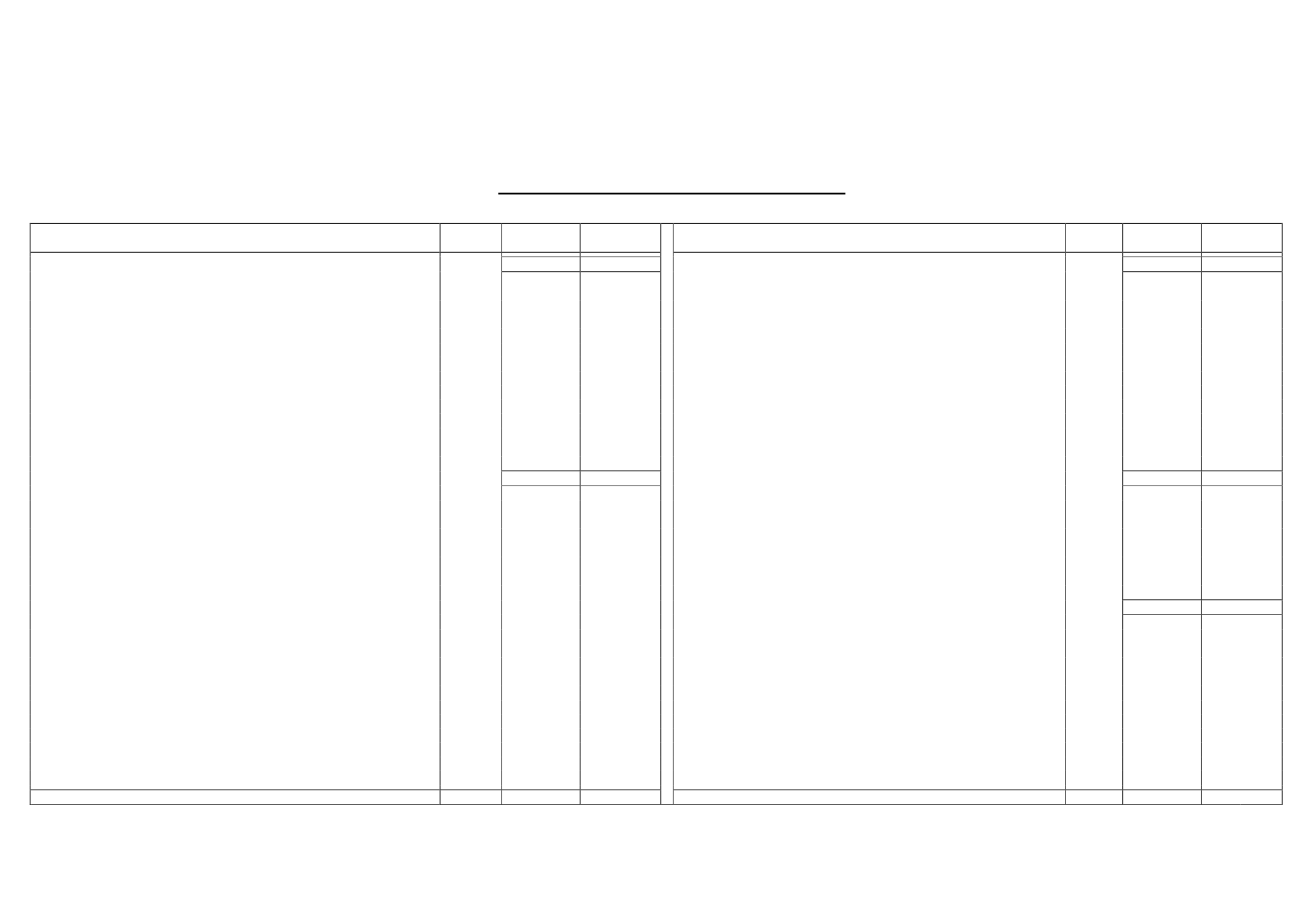

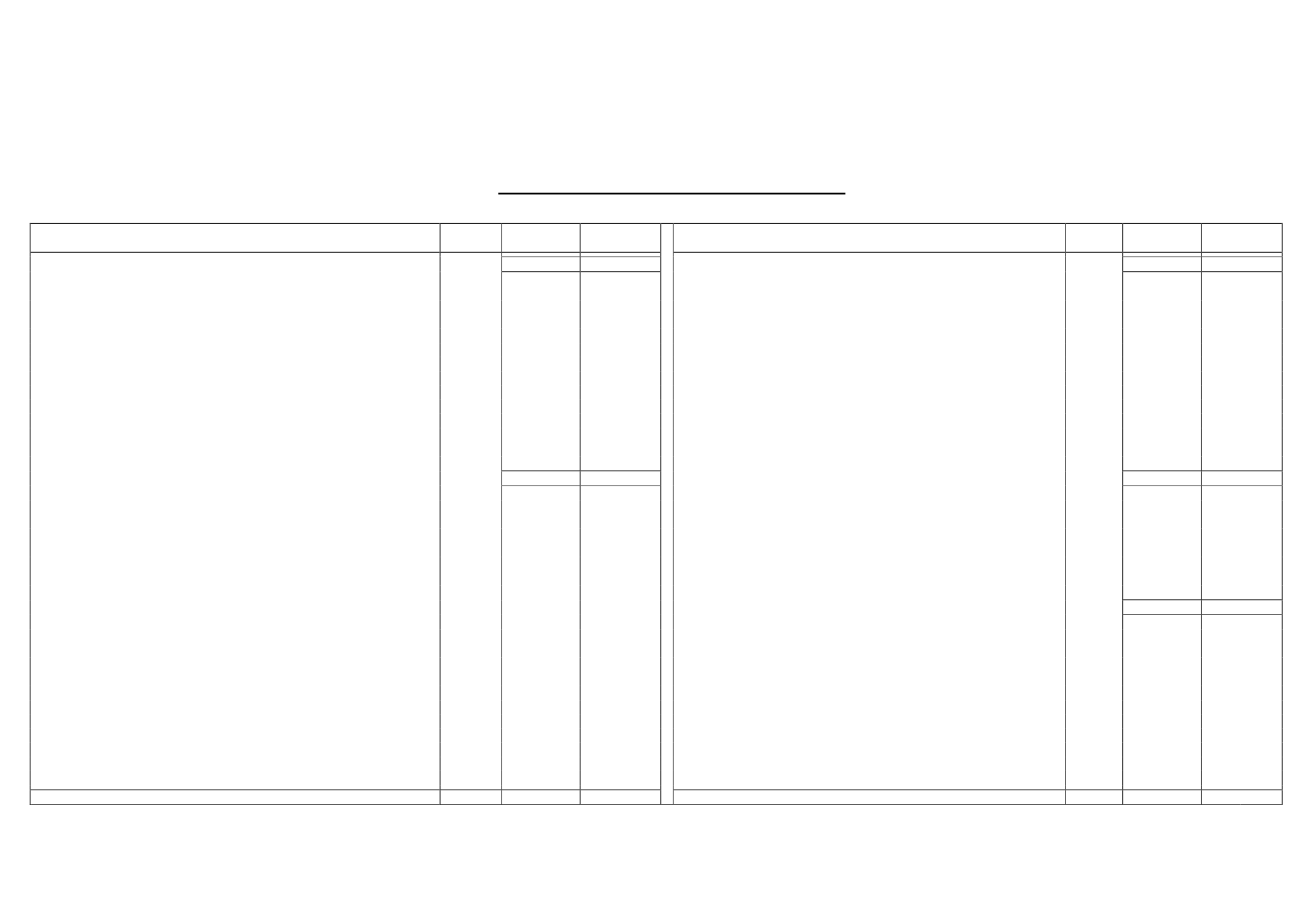

1

Translation of financial statements originally issued in Spanish and prepared in accordance with the regulatory financial reporting framework applicable to the Company (see Notes 2 and 24).

In the event of a discrepancy, the Spanish-language version prevails.

ATRESMEDIACORPORACIÓNDEMEDIOSDECOMUNICACIÓN, S.A.

BALANCESHEETAT 31DECEMBER2013

(Thousands of euros)

ASSETS

Notes

2013

2012

EQUITYAND LIABILITIES

Notes

2013

2012

NON-CURRENTASSETS

642,733 661,935

EQUITY

343,136

308,313

Intangible assets

6

81,285

82,835

SHAREHOLDERS' EQUITY-

14

Licences and trademarks

5&6

75,496

76,287

Share capital

207,604 207,604

Computer software

5,789

6,548 Registered share capital

169,300

169,300

Property, plant and equipment

7

43,492

47,540

Share premium

38,304

38,304

Land and buildings

24,866

26,439

Reserves

157,032 142,521

Plant and other items of property, plant and equipment

18,390

20,291 Legal and bylaw reserves

42,474

40,281

Property, plant and equipment in the course of construction

236

810 Other reserves

114,558

102,240

Non-current investments inGroup companies andassociates 9.3&21 201,610 211,746

Treasury shares

(99,453) (99,453)

Equity instruments

76,288

74,445

Other equity instruments

42,643

42,643

Loans to companies

125,322

137,301

Profit for the year

34,468

35,862

Non-current financial assets

9.1

10,960

16,385

Interimdividend

- (21,352)

Other financial assets

10,960

16,385

VALUATIONADJUSTMENTS-

Deferred taxassets

18

305,386 303,429

Hedges

842

488

CURRENTASSETS

549,150

478,016

NON-CURRENT LIABILITIES

288,579

91,800

Non-current assets held for sale

12

-

2,000 Long-termprovisions

15

2,328

-

Inventories

13

292,502 249,151

Non-current payables

16.1

263,600

380

Programme rights

260,305

216,937 Bank borrowings

200,129

-

Raw and other materials

3,016

2,921 Derivatives

11

207

197

Advances to suppliers

29,181

29,293 Other non-current payables

63,264

183

Trade andother receivables

167,831 190,184

Non-current payables toGroup companies andassociates 21.2

2

68,534

Trade receivables for sales and services

6,148

3,986

Deferred tax liabilities

18

22,649

22,886

Receivable fromGroup companies and associates

21.2

157,843

180,797

Sundry accounts receivable

2,050

2,187

CURRENT LIABILITIES

560,168 739,838

Remuneration payable

105

117

Short-termprovisions

15

31,976

41,692

Current tax assets

18

1,685

3,097

Bankborrowings

16.2

6,305 137,388

Current investments inGroup companies andassociates

21.2

31,124

30,487

Financial derivatives

11

3,025

485

Loans to companies

31,124

30,487

Current payables toGroup companies andassociates

21.2

87,411

83,190

Current financial assets

9.2

1,376

2,454

Trade andother payables

431,021 476,607

Derivatives

11

698

1,245 Payable to suppliers

332,714

326,454

Other financial assets

678

1,209 Payable to suppliers - Group companies and associates

21.2

75,601

124,719

Current prepayments andaccrued income

372

-

Sundry accounts payable

40

139

Cash and cash equivalents

55,945

3,740

Remuneration payable

13,565

17,445

Cash

55,945

3,740 Other accounts payable to public authorities

18

8,558

7,146

Customer advances

543

704

Current accruals anddeferred income

430

476

TOTALASSETS

1,191,883 1,139,951

TOTAL EQUITYAND LIABILITIES

1,191,883 1,139,951

The accompanying Notes 1 to 24 are an integral part of the balance sheet at 31December 2013.