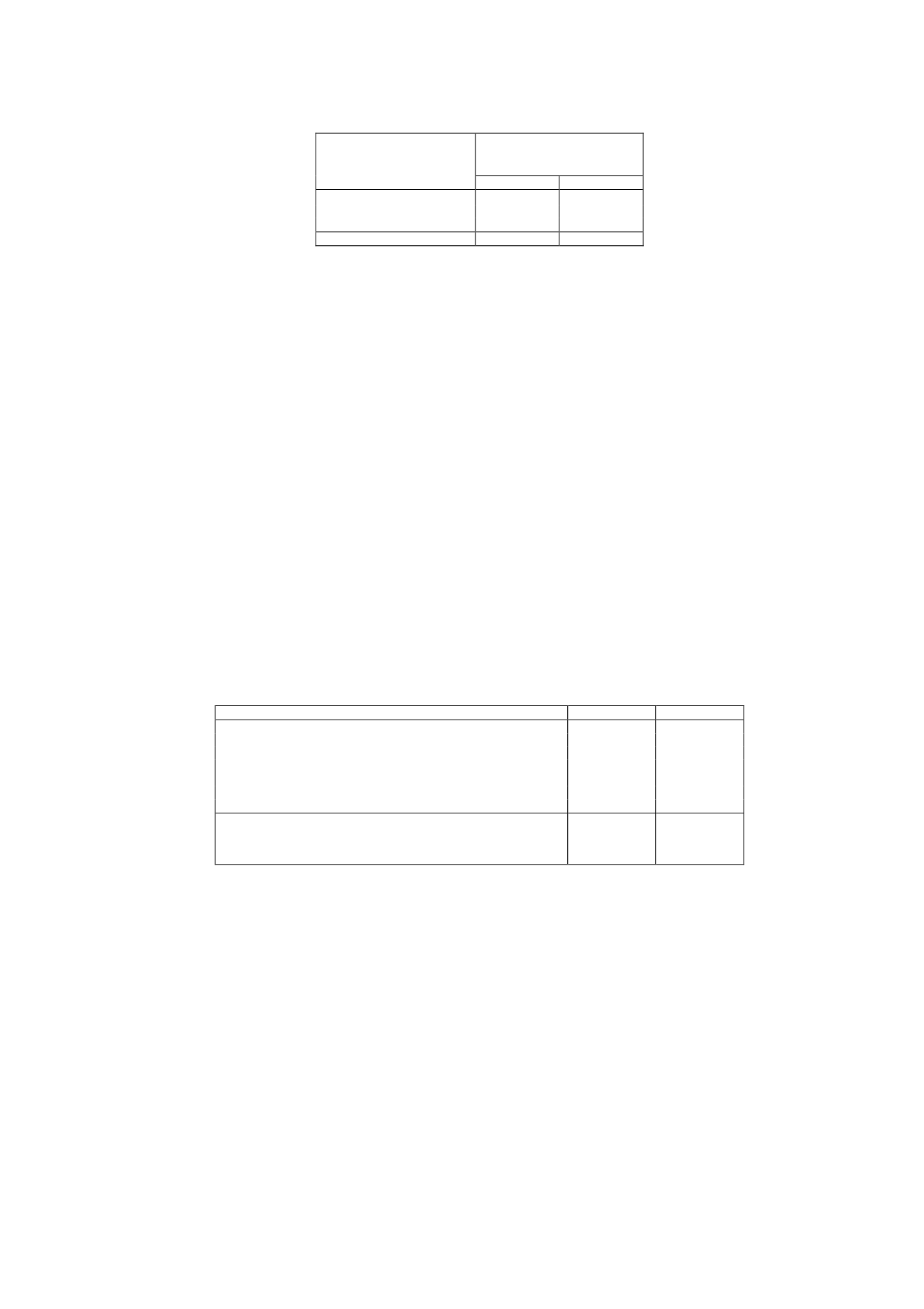

Gross carrying amount

2014

2013

Buildings

8,661

7,804

Other assets

104,941

104,592

Total

113,602

112,396

The Company takes out insurance policies to cover the possible risks to which its property,

plant and equipment are subject. At the end of 2014 and 2013 the property, plant and

equipment were fully insured against these risks.

7.- Leases

At the end of 2014 and 2013 the Company, as a lessor under operating leases, had annual

lease arrangements with certain Group companies for facilities and other scantly material

lease arrangements with a term of more than one year with non-Group companies. Since the

leased facilities are in the same building as the Company, they are not considered to be

investment property included in the Company’s assets.

Income from operating leases in 2014 amounted to EUR 7,421 thousand (2013: EUR 7,531

thousand).

8.- Financial assets (non-current and current)

8.1 Non-current financial assets

The detail of “Non-Current Financial Assets” at the end of 2014 and 2013 is as follows (in

thousands of euros):

2014

2013

Held-for-trading financial assets:

Hedging Derivatives

4,397

Other derivatives

87

9,413

Available-for-sale financial assets:

At cost (Note 21.2)

5,956

1,472

Loans and receivables:

Long-term guarantees and deposits

75

75

Total

10,515

10,960

In relation to "Other Derivatives", in December 2012 the Company entered into various

agreements with the former shareholders of Gestora de Inversiones Audiovisuales La Sexta,

S.A., including one whereby, in exchange for a fixed market consideration determined at the

date of the agreement and deliverable by Atresmedia Corporacion Medios de Comunicacion,

S.A., the aforementioned counterparty undertook to pay the Company a variable cash amount

to be determined on the basis of the future economic results of the Atresmedia Group and

payable in 2017.

On February 24, 2014, as a result of the negotiation process Novation Agreement described in

Note 12.2 will be achieved, among other agreements with Gamp Audiovisual, S.A. and

Imagina Media Audiovisual, S.A., the cancellation of its share in the financial derivative

contract described in said Note 5. The amount at December 31, 2014 includes the fair value at

that date of the financial derivative instrument closed with Gala Desarrollos Comerciales, S.L.,

whose agreed terms remain unchanged, as specified in Note 12.2.