45

11.Trade and other receivables

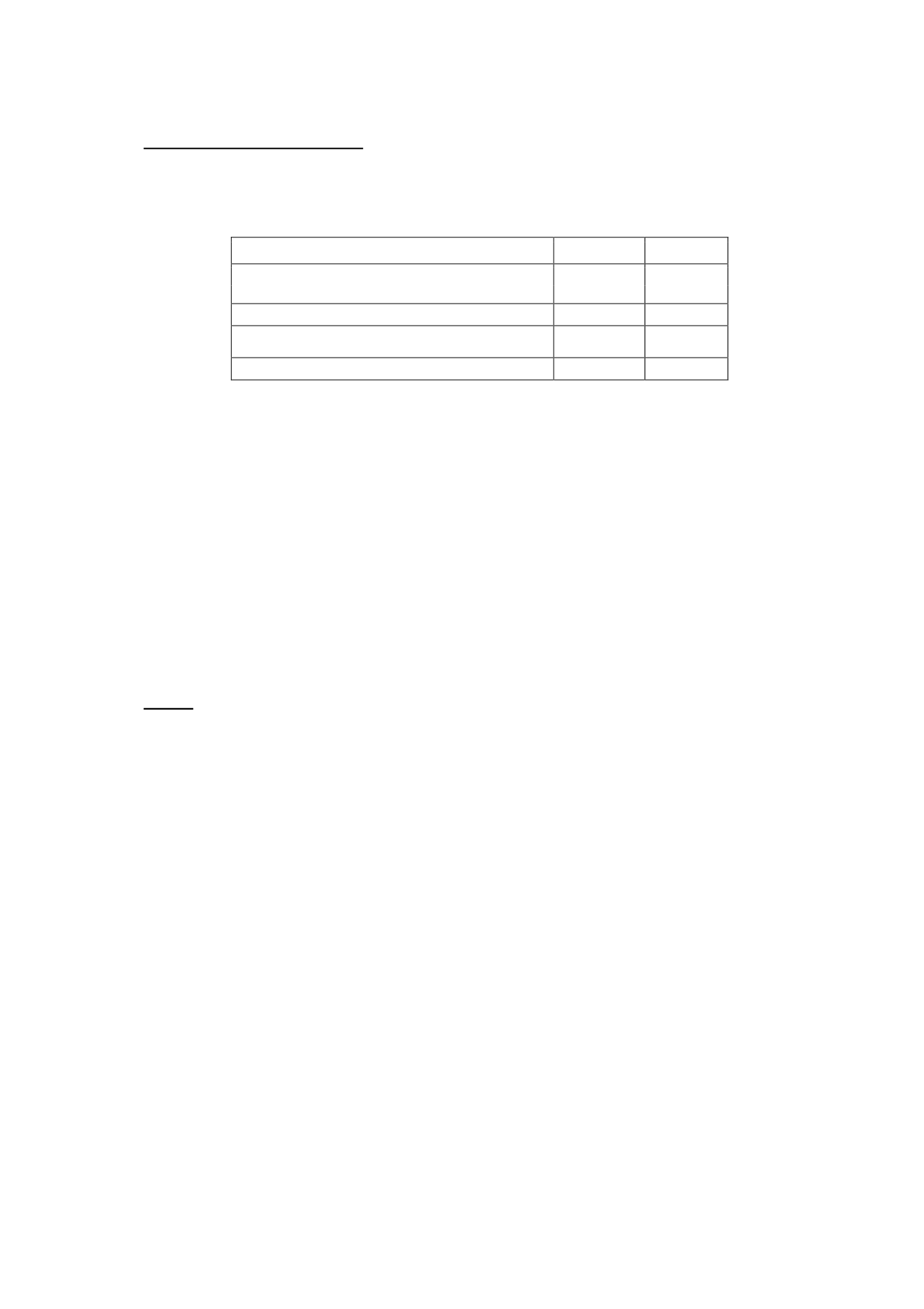

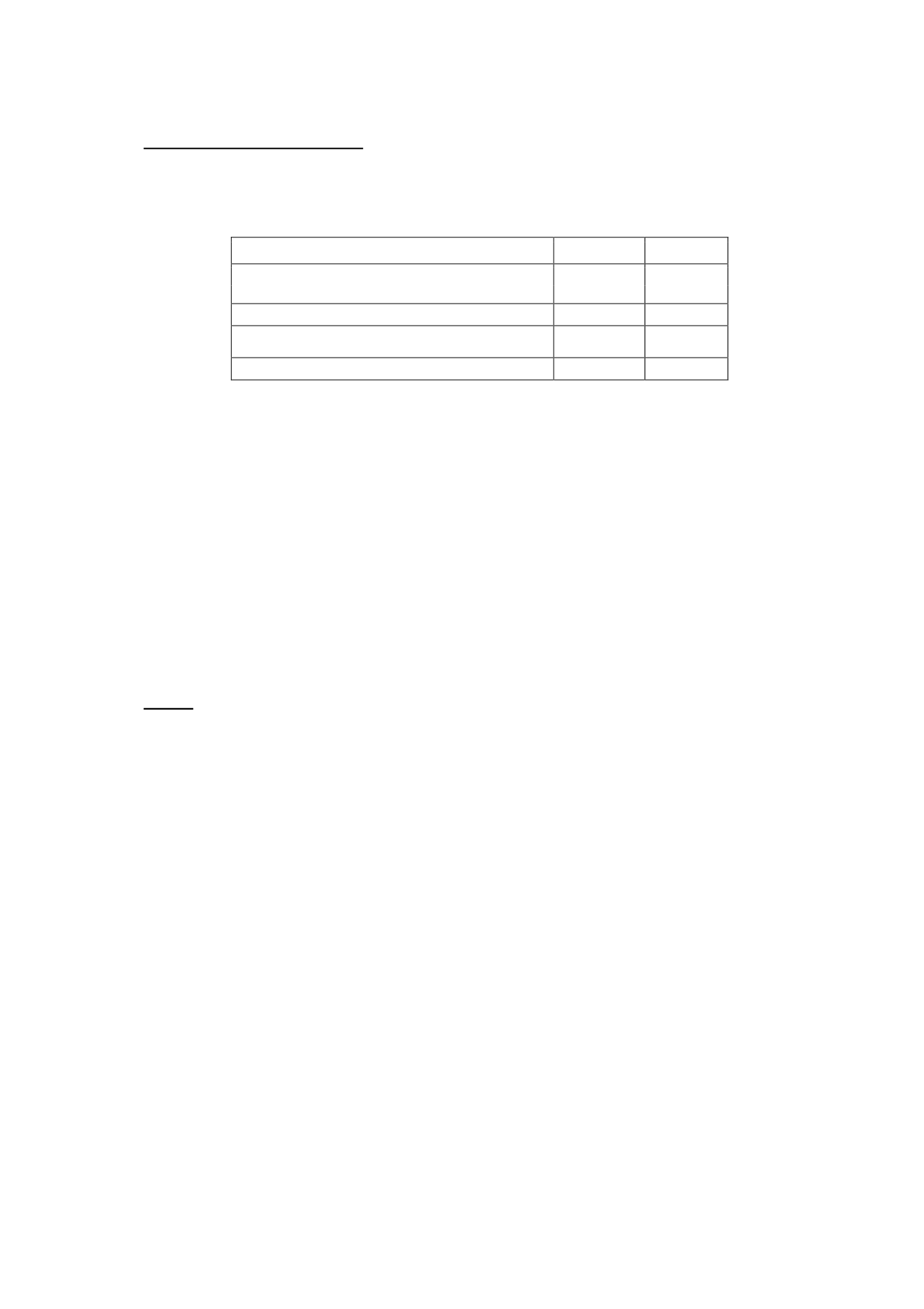

The detail of trade and other receivables in the consolidated balance sheets at 31 December

2013 and 2012 is as follows:

Thousands of euros

2013

2012

Trade receivables

184,608

169,908

Receivable from associates and related companies

38,195

46,437

Total trade receivables for sales and services

222,803

216,345

Other receivables

5,792

12,650

Total other receivables

5,792

12,650

The estimated amounts are recognised in the consolidated balance sheet, net of allowances for

estimated bad and doubtful debts, on the basis of prior years' experience and of the Group's

assessment of the current economic climate.

At 31 December 2013, the allowance for doubtful debts amounted to EUR 22,541 thousand

(2012: EUR 30,632 thousand). The provision recognised in 2013 amounted to EUR 797

thousand (2012: EUR 5,429 thousand), and EUR 8,889 thousand of the allowance were used

in the year (2012: EUR 5,626 thousand).

As provided for in the measurement bases disclosed in Note 3 to these consolidated financial

statements, impairment losses are recognised or reversed as a result of valuation adjustments

of trade and other receivables based on their due dates and the equity position of the debtors.

The related write downs and amounts charged to profit or loss are recognised under “Other

Operating Expenses” in the consolidated income statement.

12.Equity

a)

Share capital

On 29 October 2012, the Parent Atresmedia Corporación de Medios de Comunicación, S.A.

increased share capital by a nominal amount of EUR 10,965 thousand through the issue of

(i) 13,438,704 shares of EUR 0.75 par value each, of the same class and series as the

shares outstanding prior to the increase but without entitlement to dividends paid out of

the profits generated prior to the date of registration of the merger at the Mercantile

Registry, irrespective of the dividend payment date, and (ii) 1,181,296 shares of EUR 0.75

par value each, of a different class and carrying the same restriction on dividend rights as

the aforementioned shares, although in this case the restriction shall continue to apply for

24 months following the date on which the merger was registered at the Mercantile

Registry.

The aforementioned capital increase, the sole purpose of which was to cater for part of the

share exchange on the merger, was approved by the shareholders at the Company's

Annual General Meeting held on 25 April 2012 on the terms and conditions included in the

draft terms of merger and was conditional upon the obtainment of the related

administrative authorisations.

The new shares were issued at EUR 3.37 each, equal to the closing market price of the

Atresmedia share on 5 October 2012, the date on which the capital increase resolution

became effective. The difference between the issue price and the par value (i.e. EUR 2.62

per share) was treated as a share premium. The total capital increase amounted to EUR