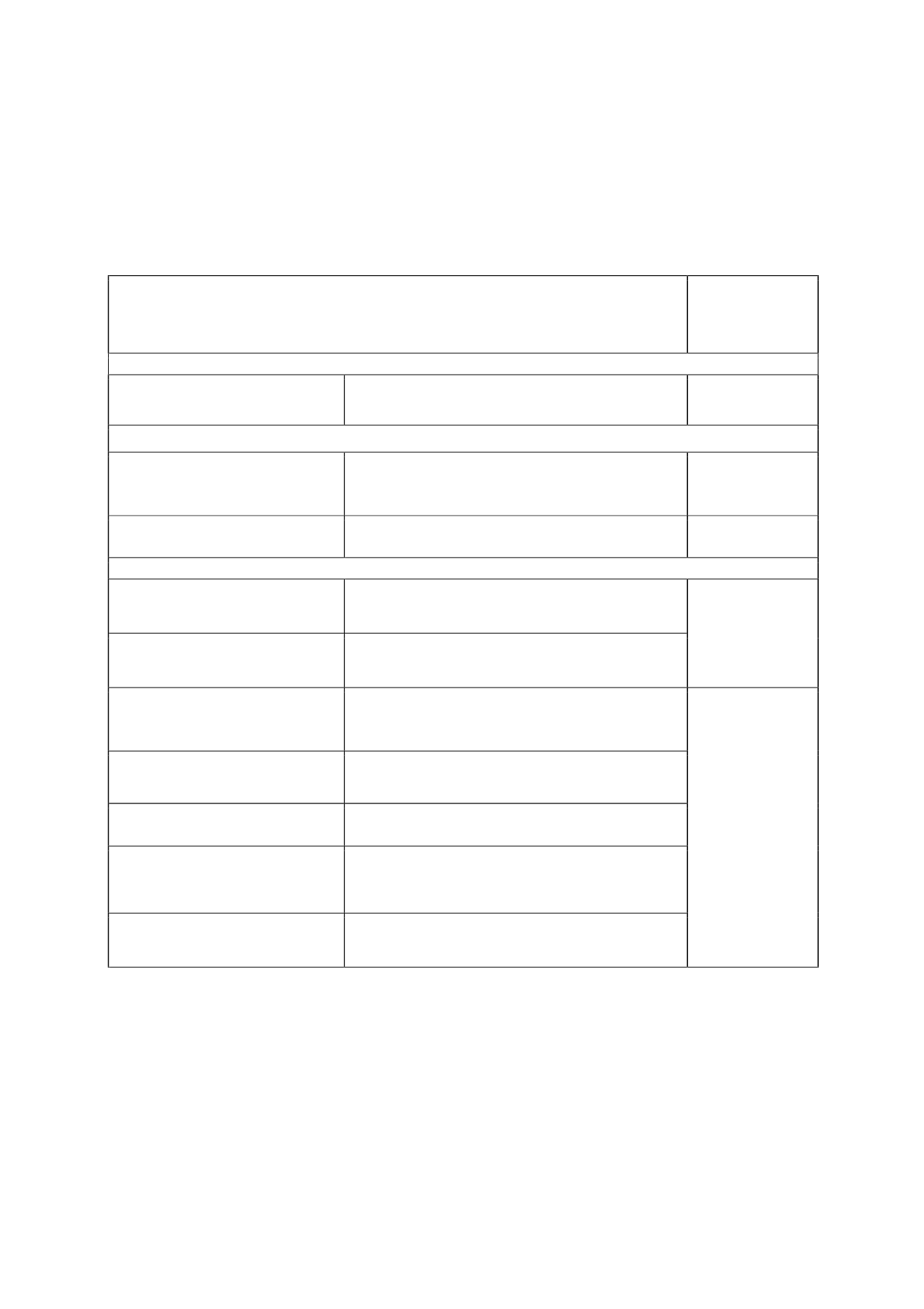

10

New standards, amendments and interpretations:

Obligatory

application in

annual reporting

periods beginning

on or after:

Approved for use in the European Union

IFRIC 21, Levies (issued in May 2013)

This interpretation addresses the accounting for a liability to

pay a levy that is triggered by an entity undertaking an

activity on a specified date.

17 June 2014 (1)

New standards not yet approved for use in the European Union at the date of publication of this document

IFRS 9, Financial Instruments (last phase

issued in July 2014)

Replaces the requirements in IAS 39 relating to the

classification, measurement, recognition and derecognition of

financial assets and financial liabilities, hedge accounting and

impairment.

1 January 2018

IFRS 15, Revenue from Contracts with

Customers (issued in May 2014)

New revenue recognition standard (supersedes IAS 11, IAS

18, IFRIC 13, IFRIC 15, IFRIC 18 and SIC-31).

1 January 2017

Amendments and/or interpretations

Amendments to IAS 19 - Defined Benefit

Plans: Employee Contributions (issued in

November 2013)

The amendments were issued to allow employee contributions

to be deducted from the service cost in the same period in

which they are paid, provided certain requirements are met.

1 July 2014

Improvements to IFRSs, 2010-2012 cycle

and 2011-2013 cycle (issued in December

2013)

Minor amendments to a series of standards.

Amendments to IAS 16 and IAS 38 -

Clarification of Acceptable Methods of

Depreciation and Amortisation (issued in

May 2014)

Clarify the acceptable methods of depreciation and

amortisation of property, plant and equipment and intangible

assets.

Amendments to IFRS 11 - Accounting for

Acquisitions of Interests in Joint

Operations (issued in May 2014)

Provide guidance on the accounting for acquisitions of

interests in joint operations in which the activity constitutes a

business.

Improvements to IFRSs, 2012-2014 cycle

(issued in September 2014)

Minor amendments to a series of standards.

1 January 2016

Amendments to IFRS 10 and IAS 28 - Sale

or Contribution of Assets between an

Investor and its Associate or Joint Venture

(issued in September 2014)

Clarification in relation to the gain or loss resulting from such

transactions involving a business or assets.

Amendments to IAS 27 - Equity Method in

Separate Financial Statements (issued in

August 2014)

The amendments permit the use of the equity method in the

separate financial statements of an investor.

(1) The EU endorsed IFRIC 21 (EU Journal of 14 June 2014), changing the original effective date established by the IASB (1

January 2014) to 17 June 2014.

IFRIC 21, Levies