27

income statement and are included under “Programme Rights” in the consolidated

balance sheet with a credit to “Additions to Programme Rights” under “Programme

Amortisation and Other Procurements” in the accompanying consolidated income

statement.

Amortisation of these programmes is recognised under “Programme Amortisation and

Other Procurements” in the consolidated income statement, on the basis of the

number of showings, at the rates shown below:

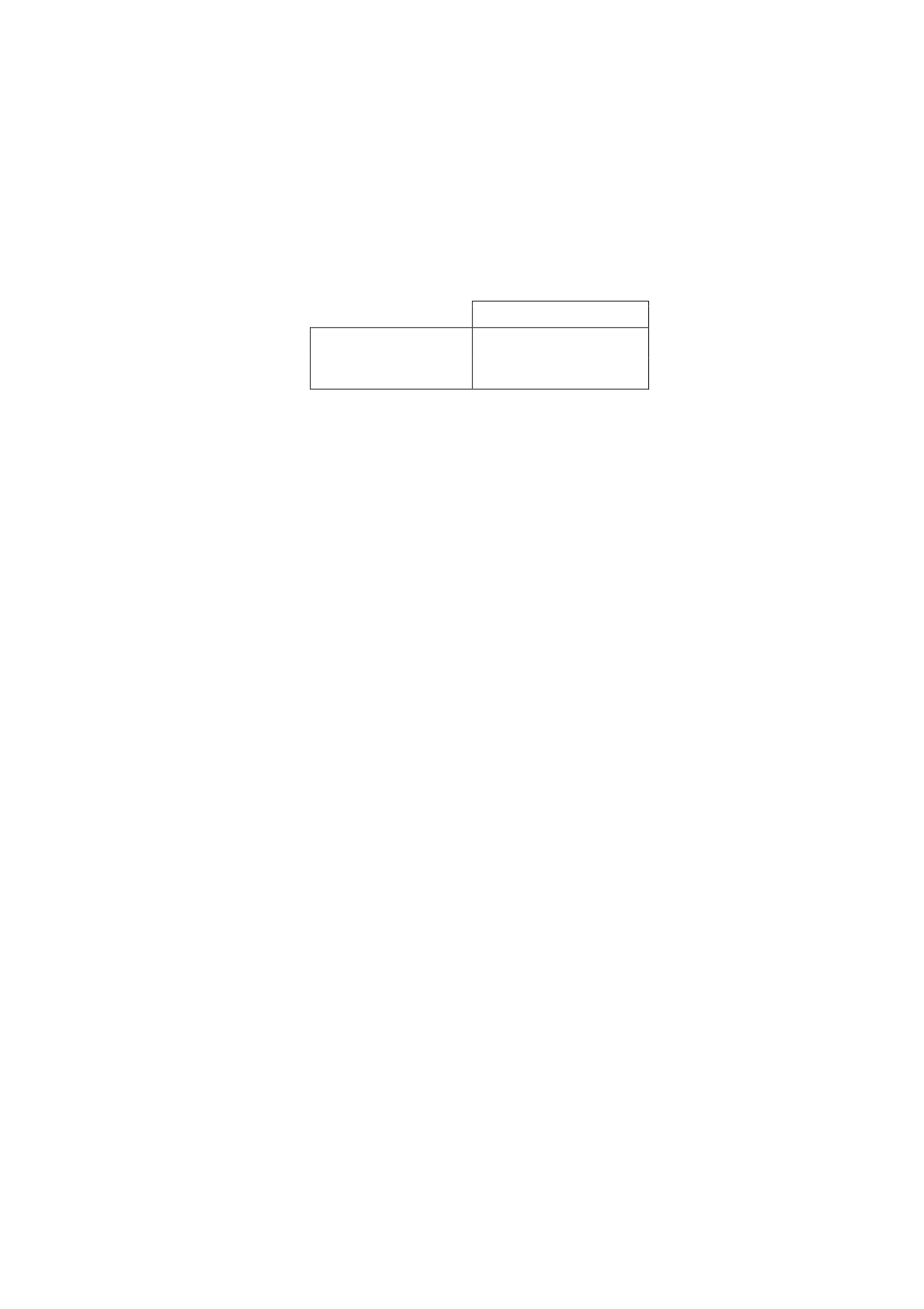

Amortisation rate

1st showing

90%

2nd showing

10%

The maximum period for the amortisation of series is three years, after which the

unamortised amount is written off.

Given their special nature, the series which are broadcast daily are amortised in full

when the first showing of each episode is broadcast.

2.

Non-inventoriable in-house productions (programmes produced to be shown only

once) are measured using the same methods and procedures as those used to

measure inventoriable in-house productions. Programmes produced and not shown

are recognised at year-end under “Programme Rights - In-House Productions and

Productions in Process” in the consolidated balance sheet. The cost of these

programmes is recognised as an expense under “Programme Amortisation and Other

Procurements” in the consolidated income statement at the time of the first showing.

3.

Rights on external productions (films, series and other similar productions) are

measured at acquisition cost. These rights are deemed to have been acquired when

the term of the right commences for the Group.

When payments to external production distributors are made in foreign currency,

these rights are recognised in the consolidated balance sheet by applying to the

foreign currency amount the spot exchange rate prevailing when the term of the right

commences.

Also, the initial value of all the external productions acquired by the Group for which

derivative instruments designated as cash flow hedges pursuant to IAS 39 were

arranged in order to hedge foreign currency risk includes:

the portion of the cumulative gain or loss recognised in equity (effective hedge) on

the hedging instrument at the beginning of the term of the right.

for payments made prior to the commencement of the term of the right, the

accumulated exchange gains or losses on that date.

The amortisation of the rights is recognised under “Programme Amortisation and Other

Procurements” in the consolidated income statement, on the basis of the number of

showings, at the rates shown below, which are established on the basis of the number

of showings contracted: