64

22.3Off-balance-sheet agreements

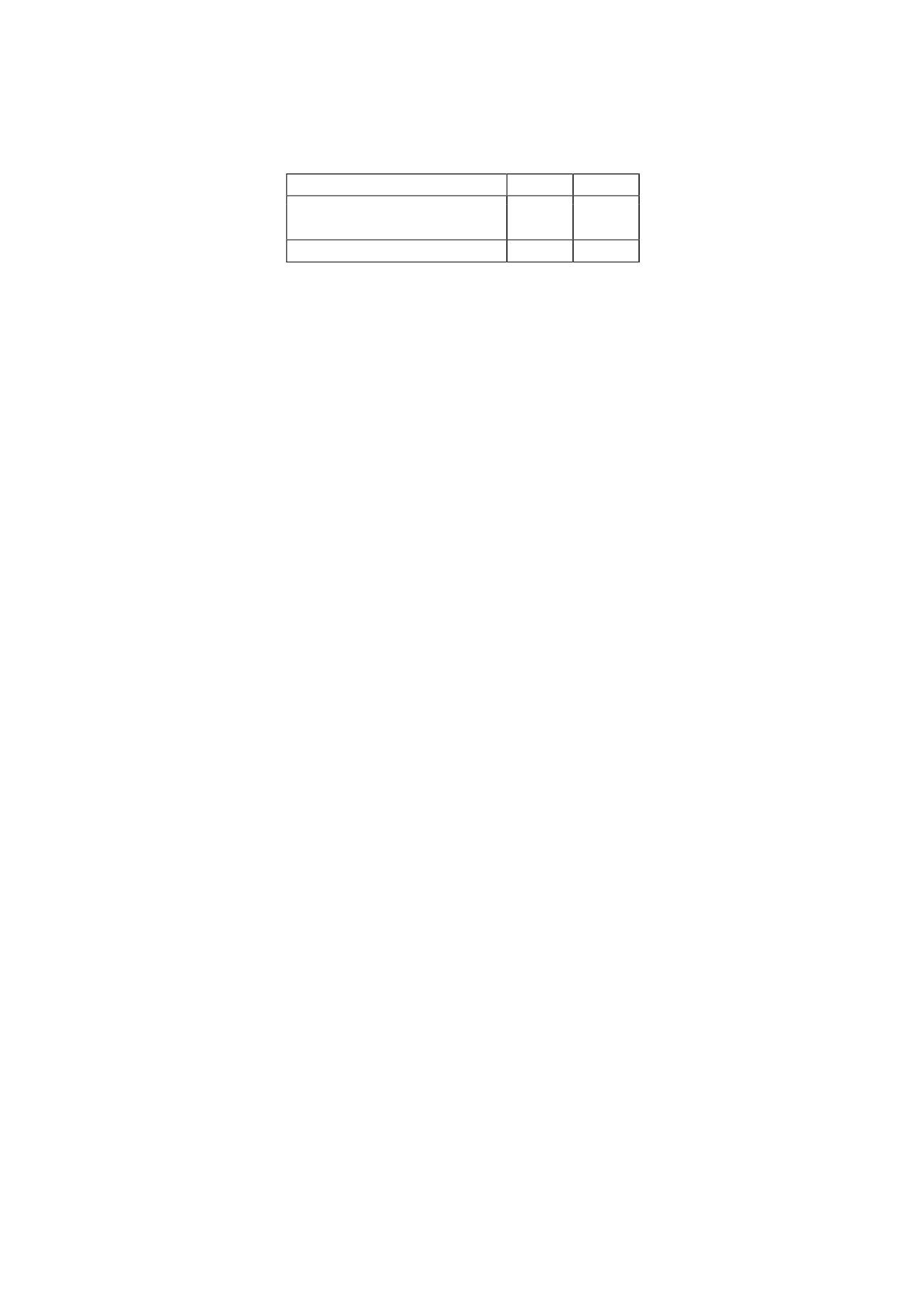

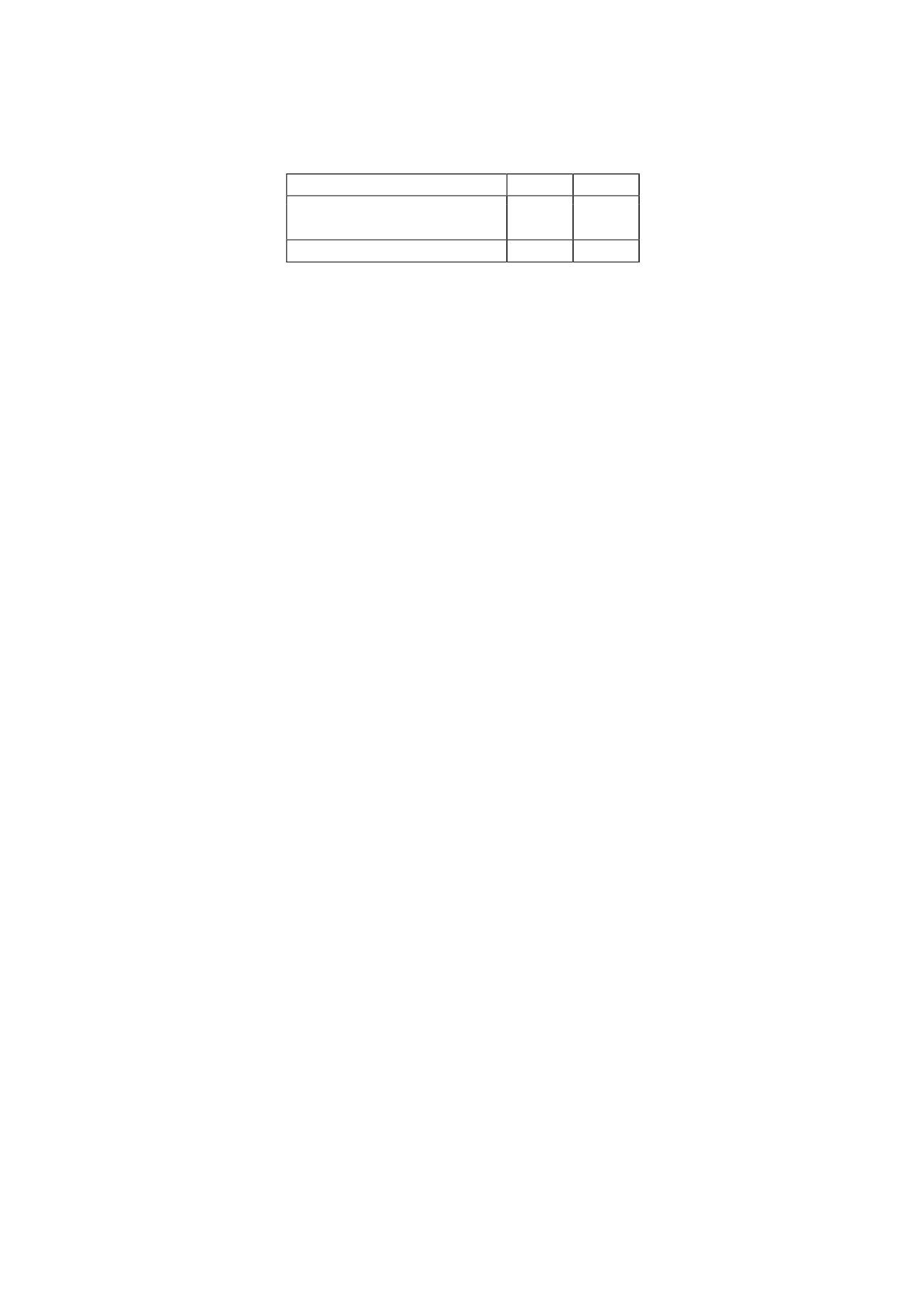

The detail of the guarantees provided by the Company to banks for third parties is as follows:

Thousands of euros

2013

2012

Group companies and associates

5,466

6,466

Other guarantees

13,868

14,009

Total

19,334

20,475

The Company's directors consider that any liabilities not foreseen at 31 December 2013 that might

arise from the guarantees providedwould not bematerial.

23.- Events after the reportingperiod

On 19 February 2014, the Company, through a relevant event communication and subsequent to a

resolution of its Board of Directors, announced a partial novation of the integration agreement

entered into on 14 December 2011 with Gestora de Inversiones Audiovisuales La Sexta, S.A. ("La

Sexta") and its shareholders, which set the terms and conditions for the integration of La Sexta

into the Atresmedia Group through a merger by absorption. Specifically, the novation of the

agreement relates to the terms and conditions regarding the "Additional Ownership Interest",

whereby La Sexta shareholders were granted the right to receive an additional ownership interest

of 7% of the share capital of Atresmedia Corporación de Medios de Comunicación, S.A., conditional

upon the Atresmedia Group's earnings performance from 2012 to 2016, inclusive.

Under the novation, Atresmedia, with Gamp Audiovisual S.A. and Imagina Media Audiovisual, S.L.,

agreed to advance and permanently settle the delivery of the partial ownership interest that would

correspond to both companies and, accordingly, on 24 February 2014 they were delivered, with a

charge to treasury shares, an ownership interest in Atresmedia Corporación de Medios de

Comunicación, S.A. equal to 2.079% and 1.631% of its share capital, respectively.

As a result of the negotiation process for this agreement and forming part thereof, other

agreements were reached with Gamp Audiovisual, S.A. and Imagina Media Audiovisual, S.L.

consisting of the cancellation of their proportional share of the financial derivative agreement

described in Note 9 and of the definitive conclusion of other matters relating to the guarantees and

obligations under the integration agreement entered into for the merger with Gestora de Medios

Audiovisuales la Sexta, S.A. (see Note 15).

The recognition of all these transactions will give rise to an estimated reduction of EUR 13,631

thousand in the shareholders' equity of the Company in the financial statements for 2014.

The terms and conditions agreed upon in the integration agreement relating to Gala Desarrollos

Comerciales, S.L. remain unchanged and, accordingly, it continues to be entitled to receive an

additional ownership interest of 0.508% of the share capital of Atresmedia Corporación de Medios

de Comunicación, S.A., conditional upon the earnings performance of the Atresmedia Group, as

indicated above.

24.- Explanation added for translation toEnglish

These financial statements are presented on the basis of the regulatory financial reporting

framework applicable to the Company (see Note 2). Certain accounting practices applied by the

Company that conform with that regulatory framework may not conform with other generally

accepted accounting principles and rules.