11

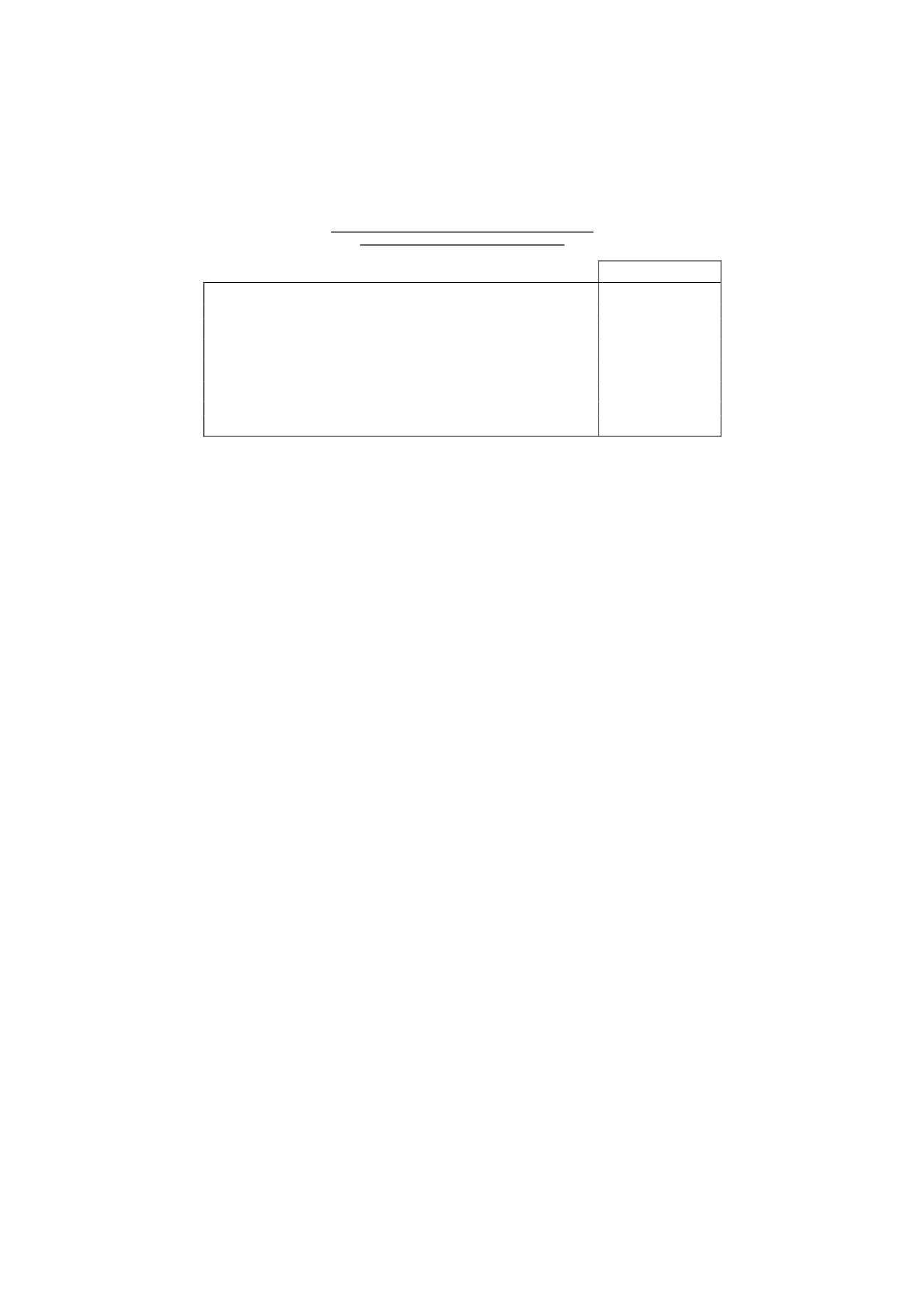

The provisional accounting statement prepared in accordance with legal requirements evidencing

the existence of sufficient liquidity for the distribution of the dividends is as follows:

LIQUIDITY STATEMENT FOR THE PAYMENT

OF THE 2015 INTERIM DIVIDEND

Thousands of euros

Liquidity at 31 October 2015

150,331

Projected cash until 31 December 2015:

Current transactions from November to December 2015

8,557

Financial transactions from November to December 2015

10,347

Projected dividend payment

(37,717)

Projected liquidity at 31 December 2015

131,518

4.- Accounting policies

The principal accounting policies used by the Company in preparing its financial statements for

2015 and 2014, in accordance with the Spanish National Chart of Accounts, were as follows:

4.1 Intangible assets

As a general rule, intangible assets are recognised initially at acquisition or production cost. They

are subsequently measured at cost less any accumulated amortisation and any accumulated

impairment losses. These assets are amortised over their years of useful life.

Licences and trademarks

These accounts include the amounts relating to the licence and the trademark identified in the

purchase price allocation process arising from the merger with Gestora de Inversiones

Audiovisuales La Sexta, S.A.

The trademark is amortised on a straight-line basis over its useful life, which is estimated to be 20

years.

With regard to the licence, based on an analysis of all the relevant factors, the Company considers

that there is no foreseeable limit to the period over which it is expected to generate net cash

inflows for the Company. As a result, the licence was classified as an intangible asset with an

indefinite useful life and, therefore, it is not amortised. This indefinite useful life assessment is

reviewed at each reporting date and is consistent with the Company's related business plans.

The Company has reviewed the licence and trademark valuations identified in the purchase price

allocation process performed within the framework of the aforementioned merger. For this review,

which included the participation of an independent expert, the standard procedures for analyses of

this kind were used, and it was concluded that the assigned values are within reasonable valuation

ranges. Consequently, it was not necessary to modify the initial estimates or make any

adjustments at 2015 year-end.

Since the asset has an indefinite useful life, a recoverability assessment was performed at year-

end. The key assumptions on which the cash flow projections are based relate mainly to

advertising markets, audience, advertising efficiency ratios and the evolution of expenses. Except

for advertising data, which is measured on the basis of external sources of information, the