10

The 2013 consolidated financial statements of the Group and the 2013 separate financial

statements of the Group companies, which were formally prepared by the companies'

respective directors, will be submitted for approval at the related Annual General

Meetings, and it is considered that theywill be approvedwithout any changes.

The 2012 consolidated financial statements, which were approved by the shareholders at

the Annual General Meeting on 24 April 2013 and are included for comparison purposes,

were also prepared in accordance with EU-IFRSs applied on a basis consistent with that of

2013.

Standards and interpretations effective in2013:

The standards and interpretations that came into force in 2013 and that were taken into

account in preparing the accompanying consolidated financial statements are described below:

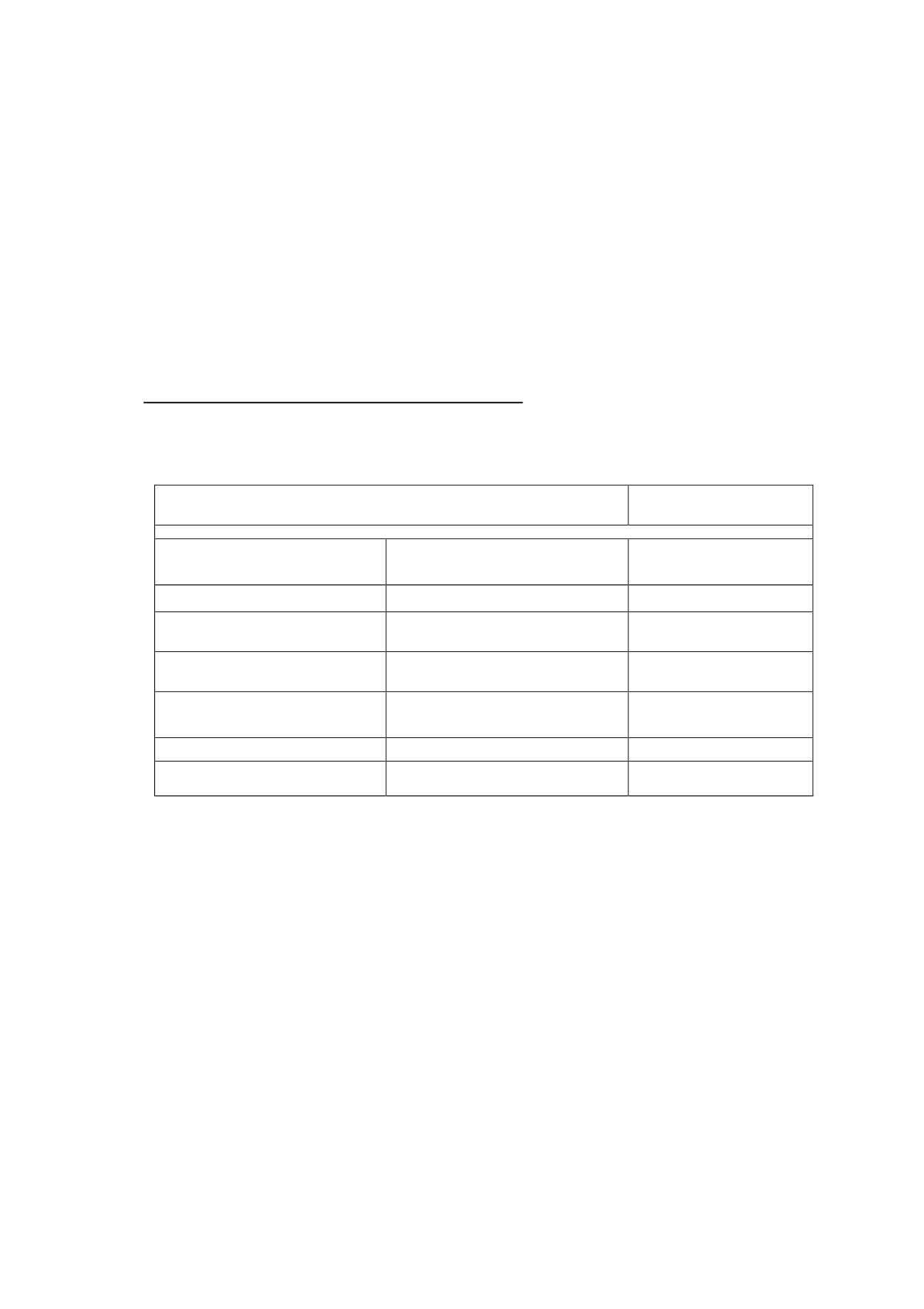

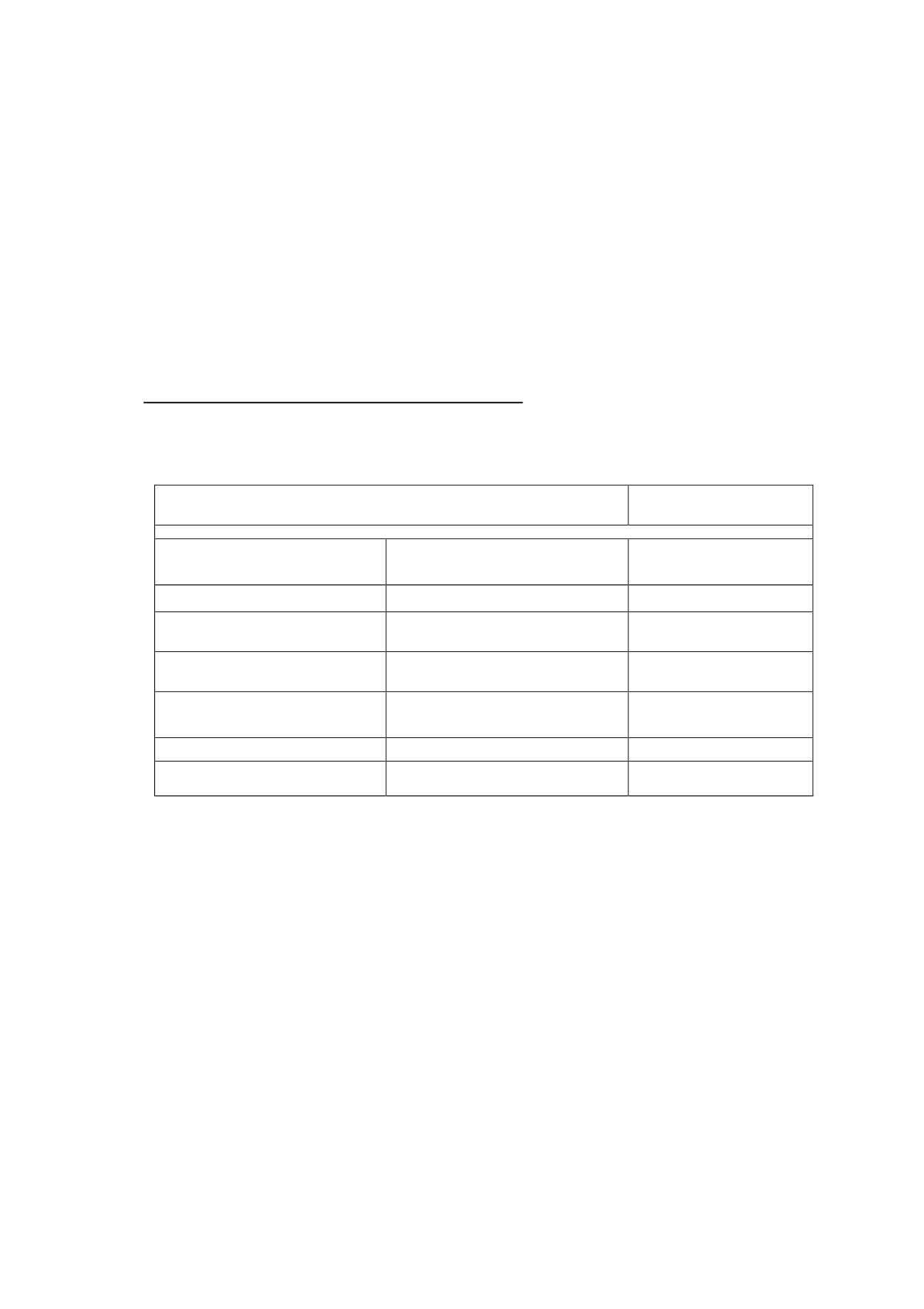

New standards, amendments and interpretations:

Obligatory application in annual

reportingperiods beginningon

or after:

Approved for use in the EuropeanUnion

Amendments to IAS 12, Income Taxes

- Deferred Taxes Arising from Investment

Property (issued inDecember 2010)

On themeasurement of deferred taxes arising

from investment propertymeasured using the

fair valuemodel in IAS 40

Annual reporting periods beginning

on or after 1 January 2013

(Original IASB date: 1 January

2012)

IFRS 13, Fair Value Measurement (issued in

May 2011)

Sets out a framework for measuring fair value

Annual reporting periods beginning

on or after 1 January 2013

Amendments to IAS 1 - Presentation of

Items of Other Comprehensive Income

(issued in June 2011)

Minor amendments relating to the presentation

of items of other comprehensive income

Annual reporting periods beginning

on or after 1 July 2012

Amendments to IAS 19, Employee Benefits

(issued in June 2011)

The amendments affect mainly defined benefit

plans since one of themajor changes is the

elimination of the “corridor”

Annual reporting periods beginning

on or after 1 January 2013

Amendments to IFRS 7, Financial

Instruments: Disclosures - Offsetting

Financial Assets and Financial Liabilities

(issued inDecember 2011)

Introduction of new disclosures relating to the

offsetting of financial assets and financial

liabilities under IAS 32.

Annual reporting periods beginning

on or after 1 January 2013

Improvements to IFRSs, 2009-2011 cycle

(issued inMay 2012)

Minor amendments to a series of standards.

Annual reporting periods beginning

on or after 1 January 2013

IFRIC 20, Stripping Costs in the Production

Phase of a Surface Mine (issued in October

2011)

The IFRS Interpretations Committee addresses

the accounting treatment of thewaste removal

costs incurred in surfacemining.

Annual reporting periods beginning

on or after 1 January 2013

New standards, amendments and interpretationsmandatorily applicable onor after

1 January 2013

Amendments to IAS 12, Income Taxes –Deferred Taxes Arising From Investment

Property

The main change introduced by these amendments is an exception to the general

principles of IAS 12 which affects deferred taxes arising from investment property that is

measured using the fair value model in IAS 40, Investment Property; there is now a

rebuttable presumption in relation to the measurement of the deferred taxes that the

carrying amount of the investment propertywill be recovered entirely through sale.