the basis of the time during which operating resources are used in production. The costs

incurred in producing the programmes are recognised, based on their nature, under the

appropriate headings in the income statement and are included under “Programme Rights” in

the balance sheet with a credit to “Procurements – Inventories” in the income statement.

Amortisation of these programmes is recognised under “Programmes Amortisation and Other”

in the income statement, on the basis of the number of showings, in accordance with the rates

shown below:

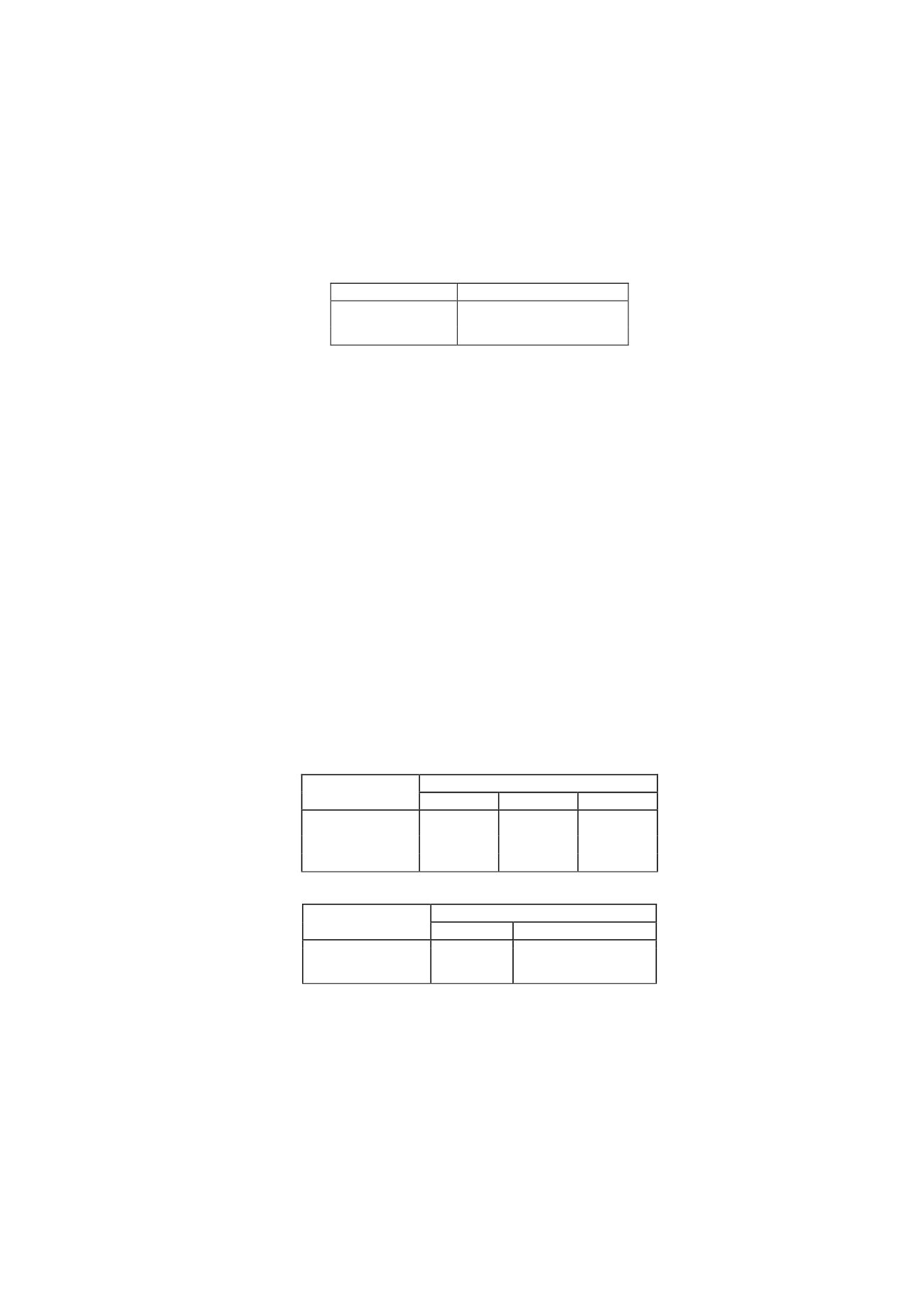

Amortisation rate

1st showing

90%

2nd showing

10 %

The maximum period for the amortisation of series is three years, after which the unamortised

amount is written off.

Given their special nature, the series which are broadcast daily are amortised in full when the

first showing of each episode is broadcast.

-

Non-inventoriable in-house productions (programmes produced to be shown only

once) are measured using the same methods and procedures as those used to measure

inventoriable in-house productions. Programmes produced and not shown are recognised at

year-end under “Programme Rights - In-House Productions and Productions in Process” in the

balance sheet. The cost of these programmes is recognised as an expense under “Programme

Amortisation and Other” in the income statement at the time of the first showing.

-

Rights on outside productions (films, series and other similar productions) are

measured at acquisition cost. These rights are deemed to have been acquired when the term

of the right commences for the Company. Payments made to outside production distributors

prior to commencement of the term of the right are recorded under “Advances to Suppliers” in

the balance sheet.

The amortisation of the rights is recognised under “Programme Amortisation and Other” in the

income statement on the basis of the number of showings, in accordance with the rates shown

below, which are established on the basis of the number of showings contracted:

FILMS

Number of showings contracted

1

2

3 or more

1st showing

100%

50%

50%

2nd showing

-

50%

30%

3rd showing

-

-

20%

SERIES

Number of showings contracted

1

2 or more

1st showing

100%

50%

2nd showing

-

50%

-

Live broadcasting rights are measured at cost. The cost of these rights is recognised as

an expense under “Programme Amortisation and Other” in the income statement at the time

of broadcast of the event on which the rights were acquired.

Raw and other materials

Dubbings, sound tracks, titles and signature tunes of outside productions are recorded at

acquisition or production cost. The amortisation of rights is recorded under “Programme