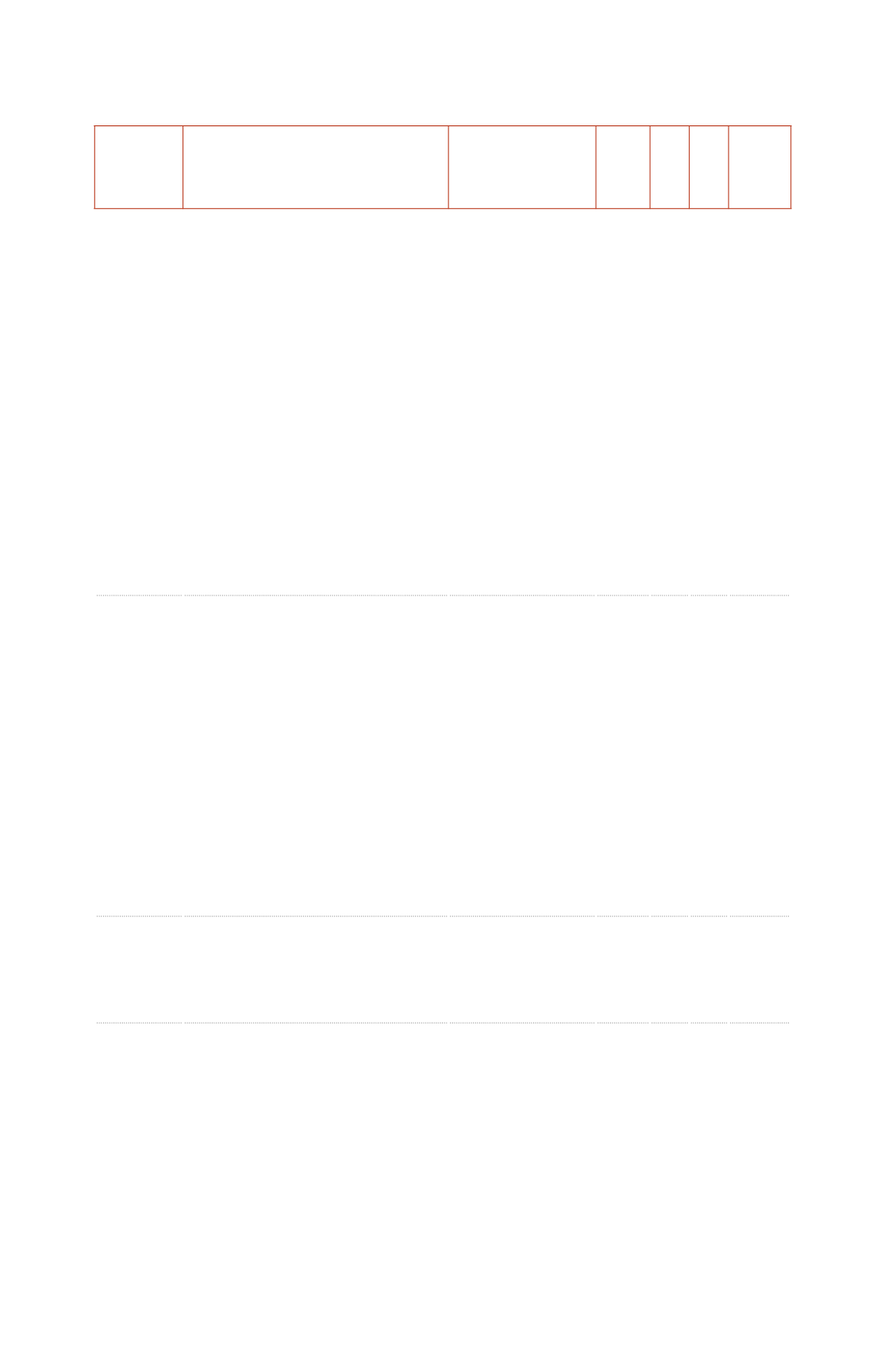

Indicators

Page / Answer

Reported

Part not

reported

Reason for

omission

External

verification

G4-EC3

Where the plan’s liabilities are met by the

organization’s general resources, report the

estimated value of those liabilities.

Where a separate fund exists to pay the plan’s

pension liabilities, report:

The extent to which the scheme’s liabilities

are estimated to be covered by the assets that

have been set aside to meet them

The basis on which that estimate has been

arrived at

When that estimate was made

Where a fund set up to pay the plan’s pension

liabilities is not fully covered, explain the

strategy, if any, adopted by the employer to

work towards full coverage, and the timescale,

if any, by which the employer hopes to

achieve full coverage.

Report the percentage of salary contributed

by employee or employer.

Report the level of participation in retirement

plans (such as participation in mandatory or

voluntary schemes, regional or country-based

schemes, or those with financial impact).

There are no pension

schemes

TOTAL

Yes, 207

G4-EC4

Report the total monetary value of financial

assistance received by the organization from

governments during the reporting period,

including, as a minimum:

Tax relief and tax credits

Subsidies

Investment grants, research and development

grants, and other relevant types of grants

Awards

Royalty holidays

Financial assistance from Export Credit

Agencies (ECAs)

Financial incentives

Other financial benefits received or receivable

from any government for any operation

Report the information above by country.

Report whether, and the extent to which, the

government is present in the shareholding

structure.

13

Report on

audited accounts

(Available at www.

atresmediacorporacion.

com)

TOTAL

Yes, 207

M1

Significant funding and other support

received from non-governmental sources.

0 euros

Report on

audited accounts

(Available at www.

atresmediacorporacion.

com).

TOTAL

Yes, 207

ATRESMEDIA

| ANNUAL AND CORPORATE RESPONSIBILITY REPORT 2015 |

ANNEXES

|

218