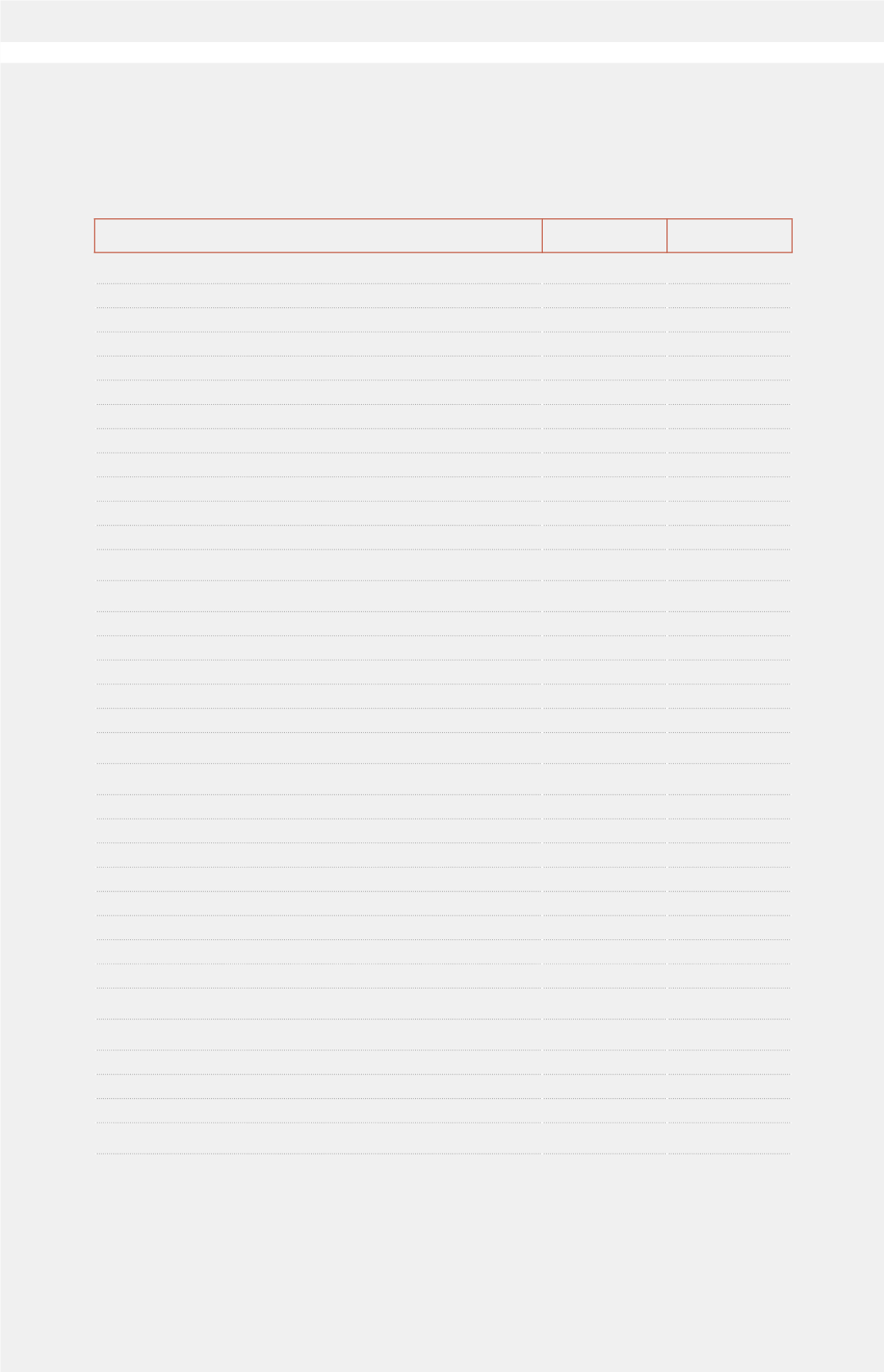

Consolidated Statement of Cash Flows of Atresmedia Corporación de

Medios de Comunicación, S.A. and Subsidiaries for the year ended 31

December 2015

(Thousands of euros)

2015

2014

1.- CASH FLOWS FROM OPERATING ACTIVITIES

Consolidated profit for the year before tax

131,547

95,327

Adjustments for:

42,285

38,874

- Depreciation and amortisation charge

17,431

16,402

- Provisions and other

12,822

10,190

- Provisions

8,134

6,532

- Net impairment losses (+/-)

2,368

1,440

- Result of companies accounted for using the equity method

2,320

2,218

Financial profit

12,032

12,282

Changes in working capital

(57,275)

(33,333)

Cash flows from operating activities

116,557

100,868

Income tax paid

(22,531)

(18,873)

Net cash flows from operating activities

94,026

81,995

2.- CASH FLOWS FROM INVESTING ACTIVITIES

Investments

(41,310)

(48,565)

Subsidiaries, joint ventures and associates

(9,447)

(13,995)

Property, plant and equipment and intangible assets

(31,863)

(34,570)

Disposals

3,472

–

Subsidiaries, joint ventures and associates

3,472

–

Net cash flows from investing activities

(37,838)

(48,565)

3.- CASH FLOWS FROM FINANCING ACTIVITIES

Finance costs paid

(9,984)

(16,506)

Financing - Associates and related companies

(326)

(33,546)

Net bank borrowings

(5,857)

(41,380)

Capital contributions

–

37

Dividends received

43

–

Dividends paid

(62,913)

(46,916)

Acquisition of treasury shares

(7,215)

–

Sale of treasury shares

–

79,680

Net cash flows from financing activities

(86,252)

(58,631)

NET INCREASE/DECREASE IN CASH

(30,064)

(25,201)

Cash and cash equivalents at beginning of year

31,081

56,282

Changes in the scope of consolidation/IFRSs

–

–

Cash and cash equivalents at beginning of year - new scope of consolidation

31,081

56,282

Cash and cash equivalents at end of year

1,017

31,081

ATRESMEDIA

| EXECUTIVE SUMMARY OF THE ANNUAL AND CORPORATE RESPONSIBILITY REPORT 2015 |

49