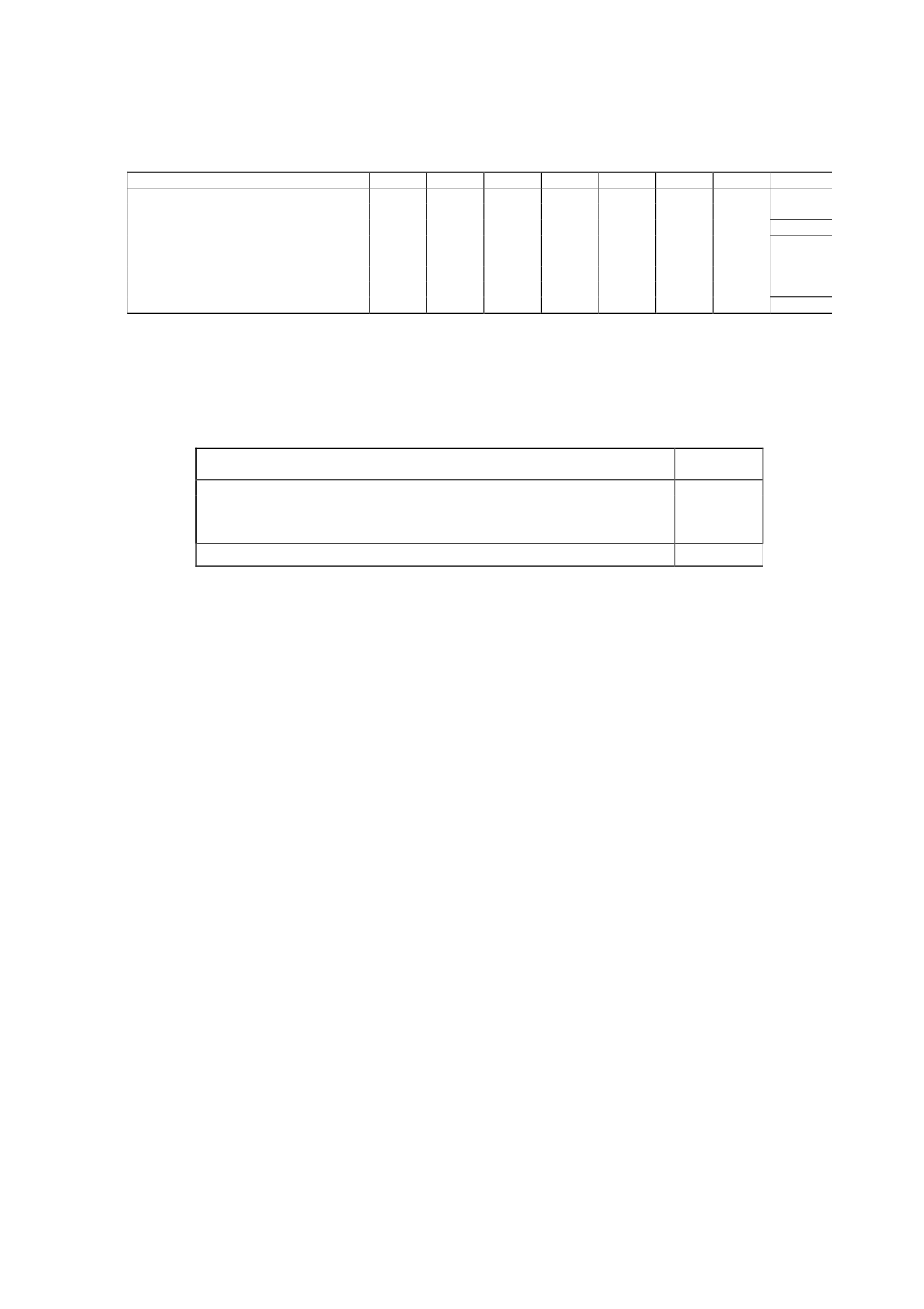

36

2006

2007

2008

2009

2010

2011

2012

Total

Intangible assets

Computer software

-

-

-

1

54

460

201

716

716

Property, plant and equipment

Plant

4

-

20

29

-

-

-

53

Furniture

293

15

6

2

20

22

-

358

Computer hardware

-

-

-

28

76

89

11

204

615

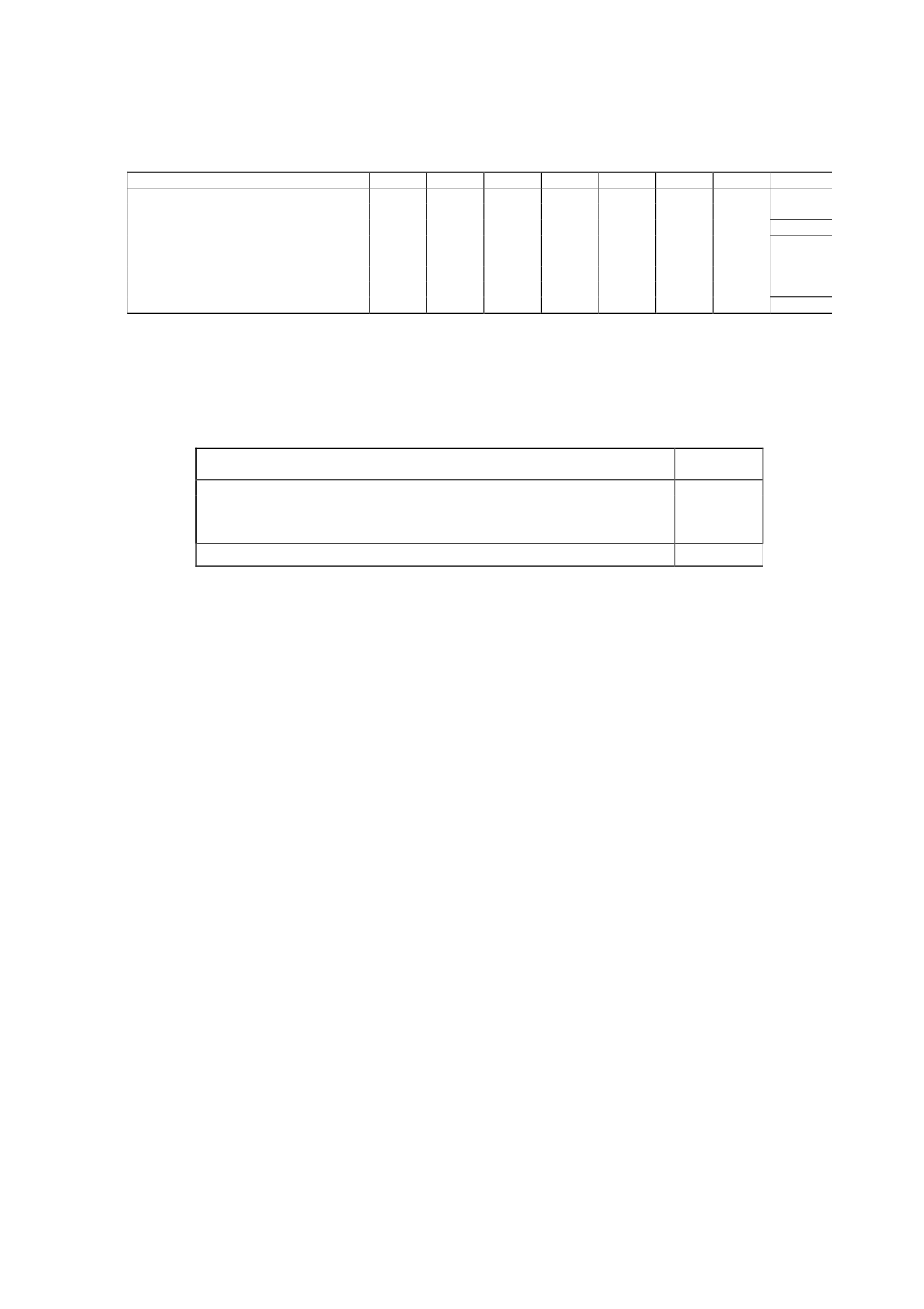

Gain from a bargainpurchase arising from the business combination

The following gain from a bargain purchase arose from this business combination:

Thousands

of euros

Consideration transferred

95,893

Less- fair value of the net assets acquired

(115,429)

Gain from a bargainpurchase arising from the business combination

(19,536)

In the aforementioned business combination, the cost of the business combination was EUR

19,536 thousand lower than the net of the acquisition-date amounts of the identifiable assets

acquired and the liabilities assumed. Therefore, as provided for in the recognition and

measurement bases, this amount was recognised as income under “Gains on Bargain

Purchases Arising on Business Combinations” in the 2012 consolidated income statement.

Assets not reflected in the accounting records of Gestora de Inversiones Audiovisuales La

Sexta, S.A. were included (i.e. the “La Sexta” trademark and the audiovisual communication

licence granted). The fair value of the licence was calculated on the basis of its capacity to

generate income with an indefinite useful life using the discounted cash flow method. The

royalty relief method was used to calculate the fair value of the trademark, considering a

useful life of 20 years.

At 2012 year-end, the allocation of the fair values of the assets acquired and liabilities

assumed, in particular of trademarks and licences, was subject to possible adjustments within

one year from the acquisition date, as required by accounting legislation. The purpose of these

adjustments is to reflect, in general, any additional information obtained during the

aforementioned measurement period, and, in the Company's particular case, the information

referring to the Spanish Supreme Court judgment of 27 November 2012 relating to the

assignment of digital multiplexes with national coverage. Once this period had elapsed and

following a review by the Parent, based on a report by an independent expert, of the values

initially assigned to the aforementioned assets (using various widely accepted valuation

methods for this purpose), therewas no change in those values.

Had the business combination been performed at the beginning of 2012, revenue would have

amounted to EUR 828,475 thousand in 2012 and a loss of EUR 22,008 thousand would have

been incurred in that year.