63

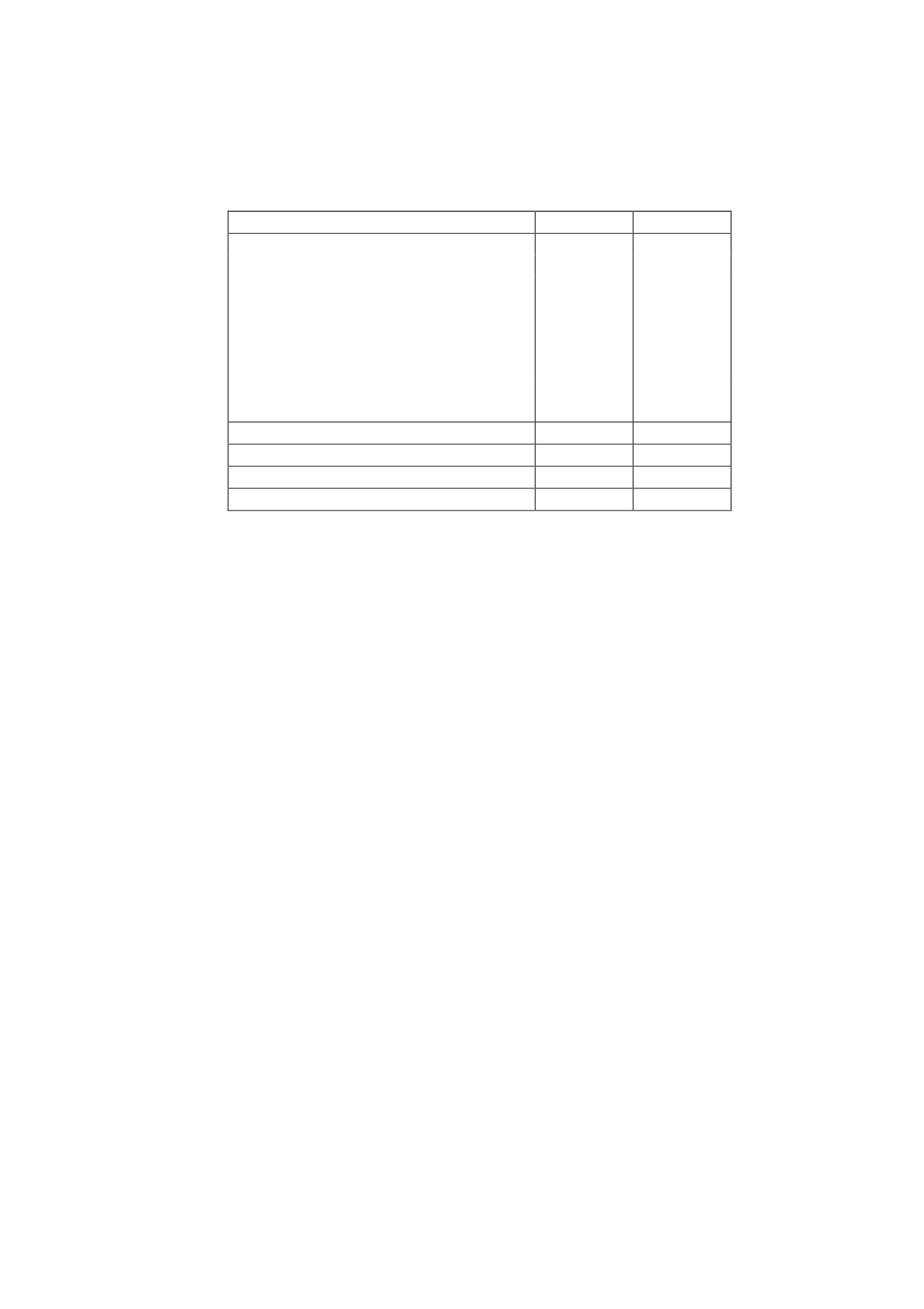

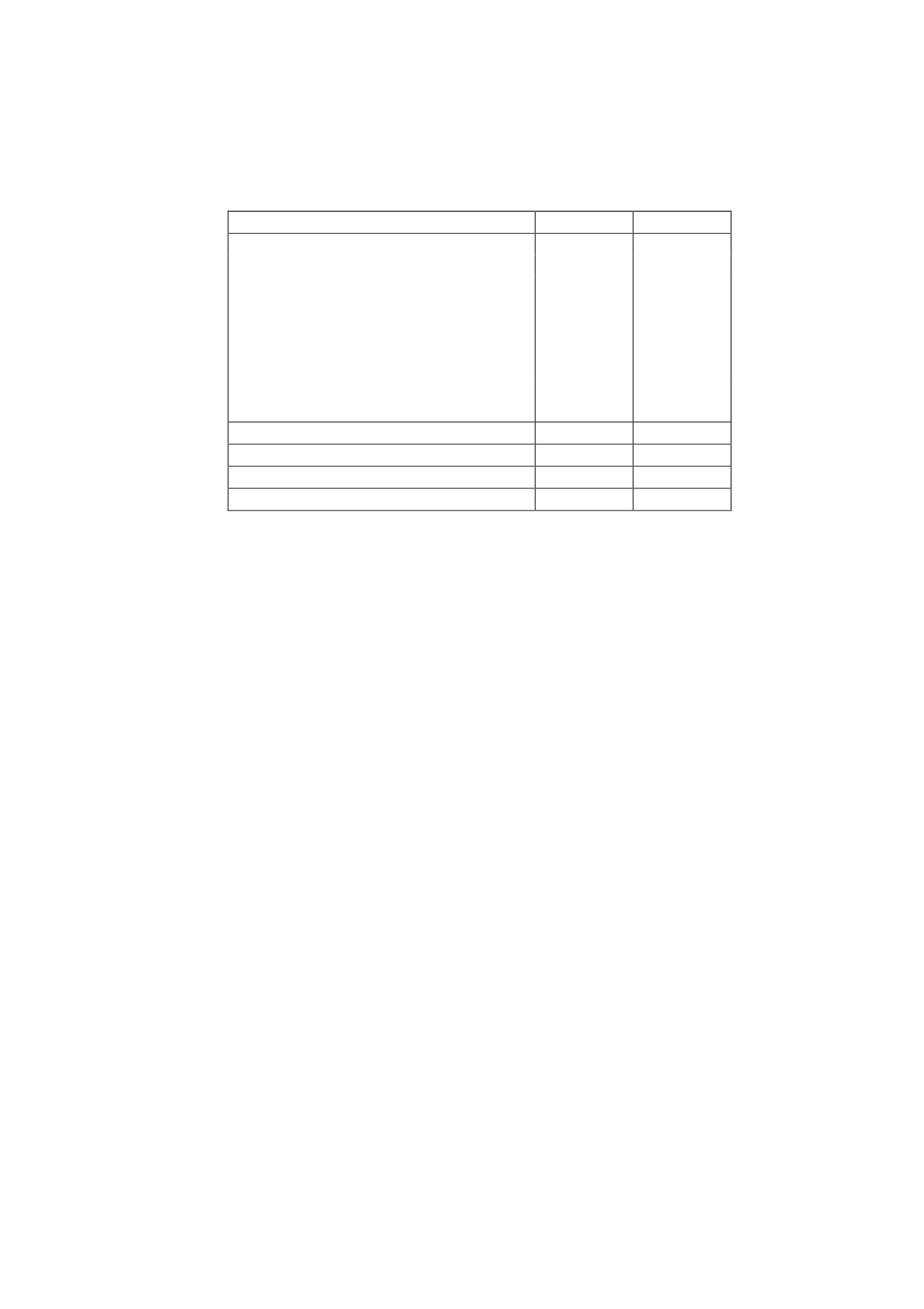

b) Reconciliationof the accountingprofit to the income tax expense

The reconciliation of the accounting profit to the income tax expense is as follows:

Thousands of euros

2013

2012

Consolidated profit before tax

47,807

11,904

Permanent differences

7,312

(13,179)

Tax losses incurred prior to the formation of the tax

group used in 2013

(4,029)

(15)

Adjusted profit (loss)

51,090

(1,290)

Tax rate

30.00%

30.00%

Adjusted profit (loss) multiplied by tax rate

15,327

(387)

Tax credits

(13,198)

(18,944)

Current income tax expense (benefit)

2,129

(19,331)

Deferred tax expense

(87)

(22)

Income tax adjustment

(289)

(652)

Total tax expense (benefit)

1,753

(20,005)

Effective tax rate

3.67%

(168.05%)

The 2013 permanent differences include mainly negative consolidation differences (EUR 1,038

thousand) and, with a positive sign, non-deductible impairment losses on equity instruments

(EUR 6,388 thousand), other non-deductible expenses (EUR 1,153 thousand) and donations

(EUR 809 thousand).

The negative consolidation differences arise from changes in the scope of consolidation (- EUR

202 thousand), the share of results of companies accounted for using the equity method (-

EUR 1,073 thousand), increased amortisation of the trademark under IFRSs (- EUR 289

thousand) and accounting elimination differences (+ EUR 2,602 thousand).

The tax credits indicated in the table above were earned by the Group in 2013 for investment

in audiovisual production and donations to not-for-profit organisations (EUR 12,915 thousand

and EUR 283 thousand, respectively).

“Income Tax Adjustment” includes the difference between the projected income tax expense

recognised in 2012 and the effective tax return filed.

The deferred tax expense relates to the tax effect of the deferred tax liability under IFRSs (see

Note 22-e).