65

On the basis of the timing estimate of future profits made by the Parent’s directors for the

offset and use of these tax items, only EUR 7,332 thousand were considered to be recoverable

in the tax return for the coming year, EUR 2,248 thousand of which relate to deferred taxes,

EUR 2,179 thousand to unused tax credits and tax relief and EUR 2,905 thousand to tax loss

carryforwards.

“Other Tax Receivables” and “VAT Refundable” are included in the consolidated balance sheet

under “Other Receivables”. Also, the items composing “Current Liabilities” are included in the

consolidated balance sheet under “Other Payables”.

At 31 December 2013, the Group had recognised unused tax credits amounting to EUR 85,364

thousand, of which EUR 4,801 thousand relate to La Sexta.

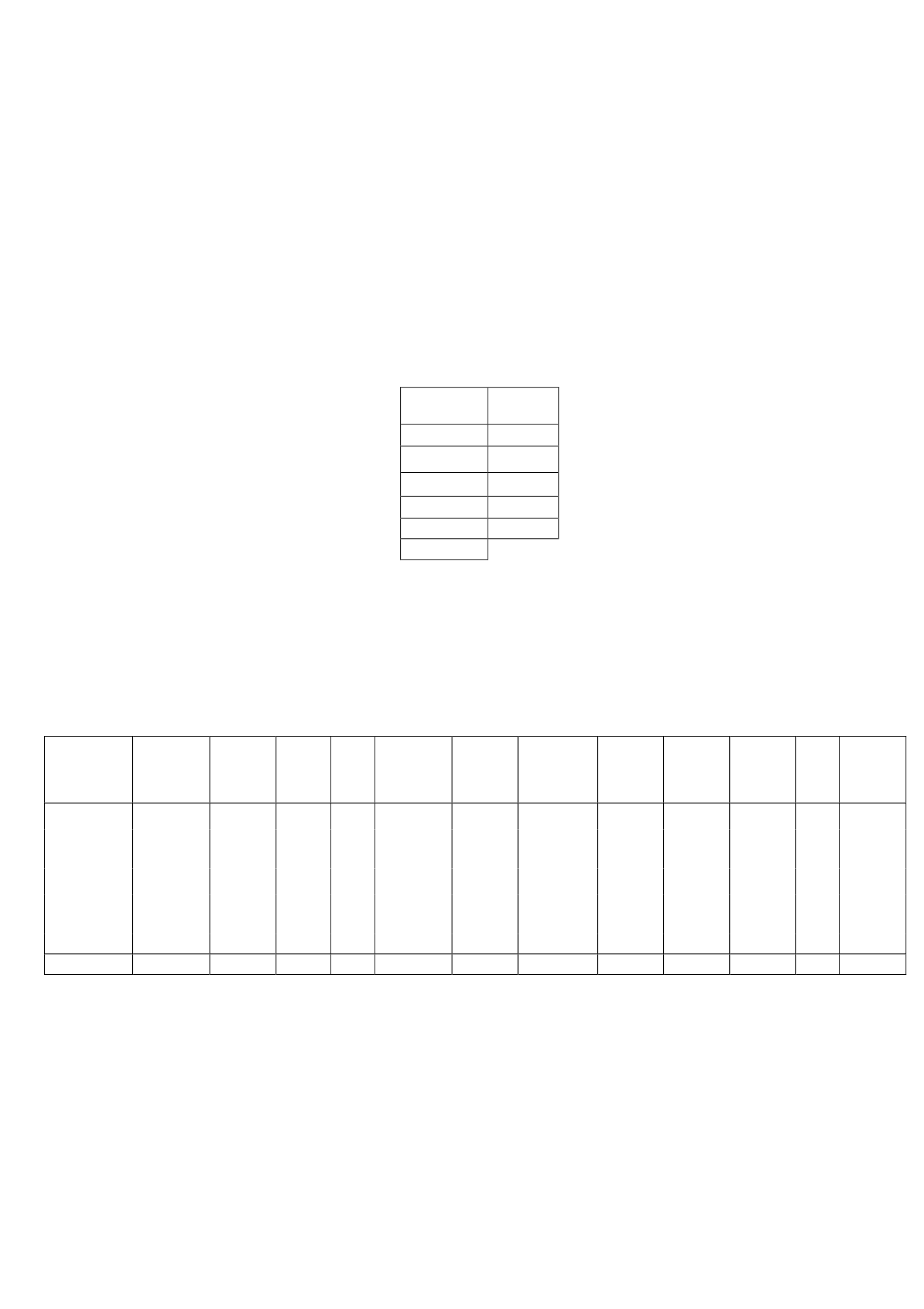

Amount

Limit

7,908

2019

19,482

2020

26,167

2021

18,892

2022

12,915

2023

85,364

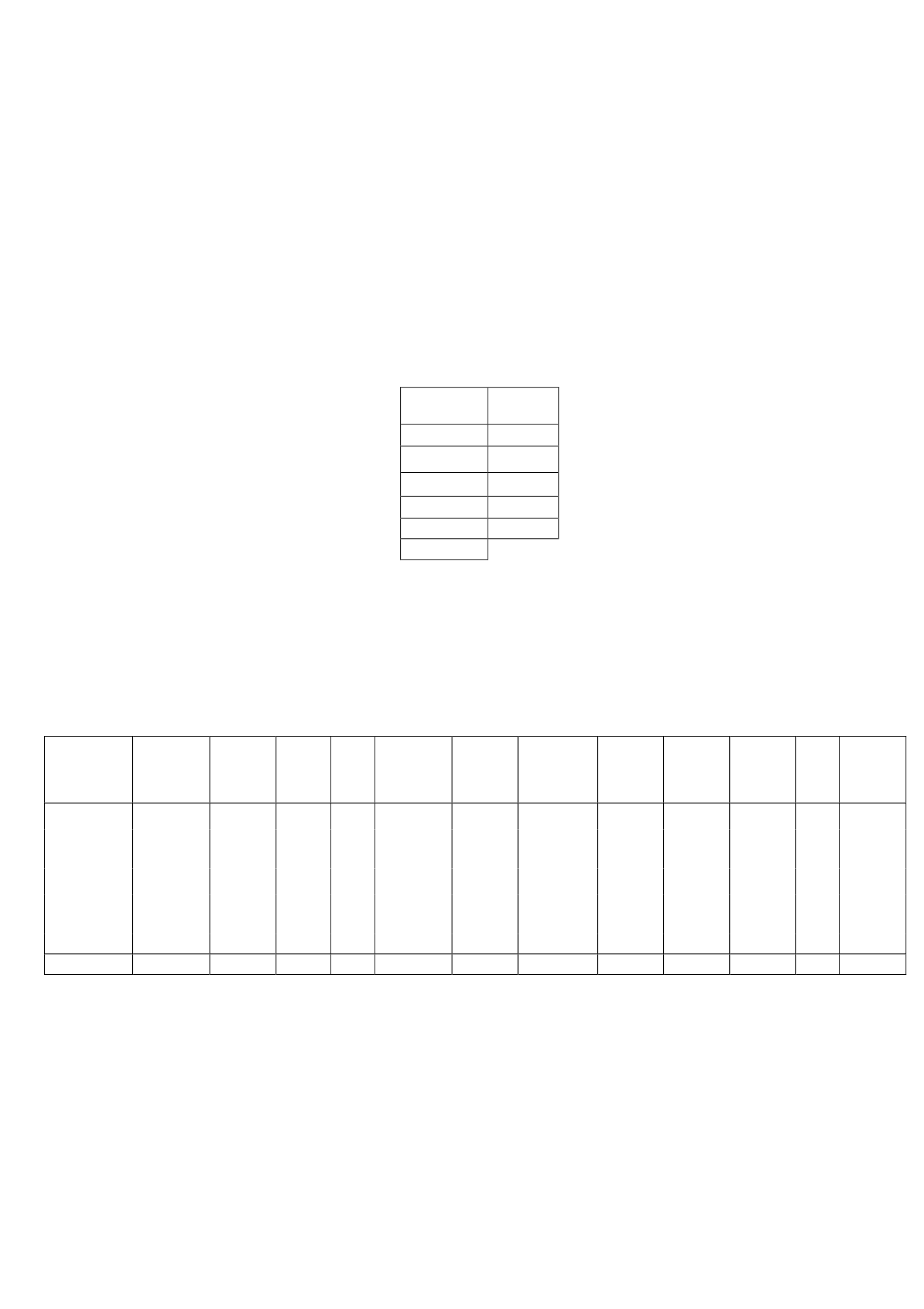

e) Deferred tax assets recognised

The difference between the tax charge allocated to the current year and to prior years and the

tax charge already paid or payable for such years, which is recognised under deferred tax

assets, arose as a result of temporary differences derived from the following items:

CHANGES IN

DEFERRED

TAXASSETS

Balance at

31/12/11

Additions Disposals Other

Transfers at

31/12/11

Inclusions

due to

merger

Inclusions

in/exclusions

from scopeof

consolidation

Balance at

31/12/12 Additions Disposals Other

Balance at

31/12/13

Thousands

of euros

Contingencies

and charges

6,061

2,554 (1,985)

24

4,024

1,561

35

12,275

3,620

(4,027)

521

12,389

Non-current

accounts

payable

1,131

1,250

(690)

135

(95)

498

-

2,228

5

(982) (644)

607

Hedging

instruments

(401)

192

-

-

-

-

-

(209)

-

(152)

-

(361)

Tax effect of

assets at fair

value

-

- (1,030)

-

-

10,513

-

9,483

-

(6,845)

(97)

2,541

Other

4,873

1,299

(362)

251

(3,929)

-

134

2,266

3,349

(611)

276

5,280

Total

11,664

5,295 (4,067)

410

-

12,572

169

26,043

6,974

(12,617)

56

20,456

The changes in deferred tax assets, included in the “Other” column, include most notably the

difference between the projected income tax expense for 2012 and the tax return actually

filed.