Risk and Control Management

System at Grupo

Atresmedia

has various

key components:

•

Definition of the objectives

: New

objectives for the Group for each of its

business units are revised and set each

year, along with the acceptable level of

risk given the Group’s global strategy

and the identified internal and external

events.

•

Internal control environment

: An

assessment of the model is regularly

conducted in order to verify, on the

one hand, how staff at the company

perceive the risks, the establishment

of controls that mitigate the risks

and the development of action plans

and, on the other, the environment in

which it acts. In turn, an assessment

is conducted of the effectiveness and

design of the controls implemented

in order to introduce new ones or

mitigate any impact. The risks are

regularly reassessed in order to check

that their control is effective.

•

Regulatory compliance

:

Atresmedia

has established a regulatory

compliance model that ensures

compliance with all the regulations,

both those specific to the sectors in

which it operates as well as generic

ones that may affect it due to being

a listed company or just generally

(labour, tax, environmental, etc.). There

are also a series of internal policies

and protocols that are equally binding

for the areas and businesses affected

by them. The System supervises this

compliance through specific controls.

•

Processes

: In order to be able to

identify the risks that impact to a

greater extent on one business process

ATRESMEDIA

| ANNUAL AND CORPORATE RESPONSIBILITY REPORT 2015 |

ATRESMEDIA

|

47