7

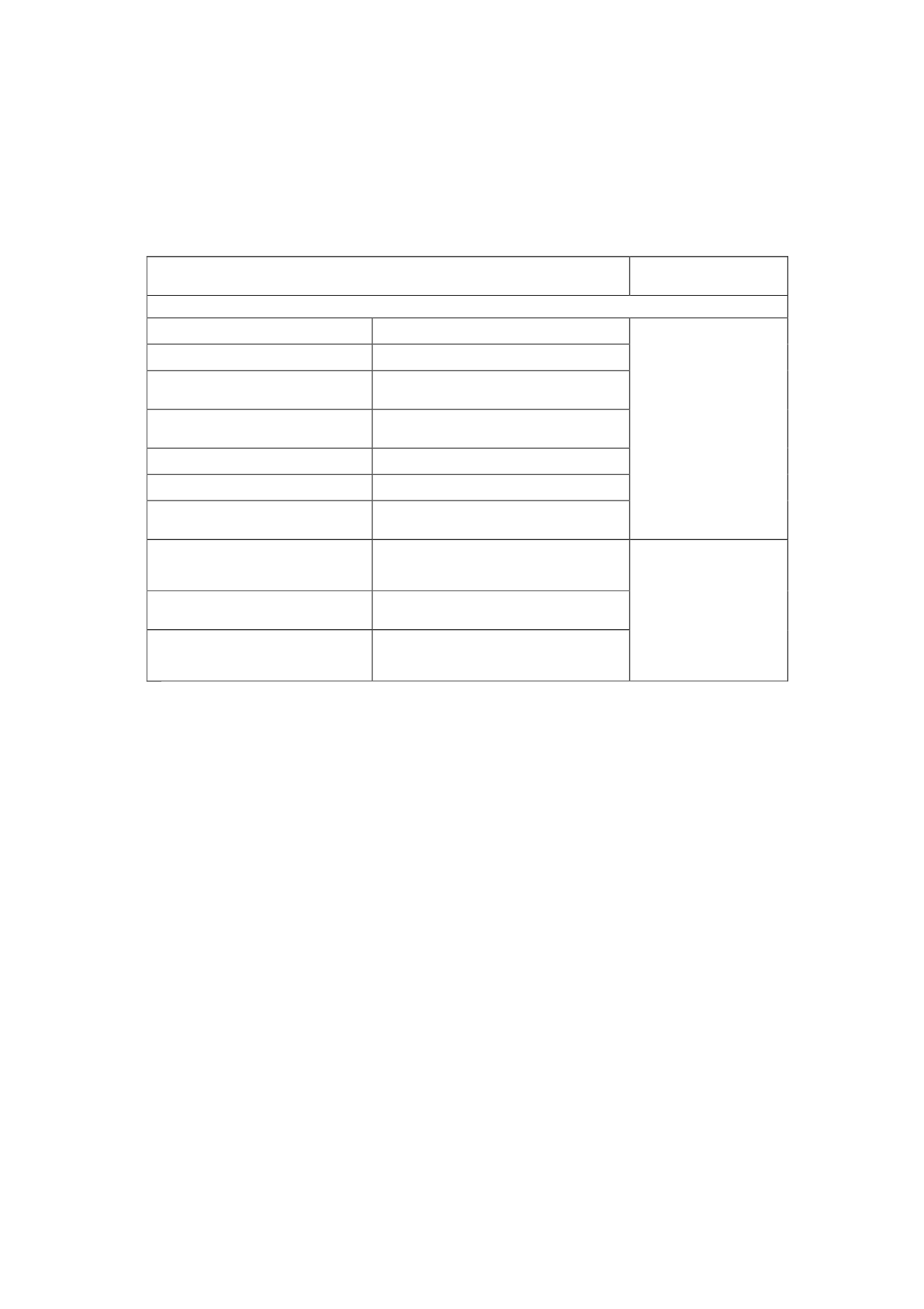

New standards, amendments and interpretations:

Obligatory application in

annual reporting periods

beginning on or after:

Approved for use in the European Union

IFRS 10, Consolidated Financial Statements

(issued in May 2011)

Supersedes the requirements relating to

consolidated financial statements in IAS 27.

IFRS 11, Joint Arrangements (issued in May

2011)

Supersedes the requirements relating to

consolidated financial statements in IAS 31.

IFRS 12, Disclosure of Interests in Other

Entities (issued in May 2011)

Single IFRS presenting the disclosure requirements

for interests in subsidiaries, associates, joint

arrangements and unconsolidated entities

IAS 27 (Revised), Separate Financial

Statements (issued in May 2011)

The IAS is revised, since as a result of the issue of

IFRS 10 it applies only to the separate financial

statements of an entity

1 January 2014 (1)

IAS 28 (Revised), Investments in Associates

and Joint Ventures (issued in May 2011)

Revision in conjunction with the issue of IFRS 11,

Joint Arrangements.

Transition rules: Amendments to IFRS 10, 11

and 12 (issued in June 2012)

Clarification of the guidance for transition to these

standards

Investment Entities: Amendments to IFRS

10, IFRS 12 and IAS 27 (issued in October

2012)

Exception from consolidation for parent companies

that meet the definition of an investment entity

Amendments to IAS 32, Financial

Instruments: Presentation - Offsetting

Financial Assets and Financial Liabilities

(issued in December 2011)

Additional clarifications to the rules for offsetting

financial assets and financial liabilities under IAS 32.

Amendments to IAS 36, Recoverable Amount

Disclosures for Non-Financial Assets (issued

in May 2013)

Clarifies when certain disclosures are required and

extends the disclosures required when recoverable

amount is based on fair value less costs to sell.

1 January 2014

Amendments to IAS 39, Novation of

Derivatives and Continuation of Hedge

Accounting (issued in June 2013)

The amendments establish the cases in which -and

subject to which criteria- there is no need to

discontinue hedge accounting if a derivative is

novated.

(1)

The European Union postponed the mandatory effective date by one year. The original IASB

application date was 1 January 2013

.

New standards, amendments and interpretations mandatorily applicable on or after

1 January 2014

IFRS 10, Consolidated Financial Statements, IFRS 11, Joint Arrangements, IFRS

12, Disclosure of Interests in Other Entities, IAS 27 (Revised), Separate Financial

Statements and IAS 28 (Revised), Investments in Associates and Joint Ventures

The main change in IFRS 10 is the amended definition of control, which is based on the

following three elements of control which the investor must have at all times: power over

the investee; exposure, or rights, to variable returns from its involvement with the

investee; and the ability to use its power over the investee to affect the amount of the

investor’s returns. IFRS 10 also addresses the situation commonly known as “de facto

control”, in which the investor may control another entity even if it holds less than a

majority of the voting rights.

In turn, IFRS 11 changes the approach to analysing joint arrangements and classifies

them into two types: joint operations and joint ventures. For accounting purposes, the

main change proposed by IFRS 11 with respect to the former standard lies in the