In 2014 the main aggregates in the consolidated financial statements are as follows: total

assets EUR 1,214 million; equity EUR 449 million; revenue EUR 850 million; and profit for the

year EUR 47 million.

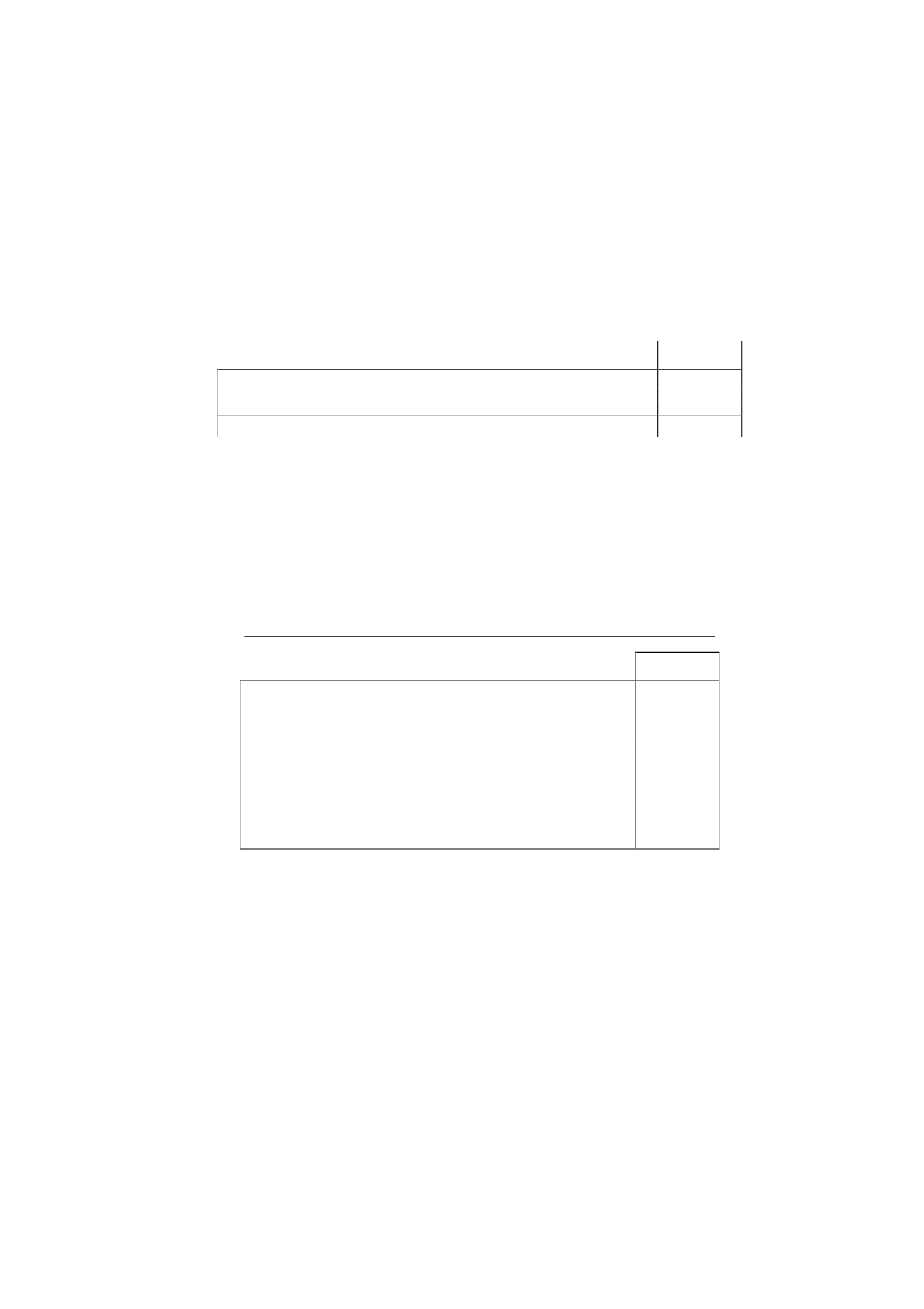

3.- Distribution of profit

The proposed distribution of the profit for the year that the Company's directors will submit for

approval by the shareholders at the Annual General Meeting is as follows (in thousands of

euros):

2014

Interim dividends paid

22,341

To voluntary reserves

22,892

Total

45,233

At the Company's Board of Directors meeting held on 19 November 2014 it was resolved to

distribute out of the Company's profit for 2014 a gross amount of ten euro cents (EUR 0.10)

for each of the shares entitled to receive this interim dividend, implying a total dividend of EUR

22,341 thousand, which were recognised under “Equity - Interim Dividend” in the

accompanying consolidated balance sheet.

The provisional accounting statement prepared in accordance with legal requirements

evidencing the existence of sufficient liquidity for the distribution of the dividends is as follows:

LIQUIDITY STATEMENT FOR THE PAYMENT OF THE 2014 INTERIM DIVIDEND

Thousands of

euros

Liquidity at 31 October 2014

88,843

Projected cash until 31 December 2014:

Current transactions from November to December 2014

10,103

Financial transactions from November to December 2014

-

Projected dividend payment

(20,534)

Projected liquidity at 31 December 2014

78,412

4.- Accounting policies

The principal accounting policies used by the Company in preparing its financial statements for

2014 and 2013, in accordance with the Spanish National Chart of Accounts, were as follows:

4.1 Intangible assets

As a general rule, intangible assets are recognised initially at acquisition or production cost.

They are subsequently measured at cost less any accumulated amortisation and any

accumulated impairment losses. These assets are amortised over their years of useful life.

Licences and trademarks

These accounts include the amounts relating to the licence and the trademark identified in the

purchase price allocation process arising from the merger with Gestora de Inversiones

Audiovisuales La Sexta, S.A.