64

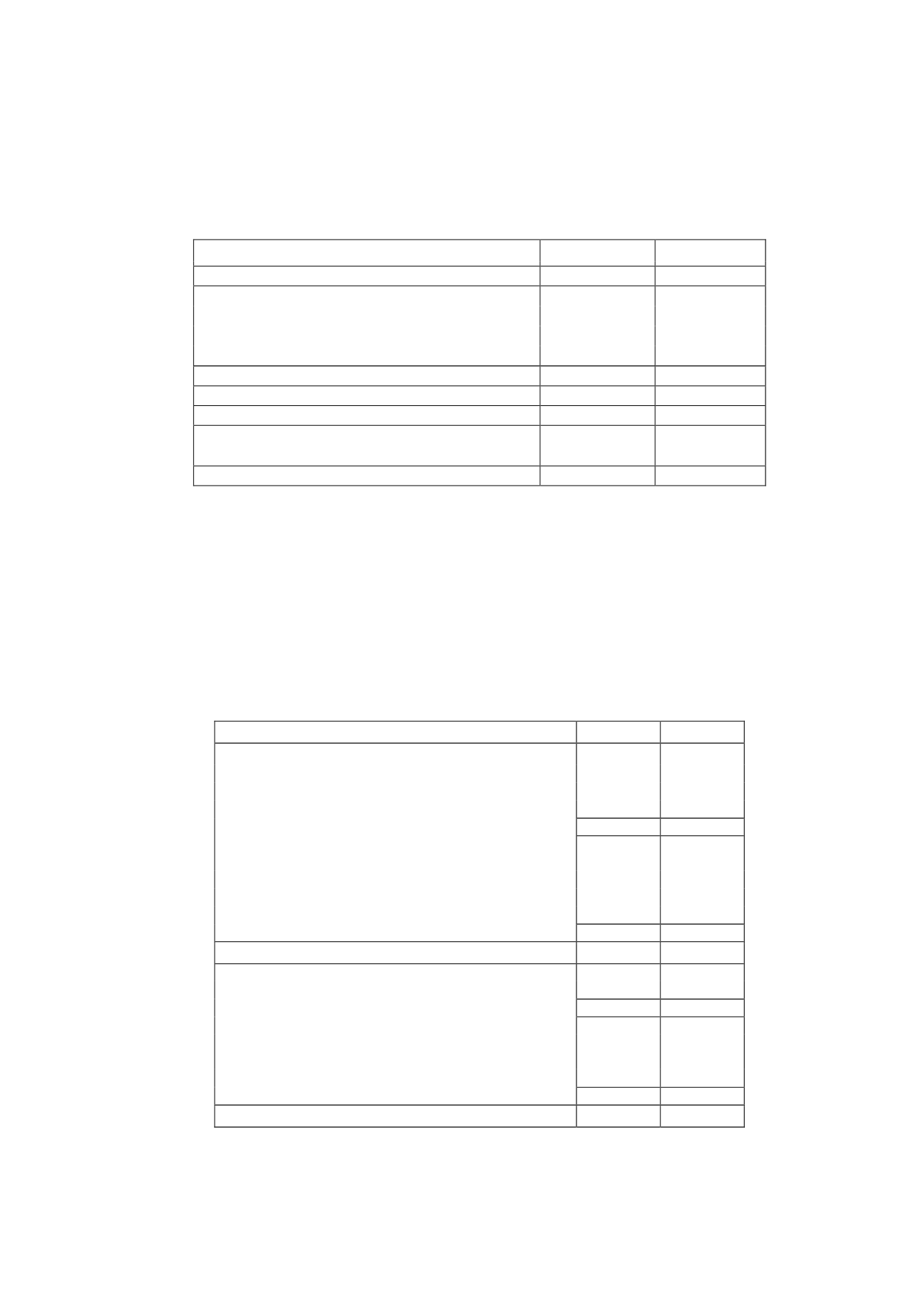

c) Reconciliationof the accountingprofit to the taxable profit

The reconciliation of the accounting profit to the taxable profit for income tax purposes for

2013 and 2012 is as follows:

Thousands of euros

2013

2012

Accounting profit after tax

46,054

31,887

Income tax

1,753

(19,983)

Permanent differences –

7,312

(13,179)

Temporary differences –

(18,751)

8,083

Offset of prior years' tax losses

(5,172)

(15)

Taxable profit

31,196

6,793

Tax rate

30.00%

30.00%

Gross tax payable

9,359

2,038

Tax credits used in 2013

(3,002)

(640)

2013 tax prepayments

(7,004)

(1,964)

Tax payable (refundable)

(647)

(566)

The 2013 temporary differences include additions of EUR 24,038 thousand and reductions of

EUR 42,789 thousand (see Note 22-e).

Additions break down into deferred tax assets of EUR 23,247 thousand and deferred tax

liabilities of EUR 791 thousand, while reductions include deferred tax assets of EUR 41,550

thousand and deferred tax liabilities of EUR 1,239 thousand.

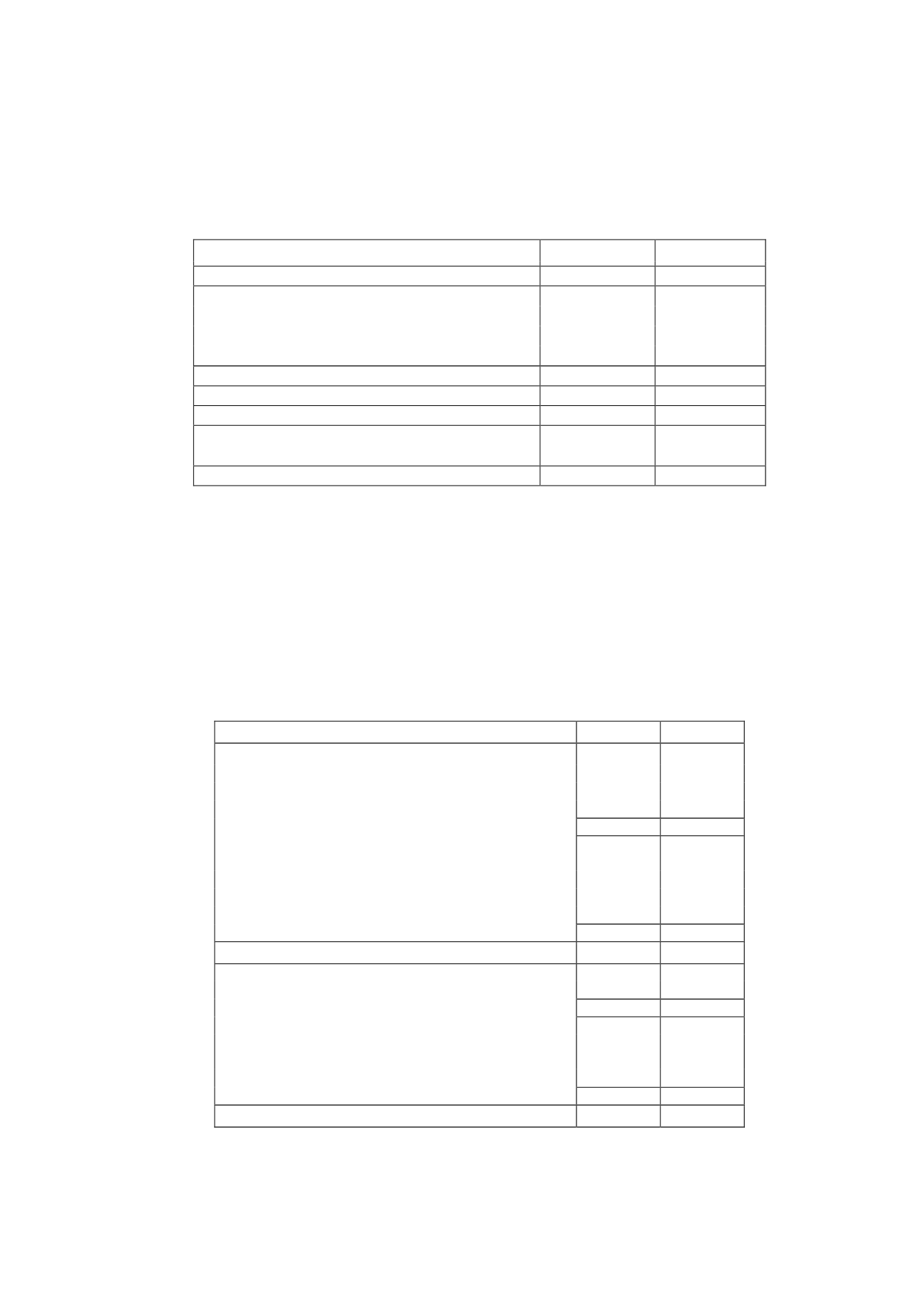

d) Tax receivables andpayables

The detail of the tax receivables and payables at 31December 2013 and 2012 is as follows:

Thousands of euros

2013

2012

NON-CURRENTASSETS

Deferred tax assets (Note 22-e)

20,456

26,043

Tax loss carryforwards (Note 22-g)

221,363

221,793

Unused tax credits and tax relief

85,364

74,703

327,183

322,539

CURRENTASSETS

Income tax refundable

911

1,188

2013 income tax refundable (Note 22-c)

647

566

Other tax receivables

26

4

VAT refundable

2,906

7,107

4,490

8,865

Total tax receivables

331,673

331,404

OTHERNON-CURRENT LIABILITIES

Deferred tax liabilities (Note 22-e)

31,345

31,488

CURRENT LIABILITIES

Tax withholdings payable

4,044

4,236

Accrued social security taxes payable

1,881

1,681

VAT payable

9,815

7,681

15,740

13,598

Total tax payables

47,085

45,086