12

Computer software

The Company recognises under “Computer Software” the costs incurred in the acquisition and

development of computer programs, including website development costs. Computer software

maintenance costs are recognised with a charge to the income statement for the year in which

they are incurred. Computer software is amortised on a straight-line basis over three to five years.

4.2Property, plant and equipment

Property, plant and equipment are initially recognised at acquisition or production cost and are

subsequently reduced by the related accumulated depreciation and by any impairment losses

recognised, as indicated in this note.

Property, plant and equipment upkeep and maintenance expenses are recognised in the income

statement for the year in which they are incurred. However, the costs of improvements leading to

increased capacity or efficiency or to a lengthening of the useful lives of the assets are capitalised.

The Company depreciates its property, plant and equipment by the straight-linemethod at annual

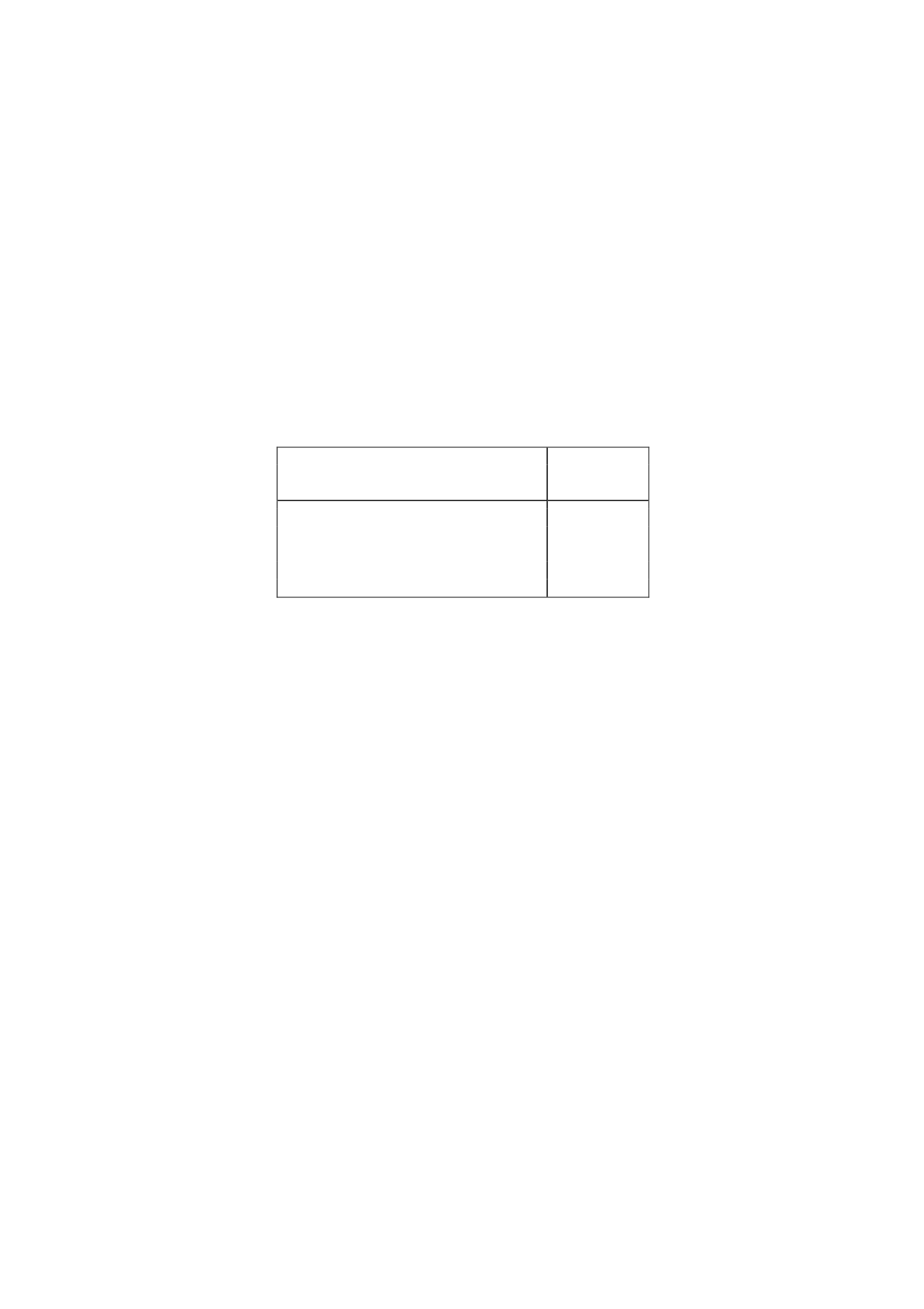

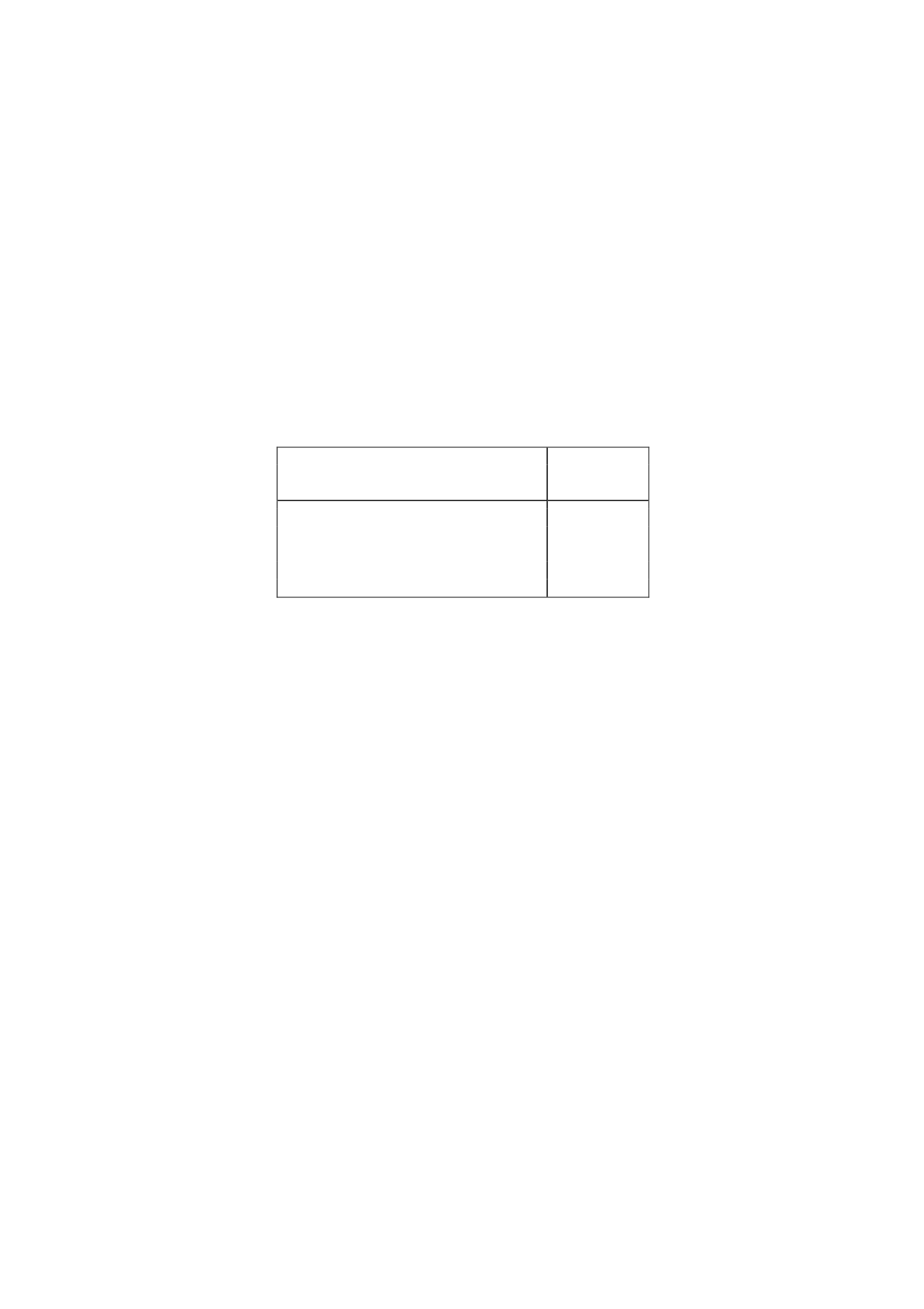

rates based on the years of estimated useful life of the assets, the detail being as follows:

Years of

estimated

useful life

Buildings

33

Plant

5 to 8

Computer hardware

3 to 5

Other fixtures

6 to 10

Other items of property, plant and equipment

6 to 10

Impairment of intangible assets and property, plant and equipment

At the end of each reporting period (for intangible assets with indefinite useful lives) or whenever

there are indications of impairment (for other tangible and intangible assets), the Company tests

these assets for impairment to determine whether the recoverable amount of the assets has been

reduced to below their carrying amount.

Recoverable amount is the higher of fair value less costs to sell and value in use.

In the case of property, plant and equipment, the impairment tests are performed individually for

each asset.

Where an impairment loss subsequently reverses (not permitted in the specific case of goodwill),

the carrying amount of the asset is increased to the revised estimate of its recoverable amount,

but so that the increased carrying amount does not exceed the carrying amount that would have

been determined had no impairment loss been recognised in prior years. A reversal of an

impairment loss is recognised as income.

4.3Operating leases

Lease income and expenses from operating leases are recognised in income on an accrual basis.

A payment made on entering into or acquiring a leasehold that is accounted for as an operating

lease represents prepaid lease payments that are amortised over the lease term in accordance

with the pattern of benefits provided.

The leases in which the Company is a lessor consist basically of facilities which the Company has

leased to companies in its Group.